KEY TAKEAWAYS

- The Fed has raised rates because it believes the U.S. economy is strong and likely to continue to grow.

- The gap between what the Fed says it will do and what the market thinks the Fed will do continues.

- U.S. housing affordability is close to all-time highs, which should assuage potential concerns related to rising rates.

Click here to download a PDF of this report.

THE WAIT IS OVER

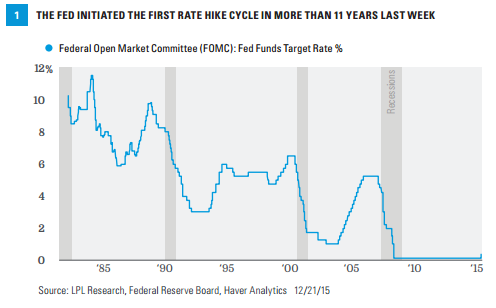

The Federal Open Market Committee (FOMC), the monetary policymaking arm of the Federal Reserve (Fed), finally raised the target for the federal funds rate by 0.25% on Wednesday, December 16, 2015. By raising this key overnight borrowing rate, the Fed raised interest rates for the first time in nine years, and began the first rate hike cycle in 11 years. The last Fed tightening cycle began in June 2004 and the last rate hike of that tightening cycle was in June 2006 [Figure 1]. While the 0.25% increase means there is potential for key rates to tick up, such as mortgage or credit card rates, the Fed has raised rates because it believes the economy is strong and likely to continue to grow without the added support of near zero interest rates. For the market, this is potentially a positive event. Yet, rate hikes also reaffirm that we are in the mid-to-late stage of the economic cycle, a part of the cycle when we can expect additional market volatility.

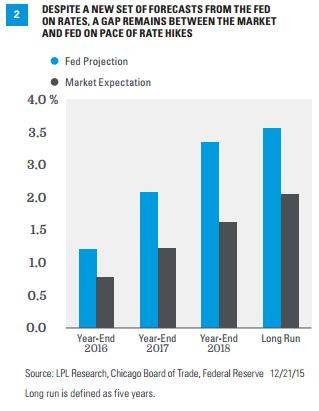

THE GAP CONTINUES

Looking forward, there continues to be a gap between what the Fed says it will do and what the market thinks the Fed will do. The latest set of “dot plots” from the members of the FOMC puts the fed funds rate at 1.375% at the end of 2016 and 2.375% by the end of 2017. As of December 18, 2015, the market–as measured by the fed funds futures market–puts the fed funds rate at just 0.84%, roughly 0.5% below where the Fed says the fed funds rate will be if the economy, labor market, and inflation unfold the way the FOMC thinks it will [Figure 2]. How that 0.5% gap is resolved will play a key role in the future direction of financial markets, particularly fixed income markets. The Fed’s policy statement and Fed Chair Janet Yellen’s comments during the post-meeting press conference and Q&A with the press suggest the Fed will continue to proceed cautiously. A slow path for further increases will give the economy and markets time to adjust to the changes, with Yellen emphasizing several times that starting early and normalizing rates gradually was preferable to waiting too long to raise rates, and having to abruptly (and aggressively) raise rates later in an effort to play “catch-up.”

Waiting on, fear of, or uncertainty around the timing of the first Fed rate hike of the cycle, and how much and how fast the Fed would raise rates once rate hikes began, have long been cited by businesses small and large, and by consumers, as objections to investing and spending. “We can’t invest until we know when the Fed will act and where rates will be,” or “I won’t commit to buying a new house until the Fed acts,” were common objections in the past several years. Although businesses and consumers still don’t know for sure how much and how fast the Fed will raise rates, they now know hikes are underway, future rate increases will be gradual, and that the end point for the fed funds rate is likely to be a lot lower in this tightening cycle than in the past. Our view remains that by the end of 2016, the fed funds rate will be in the 0.75-1.0% range, and the gradual pace of hikes may not be much of a headwind for economic growth in 2016. Even if the Fed does raise rates by 1% in 2016, monetary policy would still be accommodative and supportive of gross domestic product (GDP) growth in the 2.5-3% range for 2016.

