FED’S FIRST RATE HIKE BOOSTS YIELDS

OVERVIEW

The Search for Income publication is a quarterly guide to our top ideas for income producing securities and strategies. This publication offers active and passive income suggestions from our current mutual fund recommended list, along with suggested exchange-traded funds (ETF). Many of the asset classes/sectors can be used individually or in a diversified portfolio, and several are currently employed in our model portfolios.

Click here to download a PDF of this report.

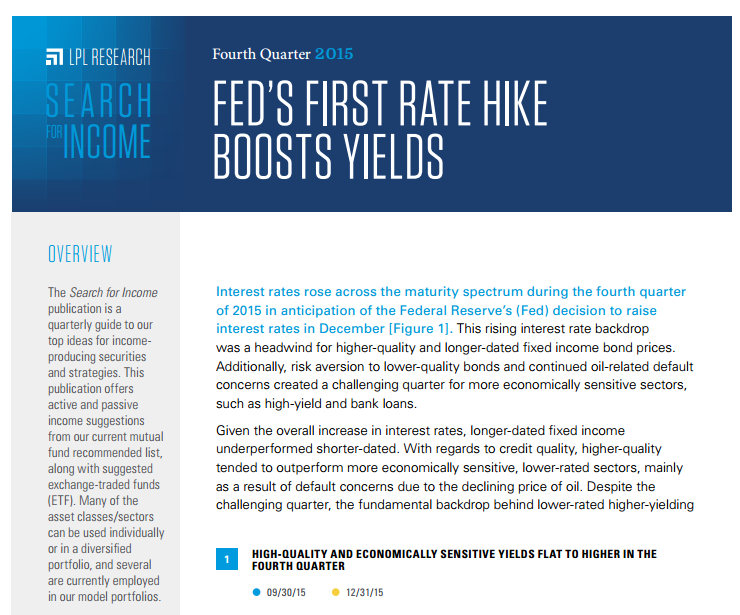

Interest rates rose across the maturity spectrum during the fourth quarter of 2015 in anticipation of the Federal Reserve’s (Fed) decision to raise interest rates in December [Figure 1]. This rising interest rate backdrop was a headwind for higher-quality and longer-dated fixed income bond prices. Additionally, risk aversion to lower-quality bonds and continued oil-related default concerns created a challenging quarter for more economically sensitive sectors, such as high-yield and bank loans.

Given the overall increase in interest rates, longer-dated fixed income under performed shorter-dated. With regards to credit quality, higher-quality tended to outperform more economically sensitive, lower-rated sectors, mainly as a result of default concerns due to the declining price of oil. Despite the challenging quarter, the fundamental backdrop behind lower-rated higher-yielding bonds remains generally positive. The economy continues to expand, albeit modestly.

Yields on high-yield bonds increased to an over four-year high, driven by continued oil price weakness and concerns over related defaults. Investor aversion to lower-quality bonds due to growth concerns became more pronounced into year-end. High-yield bonds continue to be supported by good credit quality metrics and a low default environment. Despite the continued drag of a strong U.S. dollar and the decline in the price of oil, we expect only limited impact on corporate issuers’ ability to repay debt, particularly those issuers outside the energy sector.

Although yields increased among many sectors of the bond market, valuations remain high and yields still low by historical comparison, suggesting a low return environment is likely to persist for income seeking investors.

Among high-quality bonds, we believe municipal bonds may represent a slightly better longer-term opportunity, and taxable equivalent yields remain compelling for income-seeking investors. Municipal bond valuations are still attractive on a long-term basis, but richened over the fourth quarter of 2015 as municipal yields actually declined despite rising treasury yields.

