PERSPECTIVE ON MARKET VOLATILITY

John Lynch Chief Investment Strategist, LPL Financial

Jeffrey Buchbinder CFA Equity Strategist, LPL Financial

KEY TAKEAWAYS

- Getting past the midterm election removes uncertainty and enables investors to focus on fundamentals, which we believe can be positive for stocks.

- Gridlock may potentially help shorten and smooth out the path to a possible trade deal with China.

- Industrials and healthcare stocks may be post-election winners, while scrutiny on financials may increase.

In last week’s midterm election, Republicans held onto the Senate and the Democrats claimed control of the House, bringing potential gridlock to Congress. This week we discuss some investment implications, including highlighting the positive seasonal tailwinds now in place for stocks. We also discuss potential winners and losers at the sector level post-election, and some risks that the leadership change in Washington may present. Most importantly, with the election out of the way, we welcome the opportunity to focus on fundamentals, which we believe remain quite positive.

THE BEST NEWS FIRST

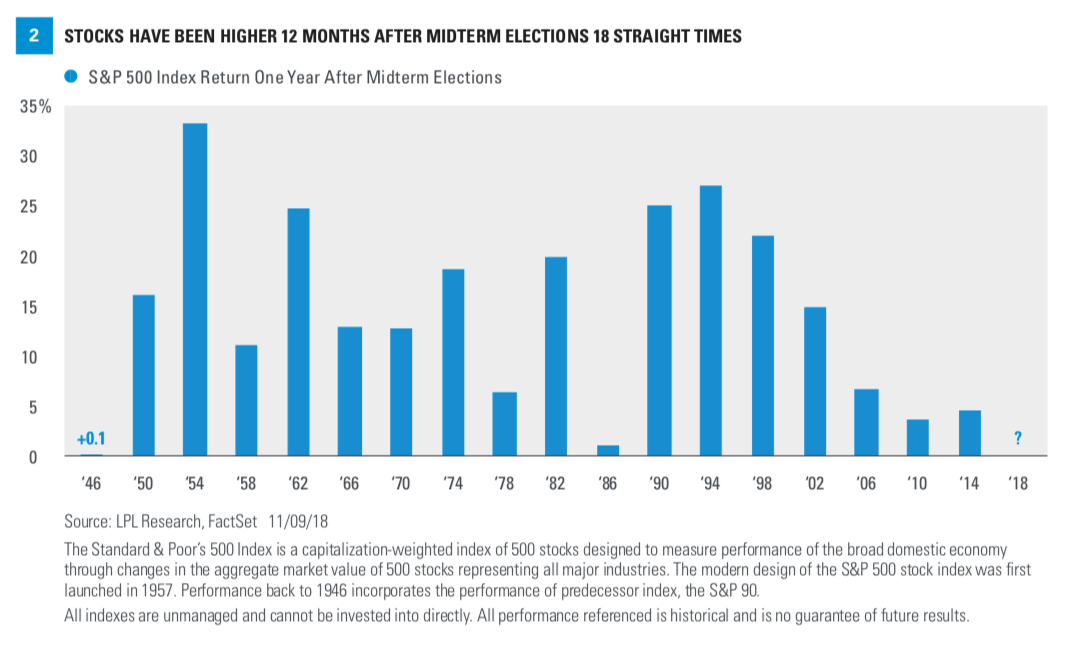

Perhaps the best news is that the uncertainty around the election has passed. This alone surely contributed to the S&P 500 Index’s biggest post-midterm election rally since 1982 on November 7, when the S&P 500 surged 2.1%. The Dow also jumped, more than 500 points.

