KEY TAKEAWAYS

- Q2 earnings season may look a lot like Q1 as companies once again face the twin drags of the energy downturn and strong U.S. dollar.

- Corporate America may impress in other ways, such as its resilience to the latest Greece and China flare-ups.

- As earning season progresses, we will watch for evidence that earnings will accelerate in the second half.

Click here to download a PDF of this report.

Q2 EARNINGS PREVIEW

Q2 earnings season could potentially look a lot like Q1. The Thomson-tracked consensus is calling for a 3% year-over-year decline in S&P 500 earnings for the second quarter, dragged down once again by the energy sector and a strong U.S. dollar. We believe this earnings estimate can be exceeded due to the improving economic growth in the U.S. and Europe during Q2, and the low bar set by an above-average 4:1 ratio of negative-to-positive preannouncements (long-term average back to 1995 is 2.7) and recent earnings trends where the average upside “beat” over the past 16 quarters is 4%. An upside in-line with prior quarters would leave earnings up by 1-2% compared with Q2 2014, similar to the Q1 result (+2%).

The biggest stories this earnings season will again be energy and the dollar, which are expected to combine for a roughly 10% drag on S&P 500 earnings overall. But these drags will potentially share the spotlight with two others: Greece and China. We expect corporate America to tell us that the knock-on effects on their businesses from turmoil in Greece and the bursting of China’s stock market bubble have been very limited and that earnings are poised to accelerate during the second half of the year.

POTENTIAL EARNINGS WINNERS & LOSERS

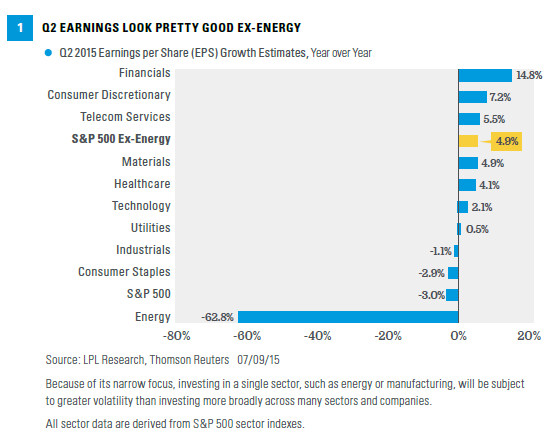

According to the Thomson-tracked consensus, the strongest earnings growth in Q2 is expected to come from the financials and consumer discretionary sectors [Figure 1], and we believe healthcare may surprise to the upside due to modest expectations and favorable industry trends. Ex-energy, consensus estimates are for a 5% gain as of Friday, July 10.

For financials, shrinking regulatory charges and a steeper yield curve could possibly help the sector produce double-digit year-over-year earnings growth in Q2. However, late quarter volatility could negatively impact trading desks for Wall Street firms.

The consumer discretionary section could potentially benefit from lower prices at the pump, relative to a year ago, and may also get a boost from the continued recovery in the housing market that gained steam during the second quarter.

We also expect healthcare to be an earnings winner, led by biotech. Continued strong drug development trends and benefits from an increased number of insured patients under the Affordable Care Act may enable the sector to run its string of consecutive double-digit earnings growth quarters to six. It won’t be easy with consensus estimates currently calling for only about a 4% increase, but remember the sector delivered a 10% upside earnings surprise in Q1 2015.

Companies in developed international markets may also be winners. Stronger economies in Europe (Greece aside) and Japan, coupled with the currency benefits to exporters from a weak euro and yen, should enable global multinationals based in Europe and Japan to potentially produce solid earnings gains in the double-digit range in Q2.

Energy is likely to be a detractor again with the Thomson-tracked consensus expecting a more than 60% year-over-year decline in Q2 earnings. However, energy’s estimates have been the most resilient of all sectors over the past three months, suggesting the sector may be poised to beat expectations despite renewed weakness in oil prices.

MANAGEABLE GREECE & CHINA IMPACTS

We do not expect instability in Greece or severe stock market volatility in China to have a meaningful impact on U.S. corporate profits or economic growth. We may see some impact on confidence in Europe, which may have a modest negative influence on consumer spending. But given the small size of the Greek economy (less than 2% of Eurozone gross domestic product as of March 31, 2015) and our belief that the risk of contagion in broad European financial markets will be well contained, we expect any impact on the U.S. to be limited, regardless of whether Greece stays in the Eurozone.