In general, we prefer to look domestically for income-generating investments given the more favorable economic backdrop, which should continue to support credit quality. Currently, our best ideas for potential income generation are:

- High-yield bonds (taxable and tax-free)

- Bank loans (floating rate funds)

- Preferred stocks

- Investment-grade corporate bonds (intermediate and long term)

- Emerging markets debt (EMD)

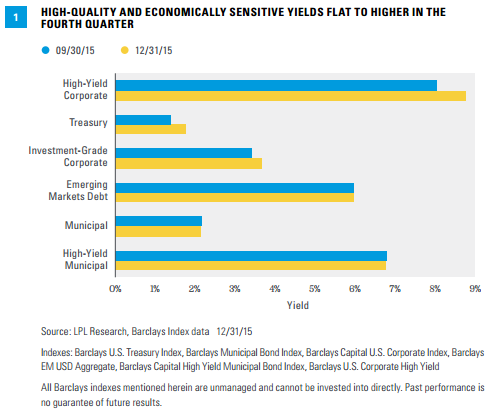

High-yield bonds (taxable) remain a way to potentially generate above-average interest income. The high-yield sector’s average yield increased to 8.7% over the fourth quarter. As of December 31, 2015, the average yield comprises a 7.0% advantage over comparable Treasuries, above that from last quarter (6.7% as of September 30, 3015) and above the 20-year average of 5.8%.

Bank loans had a volatile fourth quarter, but exhibited less volatility than high-yield bonds, as has historically been the case. Therefore, they may be an option for more conservative clients, who seek yield while simultaneously mitigating interest rate risk.

Like the broader bond market, the possibility of rising interest rates poses a risk for preferred stocks, but the added yield and good underlying credit quality should help. Bank credit quality trends continue to improve—Q3 data shows that banks continued to improve their equity to total assets ratio, indicating a further decline in leverage.

Investment-grade corporate bond prices were hurt by broad high-quality bond market weakness during the fourth quarter of 2015, but modestly outperformed Treasuries by 0.4%. Demand for investment-grade corporates, from investors rotating out of high-yield and bank loans and looking to move up the quality spectrum, was a tailwind for the sector. Valuations richened slightly as a result, with the average yield advantage to Treasuries down slightly during the fourth quarter of 2015 to 1.7%, above the long-term average of 1.4%. Investment grade corporate bonds remain an income-producing option among high-quality domestic bonds, especially considering the low yields on other high-grade bond sectors, such as Treasuries and mortgage backed securities (MBS). The high-quality nature of investment-grade corporate bonds makes them more sensitive to rising interest rates, however.

Emerging markets debt (EMD), though still impacted by the overhanging contagion fears from China’s economic slowdown and concerns over continued weakness in the price of oil, weathered the difficult fourth quarter well. Valuations are in-line with those seen early in the first quarter of 2015, with the average yield spread of 4.1%, near the high end of a five-year range.

The income-focused theme within the Model Wealth Portfolios (MWP) is another strategy to consider, which combines multiple asset classes and sectors. These portfolios’ goals are to seek excess total return and, secondarily, to pursue higher overall yields than the LPL Research blended benchmarks.

FAVORITE SECTOR/ASSET CLASS IDEAS

High-Yield Bonds (Taxable and Tax-Free): Our Preferred Asset Class Within Fixed Income

Risk aversion to lower-quality bonds was the main driver of the challenging fourth quarter for high-yield bonds. The yield difference between the highest quality high-yield bonds and the lowest-rated widened significantly over the fourth quarter, an indication of reduced appetite for risk by the markets.

Continued weakness in the price of oil, which fell another 18% during the fourth quarter, caused additional weakness in high-yield energy, exacerbating price declines in the overall high-yield market. Fear over energy-related defaults led to an increase in the average yield spread of high-yield bonds over comparable Treasuries, leading to the -2.1% return for high-yield during the fourth quarter.

The fundamental backdrop for high-yield remains positive, on balance. Credit quality remains firm and defaults, though increasing throughout 2015, remain low historically and are likely to remain low partially due to the absence of near-term maturities.

The average yield of the high-yield bond market, based on Barclays High Yield Index, reached a four year high during the fourth quarter of 2015, ending the quarter at 8.7%. Although elevated relative to recent history, this yield is still below the long-term average of 9.4% [Figure 2].

