KEY TAKEAWAYS

- While wage growth has been tepid recently, 67 industries have seen wages increase at double the average (21% per annum), with good old American know-how roles well represented.

- The April employment report suggests wage growth likely remains a concern for Fed policymakers as they debate when to begin raising rates.

- Our view remains that the Fed may begin to hike rates in late 2015.

Click here to download a PDF of this report.

WATCHING WAGES

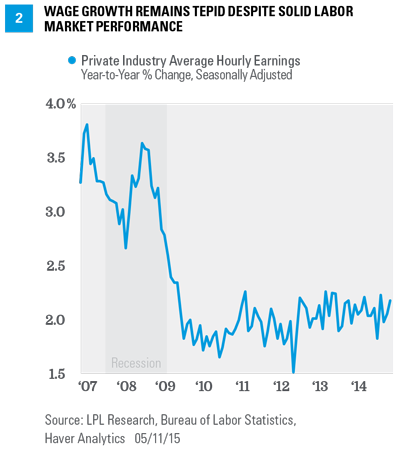

The April 2015 Employment Situation report (released on Friday, May 8, 2015) indicated that the labor market bounced back in April 2015 after a difficult March, but that wages–as measured by average hourly earnings–remained tepid, up just 2.3% from a year ago, still well below the 4%+ wage gains seen just prior to the 2007-09 Great Recession. Despite the solid but not spectacular April employment report, wage growth–or lack thereof–likely remains a concern for Federal Reserve (Fed) policymakers as they continue to debate when they will begin raising rates in this cycle. Our view remains that the Fed may begin to hike rates in late 2015. The next Federal Open Market Committee (FOMC) meeting is June 16-17, 2015.

Despite the tepid wage growth economy-wide, signs that wage pressures may be building in segments of the economy have begun to appear in recent months, most recently in the latest Fed Beige Book, released in early April 2015, ahead of the April 28-29 FOMC meeting.

The April 2015 Beige Book noted:

“Firms in many Districts, including Richmond, Atlanta, St. Louis, Kansas City, and Dallas, reported having difficulty finding skilled workers, especially in professional and business services and the IT sectors. The Richmond, Atlanta, and St. Louis Districts specifically noted an increasing incidence of voluntary turnover of employees.”

This week, May 11-15, 2015, financial markets will digest the Job Openings and Labor Turnover Survey (JOLTS) report for March 2015. Although often overlooked by the financial markets, the JOLTS report contains several labor market indicators that Fed Chair Janet Yellen says she and her colleagues on the FOMC are watching closely [Figure 1].

Click here for Figure 1, Tracking Yellen’s Indicators.

WAGES IN FINANCIAL SERVICES, HEALTHCARE & MINING LEADING THE WAY

As we wrote in our March 30, 2015, Weekly Economic Commentary, “March Employment Report Preview,” a decisive upturn in wage inflation remains key to moving inflation and inflation expectations higher; and in the past several months Yellen and the FOMC have emphasized the inflation side of the Fed’s dual mandate (low and stable inflation) rather than the employment side (promote full employment). At just 2.3% year over year in April 2015, wages remain stubbornly weak [Figure 2], despite an economy that has created 12.3 million jobs in the past five years, pushing total employment well past its prior peak (in 2007) and the unemployment rate from 10.0% in late 2009 to 5.4% in April. In the past, a drop in the unemployment rate of that magnitude over that time period has been accompanied by acceleration in wages.

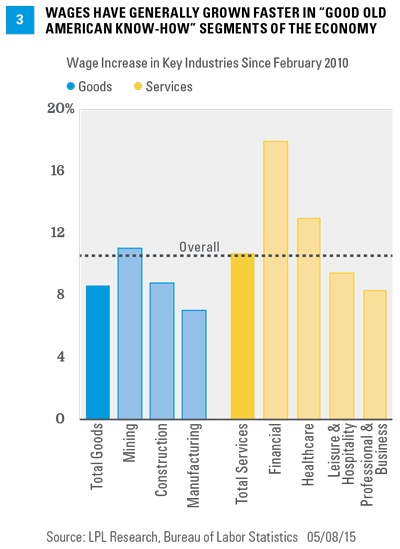

That’s not to say that there hasn’t been any wage acceleration in any sector of the economy. Overall, average hourly earnings in the private industry have increased by 10.5% since the economy began regularly creating jobs in February 2010, eight months after the end of the Great Recession. Wages in the broad goods-producing sectors (mining, construction, and manufacturing) have increased by 8.6% over that span, with mining (+11.1%) far outstripping construction (+8.8%) and manufacturing (+7.1%) [Figure 3]. That order makes sense against the backdrop of the key drivers of the economy over the past six years or so, with mining (which includes oil and gas drilling and related industries) leading the way, and manufacturing and construction struggling, especially early in the recovery.

