KEY TAKEAWAYS

- Global fiscal and monetary policy will be key to watch in the week ahead.

- Tentative signs that the global growth scare may have run its course are emerging.

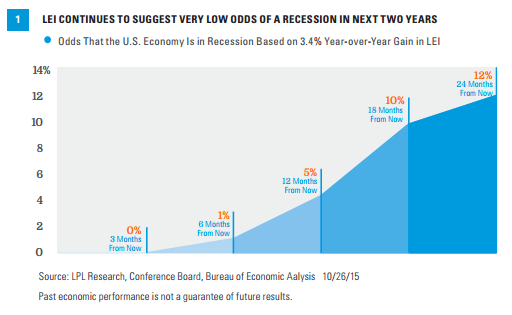

- The September 2015 LEI continues to suggest very low odds of a recession in the next two years.

Click here to download a PDF of this report.

POTENTIALLY PIVOTAL WEEK AHEAD

Last week (October 19-23, 2015), some tentative signs emerged indicating that the global growth scare may have run its course. This global growth scare has been building for over a year now, but intensified in August and September, leading to the first 10% or more correction in the S&P 500 Index in four years. This week, several key events may impact monetary, fiscal, and economic policy in the coming weeks and into 2016.

But before we look ahead, a quick look back at last week may be in order. One highlight is the September 2015 reading on the Conference Board’s monthly Leading Economic Index (LEI), released on October 22, 2015. The LEI is one of our Five Forecasters* and provides a valuable monthly guidepost regarding where we are in the economic expansion. The latest reading revealed the LEI climbed 3.4% over the past 12 months. The 3.4% reading in September 2015 is a clear downshift from the 4-6% year-over-year readings recorded throughout most of 2015, and the lowest reading in more than two years (July 2013). Based on that downshift, the odds of a recession occurring in the next few years have risen, but remain low [Figure 1].

*LPL Research looks for excesses in the market and economy by examining the Five Forecasters-data series that have had a statistically significant historical track record of providing warning signs that we are transitioning to the fragile, late stage of the economic cycle.

Reports that painted a slightly more upbeat picture of the global economy included:

- Reports on manufacturing sentiment in the U.S., Japan, and the Eurozone, which were better than lowered expectations in October and have stabilized in September and October 2015, after a difficult first eight months of 2015.

- Homebuilder sentiment in October and existing home sales and housing starts for September, which continue to suggest that housing, although just 5% of gross domestic product (GDP), remains robust amid the slowdown in the manufacturing sector.

- Better than expected readings on retail sales in the U.K. and Italy for August and September, suggested that, as in the U.S., the consumer in Europe is holding up well despite manufacturing weakness.

- In Asia, a better than expected third quarter GDP report in South Korea–an economy with close ties to China–added to the better tone, as did another month of improvement in Chinese property prices in October.

Ultimately, it was monetary policy (another rate cut in China) and a strong hint from the European Central Bank (ECB) that it would increase the size of, or extend, its quantitative easing (QE) program at its December 2015 meeting that helped to convince markets that perhaps the worst of the slowdown may be over.

BUSY WEEK OF DATA AHEAD

Looking ahead to this week, another round of key economic data in the U.S., Europe, the U.K., and China; an important set of votes in the U.S. House of Representatives that could impact near-term fiscal policy in the U.S.; and the meetings of the Federal Reserve (Fed) and the Bank of Japan (BOJ) to set monetary policy may help set the tone for the rest of 2015 and well into 2016.

The key report in the U.S. this week will be the initial release of GDP for the third quarter of 2015. The consensus of economists polled by Bloomberg News expects GDP will expand at a 1.5% annualized rate in the third quarter, a clear deceleration from the 3.9% pace in the second quarter. Market participants will scour the report for signs that the weakness in the third quarter was limited to areas of the economy most impacted by the drop in oil prices, the stronger dollar, and the slowdown in China-mainly business capital spending, inventories, and net exports. The market expects solid readings in consumer spending (which accounts for two-thirds of the economy) and housing.

The market will be using a similar set of lenses as it looks through the other data due out this week: the third quarter Employment Cost Index (ECI) data, as well as the September data on durable goods orders and shipments, pending home sales, and new home sales. The Fed is watching wages closely as it decides when-and by how much-to raise rates, and the ECI is one of the Fed’s favored metrics for wages. The market is looking for an acceleration from 0.2% in the second quarter to 0.6% in the third. The market expects some stability in the durable goods orders and shipments for September, and continues to expect that the home sales data due this week will show the housing market, and by proxy, the consumer, are holding up well despite the weakness in manufacturing.

