Main Street’s Growing Uncertainty

John Lynch Chief Investment Strategist, LPL Financial

Barry Gilbert, Ph.D., CFA, Senior Analyst, LPL Financial

Key Takeaways

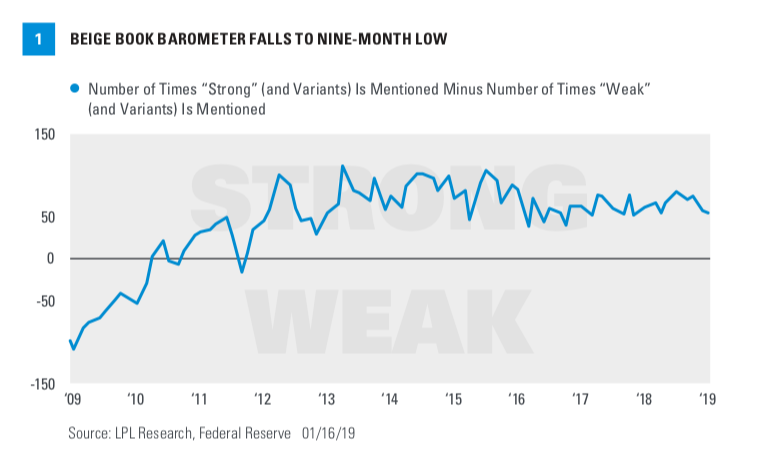

- The Beige Book Barometer dropped to a nine-month low.

- While Main Street still sees economic health, uncertainty is at its highest point in years.

- The Beige Book’s hiring indicators remain strong, and there are still signs of labor market slack.

Recent U.S. economic data have sent a lot of conflicting signals. Jobs data, pricing data, and corporate earnings reflect a solidly growing domestic economy with manageable inflation, but manufacturing reports show a downturn in demand that points to potential weakness ahead. Wall Street’s economic outlook is more clouded than at any point of the cycle, so this week, we’ve turned to Main Street for direction via the Federal Reserve’s (Fed) Beige Book survey.

Healthy, but High Uncertainty

The Beige Book, a qualitative assessment of the domestic economy and each of the 12 Fed districts, is prepared eight times a year in advance if each Fed policy meeting. In it, the Fed presents qualitative observations made by community bankers and business owners about economic (housing, labor market, manufacturing, nonresidential construction, prices, tourism, wages) and banking (lending conditions, loan demand, loan quality) conditions. The latest Beige Book was published January 16, 2019, and compiled in the weeks before January 7.

At LPL Research, we maintain a straightforward but informative indicator called the Beige Book Barometer (BBB), which helps us gauge sentiment among U.S. businesses (Main Street) by looking at how frequently keywords and phrases appear in the Beige Book. The overall Barometer measures the difference between the number of times the word “strong” or its variants appears in each Beige Book, and the number of times the word “weak” or its variants appears. When the BBB is declining, it suggests the economy is deteriorating; when it’s advancing, it suggests the economy is improving.

The BBB declined to 56 in January, a nine-month low [Figure 1]. While the overall BBB level is still healthy, the gauge has dropped 20 points since the October Beige Book.

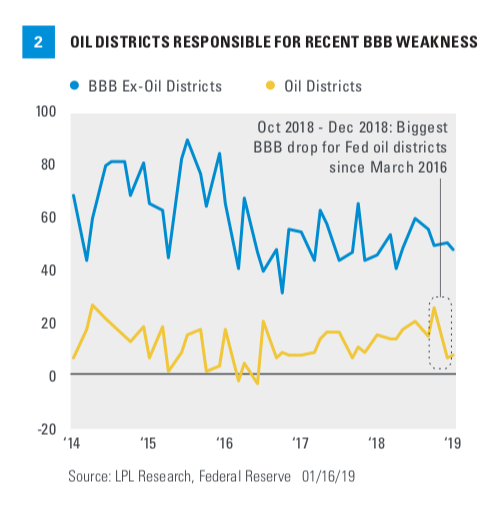

Strong words have dropped by 26 since reaching a one-and-a-half-year high in October, by weak words also slid by 6 over the same period. It’s important to note, though, that much of the decline in strong words came in reports on the Fed’s most oil-intensive districts (Kansas City, Minneapolis, and Dallas). All three districts reported slowing growth in oil prices since the beginning of October. Excluding the oil districts, the Beige Book Barometer fell to 48 in January from 50 in October [Figure 2].

