Fourth quarter earnings reporting season begins this week with about three dozen S&P 500 companies set to report results. The action kicked off this morning with Citigroup’s numbers, which will be followed by several other major banks later in the week, as well as a smattering of results from some consumer and industrial companies. So what does corporate America have in store for us?

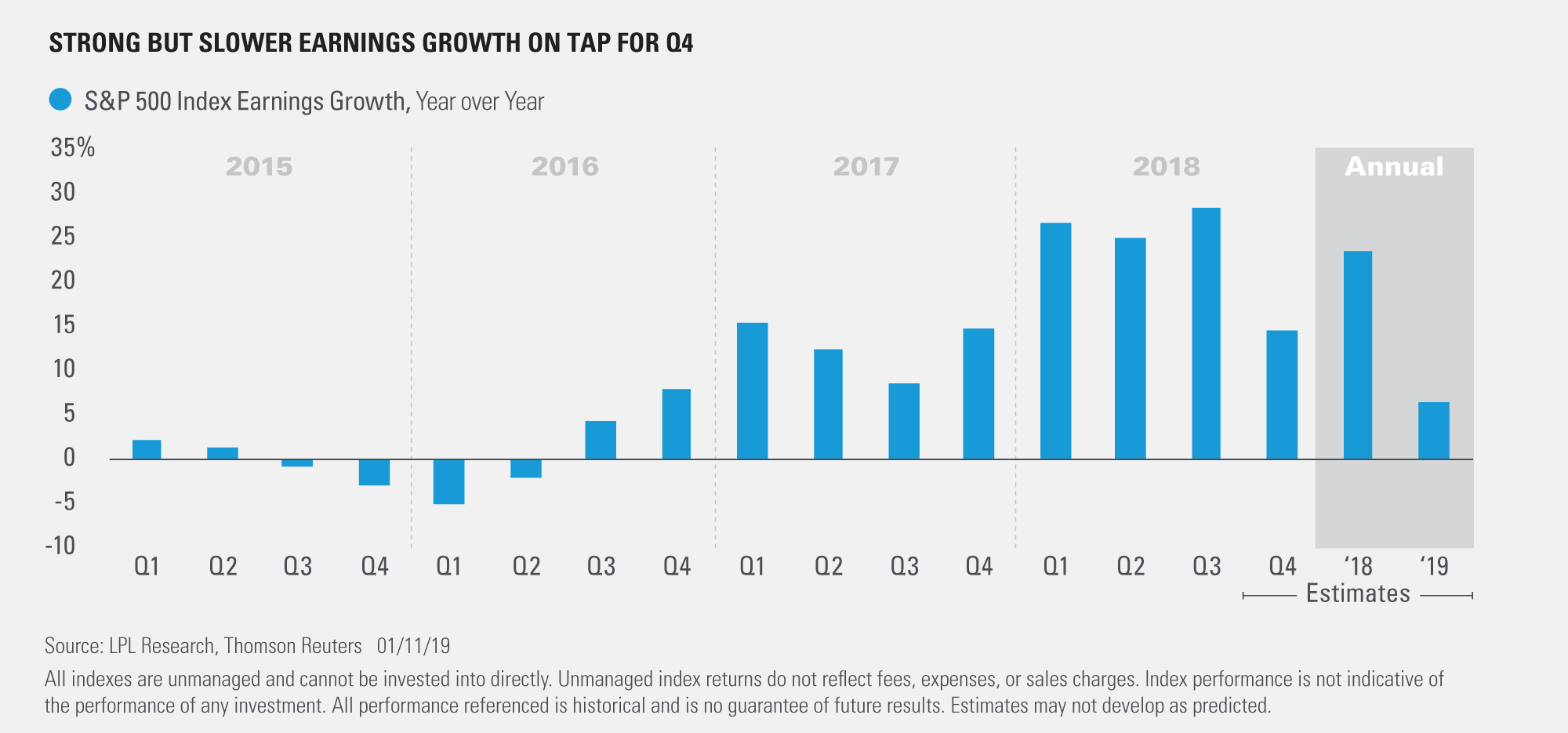

As we alluded to in the title, we expect results to be quite good, with a potential mid-to-high-teens increase in S&P 500 earnings, as shown in the LPL Chart of the Day. A solid economic growth backdrop, tax cuts, sharply higher energy sector earnings, and stock buybacks will all help drive gains. That’s strong growth for sure, but it’s slower than the 25% pace of the past three quarters. Without the big boost from tax reform in 2019, growth is set to slow even more in

Investors are understandably nervous about the impact of the U.S.-China trade dispute on companies’ profit outlooks for 2019. LPL Chief Investment Strategist John Lynch notes, “We believe a mid-to-high single-digit increase in S&P 500 earnings in 2019 is achievable, based on a still-solid, albeit slower U.S. economic growth and fiscal policy support, alongside manageable inflation and continuing share buybacks.”

Keep in mind that the bar has been lowered quite a bit already, in part thanks to the revenue warning from Apple earlier this month. Over the past three months, consensus estimates for S&P 500 earnings for the fourth quarter and 2019 have been cut by 4-5%. Still, in the coming year, tax cuts will continue to provide support, though less so, and steady economic growth and buybacks will likely continue to help. Primary risks we see include further escalation of U.S.-China trade tensions, a pronounced slowdown in Europe, and a pickup in wage inflation without corresponding productivity growth, which could impair profit margins.

To follow the numbers, look for our earnings season dashboard here next week and throughout earnings seasons.