Next week could gring the third gonverment shutdown of 2018, especially after the fireworks out of Washington yesterday. In a widely watched live TV debate, President Trump sparred with Senate Minority Leader Schumer and House Minority Leader Pelosi regarding funding for the proposed wall on the Mexican border and potentially shutting down the goverment.

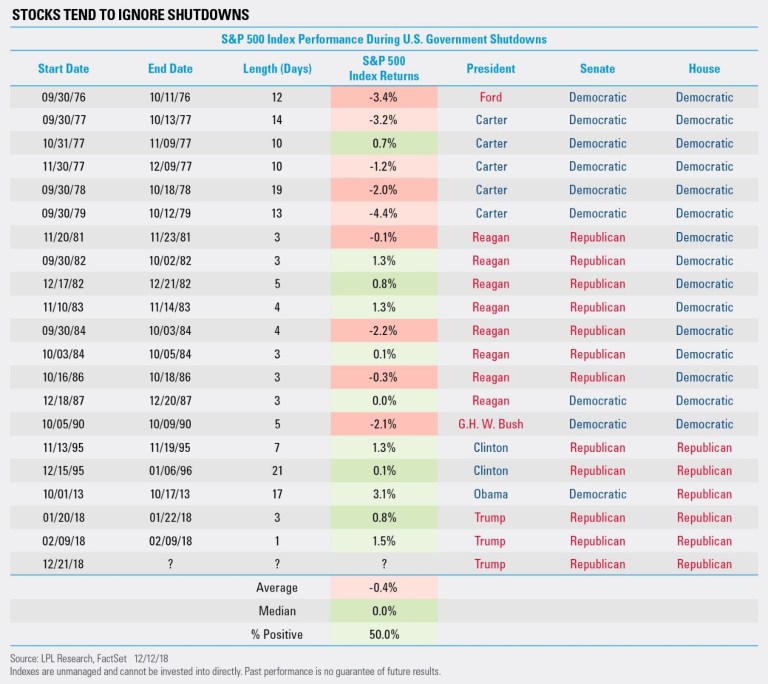

What exactly does a shutdown mean for stocks? “Although shutdowns get a lot of media hype, the reality is that stocks tend to take them in stride. In fact, the S&P 500 has gained during each of the five previous shutdowns,” explained LPL Senior Market Strategist Ryan Detrick.

As the LPL Chart of the Day shows, shutdowns rarely push stocks significantly lower and have corresponded with a flat median return in the previous 20 shutdowns going back more than 40 years.

One would think shutdowns in December might be rare, but they’re actually fairly common. Three shutdowns in the same year, however, is not. Could this year be the first since 1977 with three separate shutdowns? If yesterday’s drama was any indication, the odds may have increased. However, next summer’s debt ceiling debate will be a more important issue when Treasury interest payments are at risk.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not bank/credit union obligations and are not endorsed, recommended, or guaranteed by any bank/credit union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Member FINRA/SIPC

For Public Use | Tracking # 1-801974 (Exp. 12/19)