Slow but steady growth may win the race again as the economic expansion nears the 10-year mark.

While muted growth in the current economic expansion has been frustrating at times, especially after a swift and painful downturn amid the 2008 financial crisis, it has helped extend the life of this cycle and keep excesses in check.

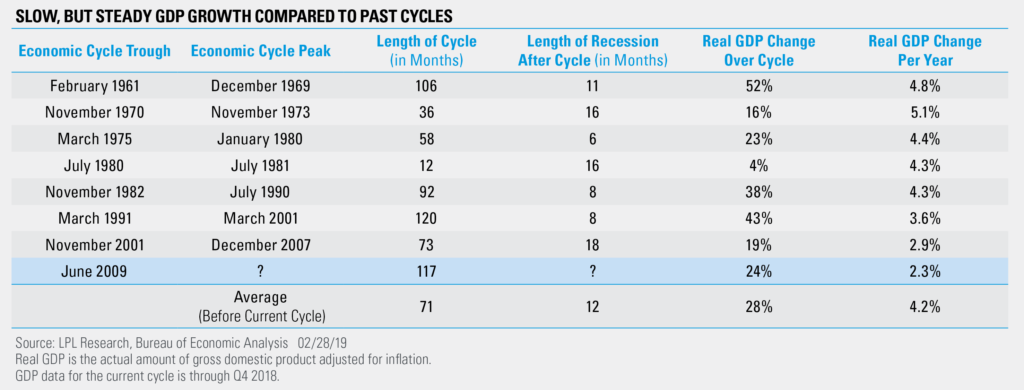

As shown in the LPL Chart of the Day, inflation-adjusted gross domestic product (GDP) has increased an average of 2.3% annually in this cycle, the slowest pace of growth among all expansions since 1970 and a key contributor to this cycle’s near-record age.

Historically, cycles with annual GDP growth higher than 4% lasted about five years on average, while cycles with annual growth lower than 4% lasted about nine years on average.

“While it’s important to be mindful of where we are in the economic cycle, later-cycle economies can continue to exhibit stable growth for years,” said LPL Research Chief Investment Strategist John Lynch. “We’re maintaining our positive outlook for 2019, thanks to our conviction in sound fundamentals supporting moderate economic growth.”

Steady economic growth has been helped in part by a careful and gradual approach to monetary policy. The Federal Reserve’s (Fed) policy efforts have been implemented for several years, but policymakers only started increasing rates in December 2015, more than six years into the expansion. This tightening cycle has persisted for three years now, yet inflation-adjusted interest rates are barely above zero.

Still, inflation has hovered around the Fed’s 2% target for several months now, and wage growth is healthy but manageable. Leading market and economic indicators (including ones we track in our Recession Watch Dashboard) also hint to more runway in the expansion.

For more of our thoughts on the age of this cycle, check out this week’s Weekly Economic Commentary.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

For Public Use | Tracking # 1-828242 (Exp. 03/20)