Even in the event that a further slowdown in the Chinese economy accompanies the bursting of the bubble in mainland China shares (so called “A-shares”), it is unlikely to have much impact on U.S. corporate profits. Europe is a destination for more U.S. exports than China (10-15% versus less than 5%). China does have outsized influence over commodity markets, for example the latest drop in oil and metal prices, which will have some negative impact on commodity producer earnings. But mining is a marginal portion of the S&P 500 and we think energy sector estimates are low enough, suggesting this impact may also be manageable.

GUIDANCE IS KEY

Guidance is always critical during earnings season and influences stocks more, because it’s forward-looking compared with the backward-looking measures of results, but we think it is especially important this earnings season for two reasons. First, consensus estimates have been slashed so much for the year that we believe the actual results may come in above current estimates. And second, the S&P 500 has pulled back about 2.5% since the May 21, 2015, peak (as of July 10) on overseas concerns, so we will be looking to corporate America to provide a catalyst for markets to reverse recent losses. We believe some optimism from management teams and potential analyst estimate hikes could help reverse this latest slide in the U.S. market.

Estimates may actually rise during earnings season. Estimates have already been cut by a sharp 7% to +1% year over year for the S&P 500. And energy estimates for Q2 and the second half of 2015 have actually increased slightly since the start of Q2.

Other factors that may support positive guidance:

- The drop in commodity prices over the past year translates to lower costs for certain consumer and industrial segments of the market.

- Continued strong cost controls should help sustain profit margins at high levels.

- Share buybacks will continue to provide a boost to earnings per share calculations (estimated at 2-3%).

- The modest pullback in the U.S. dollar (about 4% since the May 13, 2015, peak) likely means that a currency-related earnings drag will begin to ebb this quarter.

- Despite a roughly $7 drop since the latest Greece flare-up in late June, oil prices still averaged 19% more in Q2 2015 than in Q1 2015; we believe further gains in crude oil over the rest of 2015 may help steady energy profits and could create the potential for upside surprises from dramatically lowered expectations.

DON’T BE ALARMED BY FALLING ESTIMATES

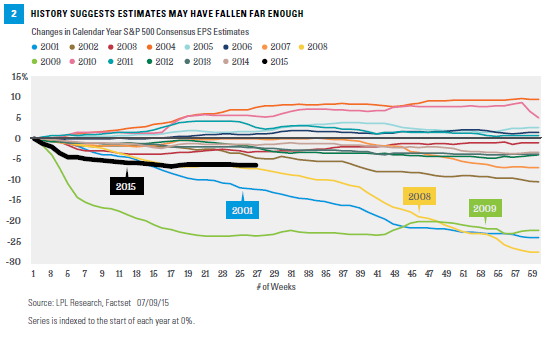

Earnings estimates typically fall throughout the year. Analysts are overly optimistic about the profits companies under coverage can deliver each year, and those estimates usually come down as results come in. On average, estimates have fallen 6% since 2001 during each calendar year. Even absent recession years, estimates still fall on average by 1%.

Figure 2 shows the path of estimates for each calendar year back to 2001 including year to date 2015. What is notable is the 6% reduction in 2015 estimates (represented by the thick black line that ends at about 28 weeks), largely due to energy and the dollar, and despite a lack of recession signals. The initial drop looks similar to the one in 2008 and is shallower than only 2001 and 2009 (all three recession years). In other words, a fairly negative outlook is factored in, compared with the estimates at the start of year. The U.S. economy is not in a recession, suggesting that estimates are likely to at least remain steady and may be poised to rise in the second half, assuming the U.S. economy doesn’t enter a recession.

Click here for Figure 2, “History Suggest Estimates May Have Fallen Far Enough.”

CONCLUSION

Q2 earnings season may look a lot like Q1 and therefore may not be particularly impressive on the surface, due to the twin drags of the energy downturn and strong dollar. But corporate America may impress in other ways, such as its resilience to the latest flare-ups in Greece and China, or by providing outlooks that lead to analysts raising estimates or to strong earnings growth outside the energy sector. As companies report over the next six weeks or so, our main focus will be looking for evidence that earnings will accelerate in the second half of the year.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

All indexes are unmanaged and cannot be invested into directly.

Because of its narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-400272 (Exp. 07/16)