KEY TAKEAWAYS

- Dealer inventories can affect the bond market, but less so than bond yields’ true drivers: economic growth, inflation, and Fed policy.

- Risks from foreign selling, or the prospect of a fragile market, are manageable in our view.

Click here to download a PDF of this report.

RISING BOND DEALER HOLDINGS

The recent rise in bond dealer Treasury holdings has spawned concerns about the U.S. bond market, ranging from foreign selling to the potential fragility of the bond market. Elevated bond dealer holdings can present a threat to bond prices, which is relevant now given bonds’ strong start to 2016, but we do not see substantial risks. High dealer inventories may have a short-term impact, but, in our view, are highly unlikely to displace economic growth, inflation rates, and Federal Reserve (Fed) policy as the primary drivers of bond yields.

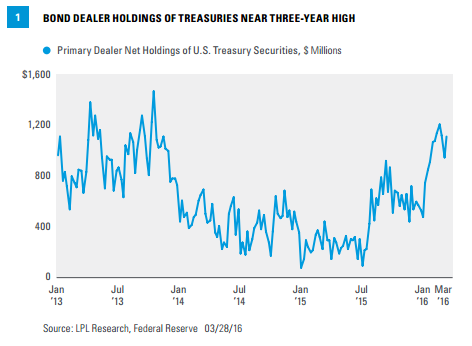

Dealer inventories of U.S. Treasury bonds have increased to the highest levels since the taper tantrum in 2013 [Figure 1]. The latest increase in inventories began this January when China conducted its latest round of currency devaluation.

FOREIGN SELLERS

China partially funded its currency devaluation by selling some Treasury holdings, raising the fear that U.S. dollar strength may spur additional selling by other countries. International investors still own roughly 50% of outstanding Treasury securities, with China the largest among them. The Treasury’s recently released Treasury International Capital (TIC) report revealed that foreign central banks and governments were sellers of Treasuries in January 2016. However, TIC data cover both official (government) and private international investors. Private foreign investors were buyers and helped offset central bank Treasury selling in January. Global economic concerns and U.S. dollar strength are two main drivers behind private foreign investor purchases.

Concerns over China’s Treasury sales may be overblown. China has been a net seller in recent months, liquidating more than $100 billion since July 2015, just ahead of its first notable currency devaluation in August 2015. However, Treasuries have strengthened significantly since July 2015, with the 10-year Treasury yield falling by 0.5% from the end of June 2015 through March 28, 2016, defying fears that foreign selling might lead to a rout in the Treasury market.

In fact, China has often been a seller of Treasuries since early 2014, but that has failed to derail a gradual decline in Treasury yields [Figure 2]. The relationship between China’s Treasury holdings (including Belgium, where some of China’s Treasury holdings are custodied) and Treasury yield changes is inconsistent at best. Concerns over foreign Treasuries sales will likely persist in the popular media but the Treasury market has shown an ability to absorb such flows.

MARKET MECHANICS

Simple market mechanics have also played a role. A strong Treasury rally, which began very early in January 2016, ultimately gave investors an opportunity to sell in February and March, given the magnitude of gains. The stock market also recovered in mid-February and provided investors with another reason to sell. By mid-March, the substantial 0.6% decline in the 10-year Treasury yield from January 1 to February 11, 2016, was cut in half. Long-term Treasuries, which led performance of high-quality bonds early in 2016,* comprise a sizable amount of the run-up in dealer inventories in recent weeks, according to TIC data.

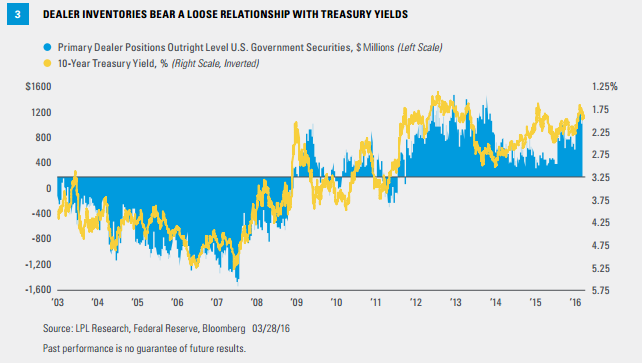

The level of dealer Treasury holdings bears a close, but not perfect, relationship with the level of Treasury yields, meaning that dealer inventories act as a shock absorber in up and down markets [Figure 3]. During higher-yielding environments, inventories are lower (and negative); conversely, inventories are higher in lower-yielding environments. Dealers act as a source of liquidity for all market participants. However, much of the post-2008 period has been influenced by financial regulation, which has motivated bond dealers to hold Treasuries at the expense of other bond sectors.

Still, the overall level of inventories suggests bond dealers’ capacity to take on additional inventory is limited, and this poses a risk to the broad bond market. Renewed selling could lead to losses, as dealers may be reluctant to support the market. In this way, inventories can act as a contrarian indicator for market direction; but their history as a timing indicator tool is spotty, as inventories can remain lean or heavy for some time before markets react.

On a positive note, elevated inventories have occurred several times before with only one, the 2013 taper-tantrum, resulting in a significant sell-off. Bond dealer inventories declined slightly at the end of March 2016, suggesting this risk is fading.

QUARTER END

Historically, the end of every quarter often results in elevated dealer inventory as bond dealers clean up balance sheets for financial reporting purposes. On a global basis, this holds true as well; the end of March marks the end of the fiscal year in Japan, a historically weak period for bonds influenced in part by Japanese sales as money is repatriated. This phenomenon has faded in recent years but could be another factor behind relatively high dealer inventories.

CONCLUSION

The recent rise in dealer inventories is not attributable to any single factor, but a strong start to 2016 for high-quality bonds, a recovering stock market, foreign central bank selling, and quarter end are all likely contributors. These market forces do not detract from what we believe are the primary drivers of bond yields: economic growth, inflation, and Fed policy. The still high level of inventories suggests the bond market may be sensitive to additional selling, but it is likely not enough to offset the impact of these fundamental drivers. This week’s batch of top tier economic data, which should impact all three of these drivers, will potentially hold more sway on bond yields than the dealer inventories.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Treasury international capital (TIC) is select groups of capital that are monitored with regards to their international movement. Treasury international capital is used as an economic indicator that tracks the flow of Treasury and agency securities, as well as corporate bonds and equities, into and out of the United States.

TIC data are important to investors, especially with the increasing amount of foreign participation in the U.S. financial markets.

INDEX DESCRIPTIONS

The Barclays U.S. Government Bond Index is comprised of the U.S. Treasury and U.S. agency indexes. The index includes U.S. dollar-denominated, fixed-rate, nominal U.S. Treasuries and U.S. agency debentures (securities issued by U.S. government owned or government sponsored entities, and debt explicitly guaranteed by the U.S. government).

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-482461 (Exp. 03/17)