IMPACT ON HOUSING

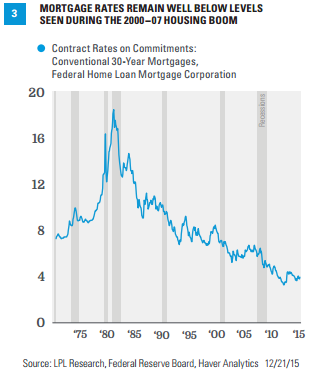

One area of the economy that is mentioned as a key area of concern as it relates to rising rates is housing. At just under 4%, the 30-year fixed rate mortgage rate is roughly 0.5% above its 45-year low of 3.5% set in late 2012/early 2013 [Figure 3]. We expect the yield on intermediate-term Treasury notes–often used as a proxy for 30-year mortgage rates–to rise between 0.25% and 0.5%, with a lesser probability of a 0.75% rise.* While mortgage rates and Treasury yields don’t always move in lockstep, if our forecast for Treasury yields is realized, mortgage rates would end 2016 in the 4.25-4.5% range and, in our view, not be a major impediment to the housing market. For perspective, note that during the 2000-07 housing boom, the 30-year fixed rate mortgage averaged 6.5%, and in the early part of that period (2000-03) mortgages averaged above 7%.

*Based on our Outlook 2016: Embrace the Routine publication, and three main challenges facing bonds: high valuations, steady economic growth, and the prospect of Fed rate hikes. These three factors should exert upward pressure on bond yields and downward pressure on bond prices.

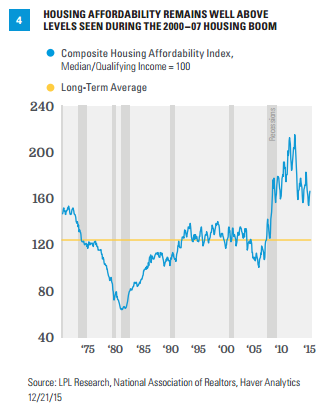

Although lending standards are tighter today than in the early 2000s, including requirements for much larger down payments and higher credit scores to qualify for a loan, the saving rate (as a percentage of income) is well above where it was in the early to mid-2000s. In addition, home price appreciation is much more aligned with income growth today than it was in the early 2000s, inventories are at or very close to historical lows, and the housing bust and Great Recession has created a pent-up demand for housing. Finally, the overall level of housing affordability (the ability of the household with the median income to afford the payments of a median priced house) has averaged near 180 in the past year, close to all-time highs. While housing affordability is likely to move lower as rising mortgage rates and home prices offset the increase in incomes, it will potentially remain well above the levels seen during the housing boom years (2000-07) of around 120-125 [Figure 4].

CONCLUSION

In our view, the Fed’s decision to initiate a gradual rate hike cycle should be taken as a vote of confidence in the U.S. economy and reaffirms that we are in the mid-to-late stage of the economic cycle, a part of the cycle when we can expect additional market volatility. While the disconnect between the Fed’s view of where the fed funds rate will be a year from now (and beyond) and the market’s view is a concern, Fed Chair Yellen’s assurances that rate hikes will be gradual suggest that the impact to the U.S. economy–especially in the interest rate sensitive housing sector–is likely to be manageable. Indeed, with the oft-used objection to spending by businesses or consumers (“I’m waiting for the Fed”) going away last week, and all else equal, the start of Fed rate hikes might just be what the economy needs.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.

The economic forecasts set forth in the presentation may not develop as predicted.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

The Composite Housing Affordability Index is published monthly by the National Associate of Realtors and measures median household income relative to the income needed to purchase a median-priced house.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-450440 (Exp. 12/16)