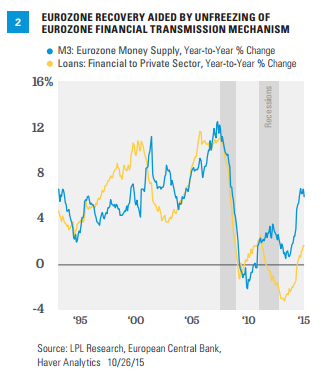

Early in the week, reports on third quarter GDP in the U.K., Spain, and Taiwan; the October Consumer Price Index (CPI) and consumer confidence data in the Eurozone; and the bank lending and money supply data in the U.K. and Eurozone are likely to draw the most attention from markets. But later in the week, focus falls on China’s manufacturing Purchasing Managers’ Index (PMI) data for October. Signs that improving domestic demand is offsetting external weakness in the Eurozone and the U.K. will be key for investors, and, of course, any signs of stabilization in China’s manufacturing activity will be welcome as well. Our long-held view is that a healthy Eurozone financial transition mechanism [Figure 2] remains key to a reaccelerating Eurozone economy, and we expect to see more evidence to that effect this week.

FISCAL AND MONETARY POLICY ALSO IN FOCUS

Policy (both fiscal and monetary) may take some of the market’s attention away from the data this week. On the fiscal front, the U.S. House of Representatives will elect a new speaker to replace John Boehner, who is leaving his role at the end of the month. Paul Ryan (R-WI) has recently become the front-runner to replace Boehner, and market participants expect that once elected speaker, Ryan will be able to pass key legislation to lift the debt ceiling early next month and avoid a government shutdown in early December. Looking ahead, Ryan provides the best hope for market-friendly economic legislation to pass into law in 2016; thus, if Ryan is not elected speaker, the market may react negatively.

Fiscal concerns in China, albeit more long term in nature, are also on the docket this week as China’s Communist Party meets to discuss its next five-year economic plan. While most market participants don’t expect any specific new spending measures to be announced this week, the tone set by the planning meeting may impact markets for years to come. Chinese policymakers have been pulling out all the stops in recent weeks and months, cutting rates, increasing fiscal stimulus, and easing regulations in order to smooth China’s transition from an export-led manufacturing economy to a more consumer-led domestically based economy. The Communist Party meeting this week will provide more information as to how China will progress toward that goal in the next half decade.

Monetary policy is at the forefront this week as well, with central bank meetings in the U.S., Japan, Russia, Mexico, Sweden, and New Zealand. While only Russia is expected to cut rates (according to the consensus of economists as polled by Bloomberg News) the BOJ may announce that it is speeding up and/or increasing the size of its QE program, while the Fed may clarify its policy plans for the coming weeks and months. Because this week’s Federal Open Market Committee (FOMC) meeting won’t include a new set of economic or interest rate projections, and Fed Chair Janet Yellen will not hold a post-meeting press conference, markets don’t expect much from the Fed this week. As it stands today, market participants (as measured by the federal funds futures contracts) don’t expect the Fed to raise rates until the middle of next year, doubting that the economy and inflation will hit the Fed’s targets. Our long-held view remains that the Fed will raise rates in late 2015 or early 2016, as the improving labor market and stabilizing oil prices push up wages and headline inflation.

IMPORTANT DISCLOSURES

All performance referenced is historical and is no guarantee of future results.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for your clients. Any economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

All indexes are unmanaged and cannot be invested into directly.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Leading Economic Indicators (LEI) Index is a measure of economic variables, such as private-sector wages, that tends to show the direction of future economic activity.

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

Quantitative easing (QE) refers to the Federal Reserve’s (Fed) current and/or past programs whereby the Fed purchases a set amount of Treasury and/or mortgage-backed securities each month from banks. This inserts more money in the economy (known as easing), which is intended to encourage economic growth.

The Bureau of Labor Statistics (BLS) Employment Cost Index (ECI) is a quarterly release that gives information on the costs of labor for businesses in the United States.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Purchasing Managers’ Indexes (PMI) are economic indicators derived from monthly surveys of private sector companies, and are intended to show the economic health of the manufacturing sector. A PMI of more than 50 indicates expansion in the manufacturing sector, a reading below 50 indicates contraction, and a reading of 50 indicates no change. The two principal producers of PMIs are Markit Group, which conducts PMIs for over 30 countries worldwide, and the Institute for Supply Management (ISM), which conducts PMIs for the U.S.

The money supply is an economic term for the total amount of currency and other liquid assets available in an economy at a point in time. There are several ways to define this number. M1 includes physical money such as coins and currency, checking accounts (demand deposits), and Negotiable Order of Withdrawal (NOW) accounts. M2 includes all of M1, plus time-related deposits, savings deposits, and non-institutional money-market funds.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-433875 (Exp. 10/16)