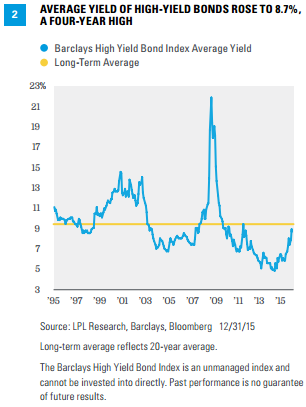

The average yield advantage of high-yield bonds to Treasuries increased to 7.0% as of December 31, 2015, up slightly from the end of the third quarter of 2015 [Figure 3]. This yield spread rose further above the long-term average of 5.8%, and therefore, may represent good value given still adequate corporate fundamentals, below-average defaults, and low high-quality bond yields. High yield has cheapened further to start 2016, with the spread to comparable Treasuries increasing to 8.3% as of January 21, 2016.

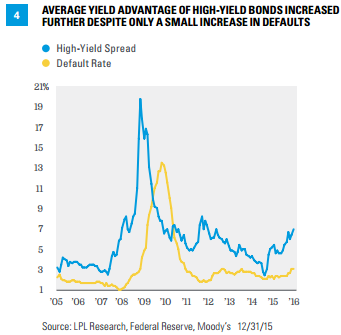

Meaningful numbers of energy sector defaults have yet to materialize but remain a risk moving into 2016. High-yield spread levels at the end of the fourth quarter were enough to compensate investors for a precipitous uptick in defaults, a scenario we see as unlikely [Figure 4]. The global high-yield default rate notched up to 3.4% over the

fourth quarter of 2015, according to Moody’s.

For diversification purposes—and to reduce individual security risk—we recommend investors use a mutual fund or exchange-traded product (ETP) for exposure to this asset class.

Suitable investors, regardless of tax bracket, may wish to consider municipal (tax-free) high-yield bonds. The average yield of tax-free high-yield bonds is 6.8%, according to the Barclays High Yield Municipal Index (as of December 31, 2015), now considerably lower than that of the taxable high yield market. The average yield of the index is a bit misleading, because a hefty 20% of the municipal high-yield market is comprised of depressed Puerto Rico bonds that are pushing the average yield of the widely followed Barclays Index higher. Puerto Rico was downgraded to below investment grade during the first quarter of 2014.

The average yield advantage of high-yield municipal bonds to AAA-rated municipal bonds increased to 4.3% (as of December 31, 2015), just above the 4.2% seen at the end of the third quarter. The average yield spread remains slightly above the four-year average but is heavily influenced by volatile Puerto Rican issues. The greater yield is not without risks. Municipal high-yield bonds have longer maturities, and therefore, tend to be more interest rate sensitive than their taxable counterparts, a risk worth noting should interest rates rise. Interest rate sensitivity was one of the primary drivers of high yield municipal bond weakness in 2013, but a strong positive driver in 2014.

Credit quality trends, like those of the taxable market, are largely supportive of the sector in our view. According to the Municipal Securities Rulemaking Board (MSRB) and Municipal Market Advisors data, the number of defaulted municipal issuers fell again in 2015, down from the already low level witnessed in 2014. In general, municipal defaults remain isolated and have been concentrated in more speculative sectors.

Please be aware that the vast majority of tax-free, high-yield funds generate income that is subject to alternative minimum tax (AMT). Again, we recommend investors use a fund to gain exposure. Please contact the fund or ETP companies directly to obtain a copy of the prospectus for the percentage of income subject to AMT.

Floating Rate Bank Loans: More Conservative Approach to High-Yield

Companies rated below investment grade issue loans (debt) via banks for their short-term funding needs (hence the name “bank loans”). Most bank loans are senior secured debt, as the companies generally pledge specific tangible assets for the loan, ranking them above traditional bonds and equities in a corporation’s capital structure. These securities typically pay a higher yield than shortterm securities (generally 1.0–4.0% above Libor, the London interbank offered rate) and seek to provide protection against rising interest rates, because the interest rate on bank loans adjusts at regular intervals to reflect changes in a short-term rate (usually three-month Libor). Unlike traditional fixed-rate bonds (where rising interest rates hurt their prices), when rates rise, bank loans pay a higher rate and their prices do not necessarily fall; but, conversely, they generally do not benefit from rising prices associated with falling interest rates.