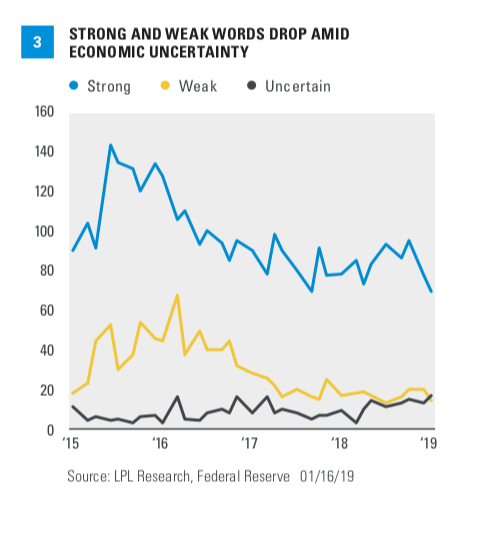

Still, the BBB has steadily declined since reaching a two-and-a-half-year high in July 2018, even as the bulk of economic data has pointed to a strong labor market and healthy consumer spending. We attributed this weakness to an increasingly uncertain macro environment as U.S. businesses grapple with a prolonged U.S.-China trade dispute, evidence of moderating global growth, a record government shutdown, and geopolitical issues overseas. The total of strong and weak words has declined to its lowest since at least 2005, while mentions of uncertainty have steadily climbed to the highest in four years [Figure 3]. Beige Book respondents are finding it more difficult to characterize current economic conditions and set expectations, so they’re just increasingly citing uncertainty.

Lately, growing economic uncertainty has been tough to ignore. We have yet to see a resolution in the U.S.-China trade tensions, and U.S. corporations are delaying expansion plans and capital investment while they wait for answers. Energy companies have also cut their spending in response to lower oil prices. In turn, manufacturing activity growth has slowed sharply recently, especially after a strong first half of 2018 on the heels of fiscal stimulus. The Institute for Supply Management’s (ISM) manufacturing Purchasing Managers Index (PMI), a gauge of U.S. manufacturing health, fell in December to the lowest level since 2016, just four months after peaking at a 14-year high. Overall, the manufacturing sector is still a relatively healthy and expansionary territory, but the unexpected severity of the PMI’s decline is a sign that uncertainty is weighing more on economic health than anticipated. Trade’s impact on sentiment could also snowball as investors digest other headwinds, and the compounded impact could bleed into other sectors.

Signs of Slack

Aside from growing uncertainty, the Beige Book’s context shows continued strength on Main Street, especially in hiring. “Wage” and “wages” were mentioned 88 times (a new record in our data), and the Beige Book’s summary of economic activity noted that wages are generally growing in all regions and for all skill levels. REspondents in several regions and for all reported difficulty in filling positions (especially in lower-skilled jobs), while others noted they expect to increase wages and incentives this year to attract talent. However, there are still some signs of slack in the labor market. “Shortage, which typically is used in Beige Book context to refer to labor shortages, appeared 15 times, the fewest mentions since July 2017. In the December jobs report, the participation rate ticked up to a 15-month high, indicating more participants were enticed by solid labor market conditions to enter the workforce. At this point in the cycle, the most important labor-market indicator to watch is average hourly earnings growth, as wages constitute about 70% of business costs. While wages are growing at their fastest pace of the cycle, we see the current pace of growth as moderate and healthy, and labor-market slack could keep wage pressures from overheating.

Conclusion

Main Street’s view of the economy remains relatively upbeat, evidenced by a solid (albeit lower) reading in the BBB. The Beige Book also showed that oil’s recent price drop has weighed on certain regions more than we thought. However, we still see a compelling argument for moderate economic growth due to strong consumer demand, modestly accelerating wages and a robust labor market.

As mentioned in our Outlook 2019, we expect U.S. gross domestic product growth of 2.5%-2.75% in 2019, even as the cycle enters its tenth year. To us, all the fundamental pieces are in place for a continued expansion, but heightened uncertainty has increasingly soured U.S. corporate sentiment and weighted on capital expenditures. Increased capital spending is an important part of our economic outlook (as it leads to increased productivity and contained labor costs), and we still believe business investment will grow in 2019. We see trade tensions as the primary roadblock to sentiment, and we expect the United States and China to reach a deal soon, eliminating a great deal of current uncertainty and allowing companies to resume their expansion plans.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

Any economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Investing involves risk including loss of principal.

DEFINITIONS

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments, and exports less imports that occur within a defined territory.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

RES 69526 0119 | For Public Use | Tracking #1-814074 (Exp. 01/20)