An Attention-Grabbing Jobs Report

John Lynch Chief Investment Strategist, LPL Financial

Barry Gilbert,

Callie Cox Senior Analyst, LPL Financial

Key Takeaway

- February’s job growth was disappointing, but it followed the biggest two-month gain since 2016.

- Job growth and modestly rising wages remain strengths of the current economy.

- We don’t see signs of February’s jobs report impacting growth expectations or the Fed’s path.

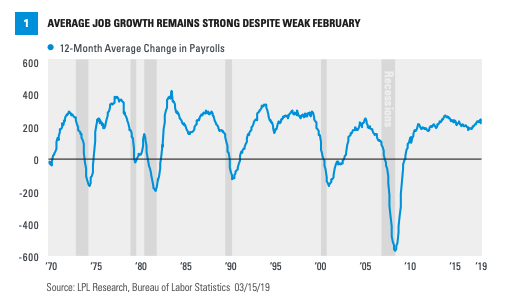

A disappointing February jobs report, released March 8, has increased concerns about a slowing U.S. economy among some market participants. However, we believe the report did little to change the overall economic picture. In fact, job growth and modestly rising wages remain strengths of the current economy and continue to support consumer activity. The economy added 20,000 jobs in February, the slowest pace of growth since September 2017. While that level of gains would be a concern if it were to continue, it comes against a backdrop of robust jobs gains the prior two months, and looking back a year, annual job growth remains well above the cycle average. The economy is slowing from a strong 2018, but we still expect above-trend growth in 2019. We will be monitoring how things develop, but overall we still believe strong labor markets with manageable wage growth will remain supportive of the overall economic picture, even taking the February slowdown into account.

The Bigger Picture

Job growth appeared to be going through some normal cyclical slowing toward the end of

Above-Average Growth

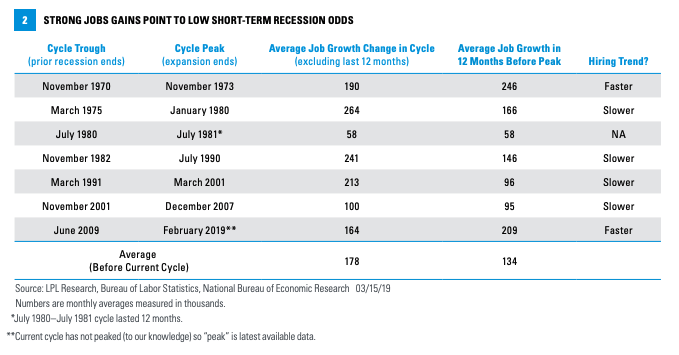

Historically, in the twelve months before the start of a

Unchanged Expectations

The Atlanta Fed and New York Fed both produce “NowCast” forecasts of current quarter gross domestic product (GDP) that updates as new data are released. The Atlanta Fed’s NowCast forecast for first quarter GDP actually increased following the release of the jobs report because of unusually strong housing data released at the same time, which more than offset the negative impact of the jobs report. The New York Fed’s NowCast viewed the jobs report’s impact as neutral, with a bump up in the outlook due to a decline in the unemployment rate, completely offsetting the negative impact of the weak jobs number. Again, housing data were a much larger positive. First quarter 2019 GDP growth is expected to be disappointing, with the Bloomberg-surveyed economists’ consensus currently sitting at 1.5%, and then bounce back later in the year, but so far, the jobs report has had no real negative impact to current quarter GDP expectations.

What About the Fed?

We received several key data points on inflation last week, reinforcing the jobs report’s message that economic reports likely won’t deflect the Fed from its current stance. The Fed next meets March 19–20 with no real likelihood that it will raise rates, but markets will be paying close attention to changes in the policy statement, updated projections, and Fed Chair Jerome Powell’s press conference following the meeting’s conclusion. The weak February jobs data and generally in-line inflation readings will do little to disrupt the Fed’s current path of pausing on rate hikes until evidence appears that further hikes are merited. Modest but well-contained inflation does not seem a precursor of potential overheating, allowing the Fed to wait patiently for signs that a decelerating U.S. and global economy has potentially reversed course.

Conclusion

Attention-grabbing weak job creation in February shouldn’t distract investors from otherwise strong labor market trends, especially for this point in the cycle. At the same time, the February jobs report and manageable inflation data support a continued pause in rate hikes while the Fed continues to watch for signs of a rebound in the U.S. and global economies. We’ll continue to watch for signs of a weakening labor market, but for

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in this material may not develop as predicted.

Investing involves risk including loss of principal. No investment strategy or risk management technique can guarantee

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

RES 87312 0319 | For Public Use | Tracking #1-833010 (Exp. 03/20)