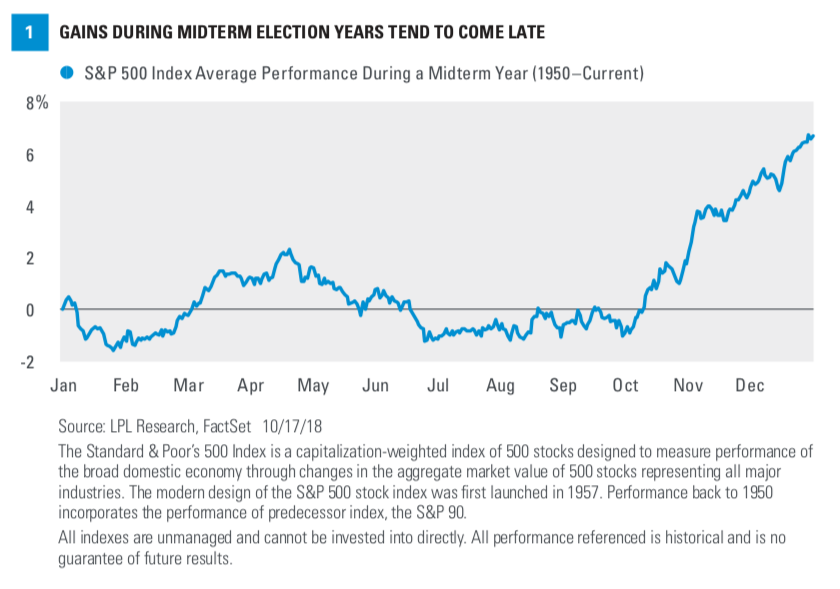

The removal of uncertainty is a key reason stocks have historically done so well after midterm elections, regardless of results. That includes strong year-end rallies [Figure 1] as well as the impressive streak of 12-month gains for the S&P 500 (18 for 18) after every midterm election since 1946 [Figure 2]. Past presidents have tried to boost the economy with pro-growth initiatives to improve their re-election chances. While divided government may make it tougher for the Trump administration to get things done, we do see some avenues that may potentially help strengthen the U.S. economy in 2019.

FUNDAMENTALS IN FOCUS

Getting past the election also allows investors

to focus on stock market fundamentals. Those fundamentals are still positive in our view, including solid U.S. economic growth, fiscal stimulus, deregulation, record corporate profits, and low (though gradually rising) interest rates and inflation.

We do not expect House Democrats to meaningfully change the path of fiscal stimulus or deregulation

in 2019. The U.S. economy will continue to benefit from tax reform, even though growth may slow from the near 4% pace of the past two quarters to around 3% in the near term.

Tax cuts for individual taxpayers will continue to support consumer spending and small businesses. Lower corporate tax rates have made the U.S.

more competitive globally. Immediate expensing provisions encourage companies to invest in capital projects while repatriation encourages them to bring their overseas profits back to the U.S., providing further stimulation for economic growth. Congress also passed an additional government spending package this spring worth $300 billion over the next two years.

Meanwhile, the regulatory environment has become less burdensome for many businesses, particularly in energy and financial services.

We do not expect a split Congress to meaningfully alter the path of corporate profits, which should continue to garner support from both consumer and business spending, bolstered by tax reform. Despite concerns about a potential peak in profit growth (which some are incorrectly referring to as simply peak profits), high single-digit, if not low double-digit, earnings growth in 2019 is possible, consistent with Thomson Reuters’ consensus estimates.

We do not expect new leadership in Washington to alter the Federal Reserve’s (Fed) plan to gradually hike rates over the coming year. Despite the central bank’s favorable assessment of the U.S. economy in its policy statement last week, we still maintain that the Fed will be less aggressive than currently feared. Our projections remain for another interest-rate hike in December, followed by just two increases in 2019. As a result, market interest rates should nudge higher, though likely accompanied by periodic and volatile temporary surges as deficit spending battles ensue.

GRIDLOCK

Is gridlock good for investors? In this case, it might be. Wednesday’s stock market reaction sure suggests the market thinks so, and history says the same. A Republican president with a split Congress has been one of the best combinations for the S&P 500 historically, with 15.7% gains on average in this

scenario [Figure 3]. Investors tend to like checks and balances that can take extremes out of play and maintain the status quo.

One potential positive implication is that, under a split Congress, we believe the path to a trade agreement with China may be shorter and smoother, and the eventual deal could end up being less onerous. While we wait for a deal that may not come until after New Year’s Day, keep in mind that the amount of tariffs implemented or proposed is far less than the total stimulus that has been pumped into the U.S. economy, and that trade represents a surprisingly small portion of the U.S. economy.

SECTOR THOUGHTS

Here are some potential winners and losers at the sector level following last week’s election results:

Industrials and Materials: We believe infrastructure spending is an area where the two parties are more closely aligned than was apparent during the campaign season. The ultimate size of a package is unclear, and Republicans probably won’t support repealing a portion of their tax cuts to pay for it, but we do expect some progress in this direction that would be supportive of demand in the industrial and materials sectors.

