We believe we are now in the early stages of a new economic cycle. We anticipate many more years of growth.

WHERE WE ARE

More than most years, it’s hard to look ahead to the next year, to 2021, without looking back at 2020. A global pandemic, a massive economic collapse, a bear market, a surprisingly sharp reversal, a hotly contested election where passions ran high, the impact of lockdowns—it was an unusual year of extraordinary challenges. In 2021 it’s time to restart the engines, but things are going to look different, feel different. 2020 has changed us, the way we do business, the way we connect. It’s also shown us our constants, what works for us, and what we hold on to.

In 2021 we restart the engine, but we’re not driving toward the same world we left behind in 2019. It’s not even our destination. There has been damage to areas of the economy that may never fully recover, but there are other areas that will adapt, reinvent themselves, and help reinvigorate growth. In Outlook 2021: Powering Forward, we’ll talk about stocks and bonds, the economy, and the post-election policy environment, but in the background will be new challenges, new opportunities, and new ways of doing things.

Thankfully, one constant has been the value of personal and professional relationships, even if we’ve had to learn how to connect in new ways. Sound financial advice offered a long-term map for many investors that helped them from getting off course in a turbulent 2020. There are still risks to navigate in 2021, but it’s time to get back on the road.

COVID-19. Over the course of the year, we have seen an increased understanding of how to contain the COVID-19 virus, important progress on how to treat those hospitalized, and promising developments on treatments and potential vaccines. Nevertheless, conditions have worsened heading into late 2020, with a record number of confirmed cases and increased hospitalizations. We believe we will see continued advances in 2021 that will further limit the impact of the virus by the end of the year, but it will be a process. In the meantime, the goal remains to keep the economy as open as possible while making sure that our healthcare system doesn’t get overwhelmed and the most vulnerable are protected.

Policy. We expect global central banks to remain supportive and for individual economies to continue to refine their responses to COVID-19. In the United States, what will likely be a divided government may help limit the size of any tax hikes and regulation while still supporting additional fiscal stimulus that may include high-priority items for both Democrats and Republicans. We could also see movement toward a similar deal on infrastructure. Greater clarity on trade may make it easier for some companies to do business, but a more challenging regulatory environment may be an offset.

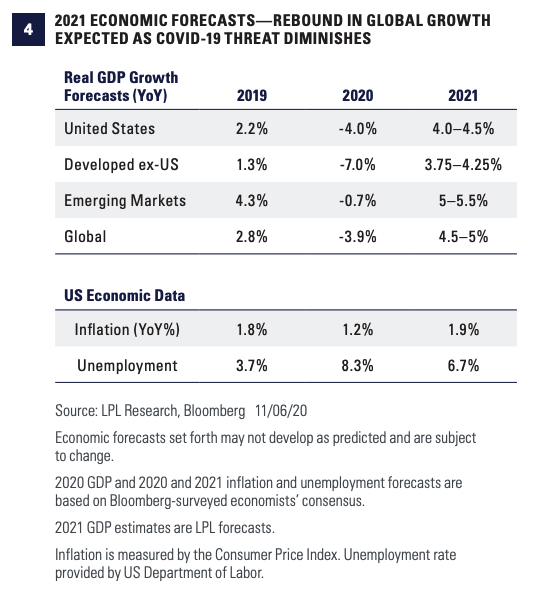

Domestic Economy. Continued progress in the response to COVID-19, including further stimulus, will be the key to sustaining the recovery. COVID-19-impacted service industries may be the last to bounce back. We expect some of the accelerated innovation that came with the COVID-19 response to have a positive long-term impact. We forecast a 4–4.5% US gross domestic product (GDP) growth in 2021.

International Economy. Emerging market economies may lead to a global rebound. We believe growth in international developed economies may lag behind the United States, although a strong fiscal response may help Japan. We forecast global GDP growth of 4.5–5%.