With an above-average yield, bank loans are an income alternative that helps balance the need for income generation with interest rate risk. Bank loans were one of the least impacted sectors during the taper tantrum bond market sell-off of May and June 2013 due to their lack of interest rate sensitivity. Conversely, the sector did not benefit from falling interest rates during the third quarter of 2015.

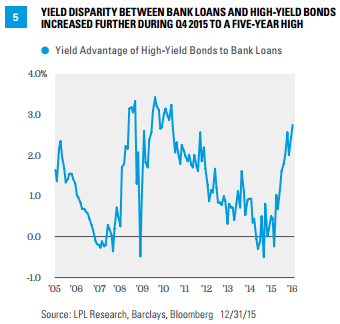

The yield differential between bank loans and high-yield bonds increased again over the fourth quarter of 2015 [Figure 5]. At the margin, this makes high-yield bonds more attractive relative to bank loans. However, bank loans have historically exhibited much less volatility than high-yield bonds, and therefore, may be a good option for more conservative investors. The lower volatility of bank loans was evident during the equity market weakness of the third quarter 2015 when bank loan prices held up better relative to high-yield. During the fourth quarter, however, bank loans underperformed high-yield. Much of this was driven by supply and demand as investors, ahead of the Fed meeting in December, exited positions that were popular during periods of rising interest rates. The yield disparity between high-yield bonds and bank loans increased slightly during the fourth quarter to 2.7%, its highest level in over five years and well above the 10-year average of 1.3%.

Like high-yield bonds, credit quality metrics for bank loans are good, and defaults remain well below the historical average. Exposure to the energy sector in the bank loan market is much less than in the highyield market and comprises just 5% of the market according to Standard & Poor’s data.

Preferred Stocks: Potentially Attractive Yields

Preferred stocks are fixed income securities that income-seeking investors may want to consider. The financial sector, which comprises roughly 80% of all preferred issuers, has benefited from stable to improving bank credit quality metrics. Financial regulation may limit growth opportunities but increased capital requirements help reduce bondholder risks. An improving economy will likely also lend support.

We still believe the sector can be used as a potential income generator in today’s fixed income environment, but caution is warranted. Average yields of preferred stocks decreased to 5.5% over the fourth quarter of 2015, but are still more than 1% above the start of 2015. This yield level is misleading, however, as very low interest rates have increased redemption risk for preferred stocks, driving down the yield-to-call in the sector. Whether many preferred securities will be redeemed is unknown at this point and will take time to unfold. Due to the varied nature of the preferred market, the yield advantage to comparable Treasuries may vary depending on the specific investment product.

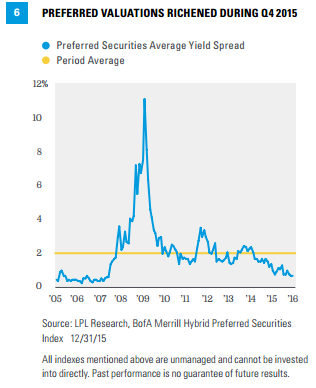

The average yield advantage to Treasuries decreased to 0.7% over the fourth quarter of 2015, indicating slightly richer valuations compared with the end of the third quarter. During the fourth quarter, preferred stocks benefited from investor demand, as investors left more economically sensitive asset classes, leading to a tailwind for preferreds. Yield spreads fell even farther below the historic norm [Figure 6]. Given the favorable economic backdrop and improved credit quality of financials, we believe the sector can be used as an income option; however, lower yields will likely result in lower total returns.

Because preferred stocks have extremely long 30-to 50-year maturities, they possess interest rate sensitivity. The sector exhibited good resiliency during bouts of rising interest rates over the past three years, but 2013 price weakness served as a reminder to investors. The yield advantage to Treasuries will help offset higher interest rate risk, but investors need to be aware of this risk.