Aerospace and defense companies are still operating in a favorable political environment post-election, which is positive for the industrial sector. Defense spending is expected to increase even under divided government, though perhaps less so than it might have under a Republican sweep scenario. Given that the two-year, $300 billion package of additional government spending enacted earlier this year was largely focused on defense, the outcome of the midterms doesn’t alter the trajectory of defense spending in 2019.

Healthcare: Healthcare has been the leading sector in the S&P 500 Index this year, but we expect headline risk to weigh on some industries within the sector, including big pharmaceuticals and biotech. Efforts to control drug prices are likely to continue. On the other hand, Medicaid expansion by more states bodes well for managed care and hospital stocks while a Democratic majority in the House negates any further discussion of repealing the Affordable Care Act.

Energy: Deregulation efforts by Republicans may slow down, though presidential executive orders remain in play. We believe excess production is still the primary determinant of oil prices, again minimizing the impact of the election on the space. We continue to market weight the energy sector.

Financials: While new leadership of the House Financial Services Committee will not be as supportive of the financial sector, it should be emphasized that less-stringent bank stress tests (as regulated by the Fed) continue to favor the expansion of lending capacity, which is typically a boon to economic growth. Considering taxes, improved net interest margins, and profit forecasts, we maintain our positive view of the financial services sector.

Telecom: Now part of the revamped communication services sector, traditional telecom stocks may struggle as a Democratic majority in the House is expected to push for net neutrality and increased regulation of telecommunications providers, though any legislation would require 60 votes in the Senate.

Technology and Communication Services: We would not be surprised to see the Trump administration ramp up its scrutiny of leading technology and internet companies, though the Democrats taking the House may soften the blow. We maintain our positive but tempered view of the technology sector and are neutral on communication services.

RISKS

Taxes: We believe it is very unlikely that House Democrats will be able to get Republicans and President Trump to go along with tax increases. That said, potential Democratic initiatives including infrastructure have to be paid for somehow amid a rising U.S. deficit, and rolling back tax cuts on the wealthiest Americans is one possible way to do it, introducing some risk.

Though not a risk, so-called tax reform 2.0, which would have made the December 2017 individual tax cuts permanent (they are currently slated to sunset in 2026), is now off the table. The chance that the president moves to index capital gains taxes to inflation, already unlikely, looks even more remote.

Debt ceiling: To achieve some of the party’s priorities in 2019, Democrats could use the debt ceiling as leverage, much like Republicans did in 2010-11 to get spending cuts. Congress must raise the debt ceiling in 2019, with 60 votes required in the Senate. The odds of a 2011-esque standoff may be very low, but this risk should not be ignored.

CONCLUSION

We believe simply getting past the midterm elections is good news for stocks, as it removes significant policy uncertainty and provides a strong seasonal tailwind historically. On top that, with all (or nearly all) of the votes counted, investors can now shift their focus to fundamentals. On that score, the picture looks pretty good. GDP is growing north of 3% with the impacts of fiscal stimulus still flowing through. Corporate profits are growing at a very strong pace and—despite widespread peak earnings concerns—we think earnings gains may exceed long-term averages in 2019. While inflation has accelerated recently and interest rates have increased, both remain at low levels relative to history and the Fed will likely continue its gradual pace of hikes.

We continue to expect stocks to rally into year-end, putting the S&P 500 in our year-end target range

of 2900–3000. We recognize that several big risks are still hanging over this market—namely, reaching a trade agreement with China and a potential policy mistake by the Fed. However, as we put our 2019 Outlook together, our expectation is for another solid year of stock market gains in 2019. Look for much more from us on 2019 in a few weeks.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

Because of its narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Dow Jones Industrial Average (DJIA) Index is composed of U.S.-listed stocks of companies that produce other (nontransportation and nonutility) goods and services. The Dow Jones Industrial Averages are maintained by editors of The Wall Street Journal. While the stock selection process is somewhat subjective,

a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth, is of interest to a large number of investors, and accurately represents the market sectors covered by the average. The Dow Jones Averages are unique in that they are price weighted; therefore, their component weightings are affected only by changes in the stocks’ prices.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit.

RES 38342 1018 | For Public Use | Tracking #1-791982 (Exp. 11/19)