On the services side, wages in the private sector (up 10.8% since February 2010) have outpaced wages in the goods-producing sector as a whole (+10.5%), but lagged the 11.1% gain in mining wages. Within the private services sector, the clear winner is the broad financial services area, where wages have increased more than 18% since February 2010 [Figure 3]–albeit from a depressed base, as no sector suffered more than the financial services sector during the housing induced Great Recession. Of course, the financial services industry does have several categories that fall under our good old American know-how umbrella, including insurance carriers and credit intermediation, commonly known as commercial banking. Wages in those areas are up 14% and 20%, respectively, since February 2010.

Another good old American know-how segment of the economy is education, where the U.S. runs a very large trade surplus, as far more overseas students come to the U.S. to study amongst our best and brightest than we send abroad. Of course, education itself is a key determinant of employment status; as of April 2015 the unemployment rate for those with less than a high school diploma was 8.6%, while the unemployment rate for those with at least a bachelor’s degree was 2.7%. This wide gap is driving more Americans to pursue higher education, and is driving up wages in the educational sector.

Healthcare wages have increased by 13% since February 2010, far outstripping the gain in overall wages (+10.5%). The key driver here of course is demographics, and shortages of skilled medical professionals in certain areas of healthcare in certain areas of the country. Here again, education is a key overlap, as many of the skilled positions in healthcare require further training after high school.

While wages in the professional and business services (+8.3% since February 2010) and leisure and hospitality (+9.5%) have lagged overall wage gains in services and the overall economy, there are good old American know-how segments of each broad category that have seen better than average wage gains. For example, in the professional and business category, accountants have seen wages increase by more than 15% since February 2010, while those in the high-demand graphic design services field have seen wages increase, on average, by more than 25%. Wages in advertising services–a key good old American know-how export category–have increased by 21%.

Within leisure and hospitality (the U.S. is a large net exporter of travel), museums, historical sites, and zoos have seen an 11% increase in wages since 2010, while wages at full-services restaurants have grown by nearly 15%. Until the harsh winter, wages at caterers and mobile food services (aka food trucks) had been increasing at 15-20% per annum for several years. Although not a direct beneficiary of good old American know-how, a lunchtime walk in virtually any town or city in the U.S. will reveal the tremendous popularity of these emerging small businesses.

On balance, while wage growth has been rather tepid over the last 12 months (+2.3%) and since the economy began creating jobs in February 2010 (10.5% or 2% per annum), 67 industries have seen wages increase at double (21%) the average with good old American know-how roles well represented among those 67 industries. Which industry saw its wages increase the most over the past five years? That would be in the reinsurance carriers’ area of within financial services, where the average hourly wage in March 2015 was a whopping $64.79 per hour, up more than 55% from the not too shabby $41.14 per hour the industry paid, on average, in February 2010. While not mentioned specifically in the Beige Book, it’s that type of position (highly skilled, highly educated, in areas of the economy that do the best job exporting) where employers are having difficulty finding workers. History suggests that it is only a matter of time before the shortages of labor in the skilled professions begin to spread to other areas of the economy and push the broad measures of wage inflation higher. That scenario would be a likely precursor to the first Fed rate hike of the cycle, which we continue to expect in late 2015.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for your clients. Any economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, geopolitical events, and regulatory developments.

Because of its narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

DEFINITIONS

Job Openings and Labor Turnover Survey (JOLTS) is a survey done by the United States Bureau of Labor Statistics to help measure job vacancies. It collects data from employers including retailers, manufacturers, and different offices each month. Respondents to the survey answer quantitative and qualitative questions about their business’s employment, job openings, recruitment, hires, and separations. The JOLTS data are published monthly, by region and industry.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-381365 (Exp. 05/16)