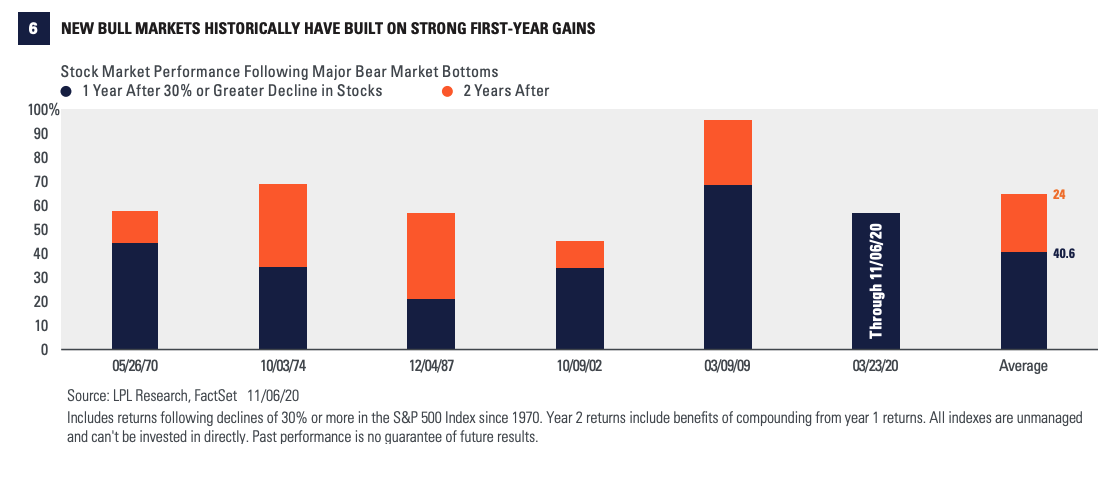

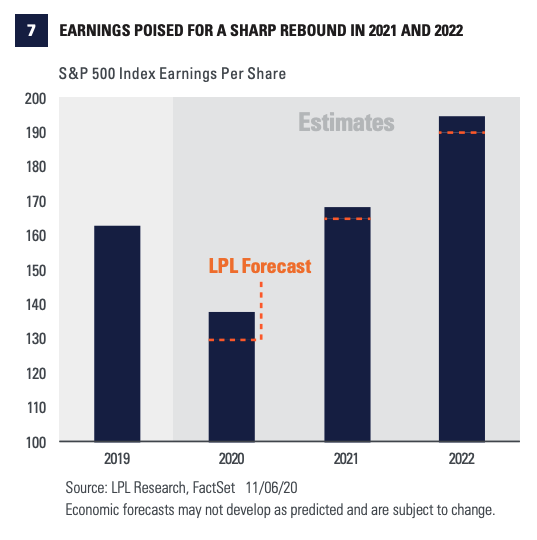

Stocks. A strong earnings rebound in 2021 may allow stocks to grow into somewhat elevated valuations. Cost efficiencies achieved during the pandemic may persist. We see an S&P 500 Index fair value target range of 3,850–3,900 in 2021 with potential for upside with better-than-expected vaccine progress.

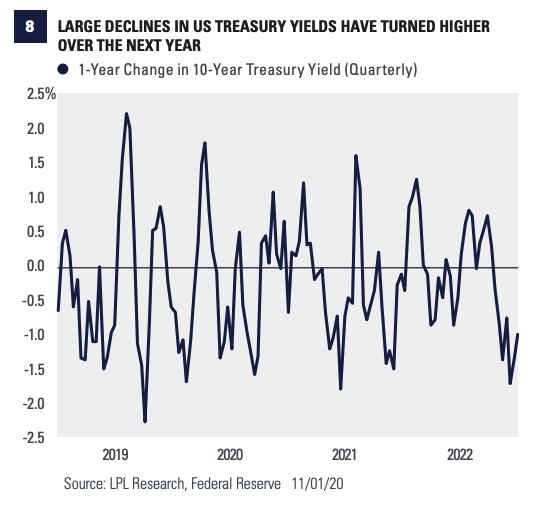

Bonds. Inflationary pressure is likely to be limited, and the Federal Reserve (Fed) is expected to keep rates low, but economic improvement and even normalizing inflation could put upward pressure on rates. We see the 10-year yield finishing 2021 in a range of 1.25–1.75% with a bias toward the lower end.

POLICY: A NEW COURSE

It can be tempting to over-emphasize the importance of elections in formulating investment strategies. But in 2020—from a markets perspective—the elections garnered a distinct level of importance with so much at stake, including the potential impact from COVID-19 policy, tax increases, a change in direction on trade relations, and multi-trillion dollar government spending programs.

Getting past the uncertainty presidential elections bring, with all else being equal, has been positive for the stock market historically. 2020 was no different, with a strong post-election rally in November as investors gained some clarity.

The Senate, however, has not delivered the policy clarity investors and corporate leaders would like. Control of the Senate will be decided on January 5 with runoff elections for Georgia’s two Senate seats, with Republicans currently holding a 50–48 advantage. If the Democrats win those two seats, the vice president would cast any tie-breaking votes, effectively giving the Democrats control of the Senate.

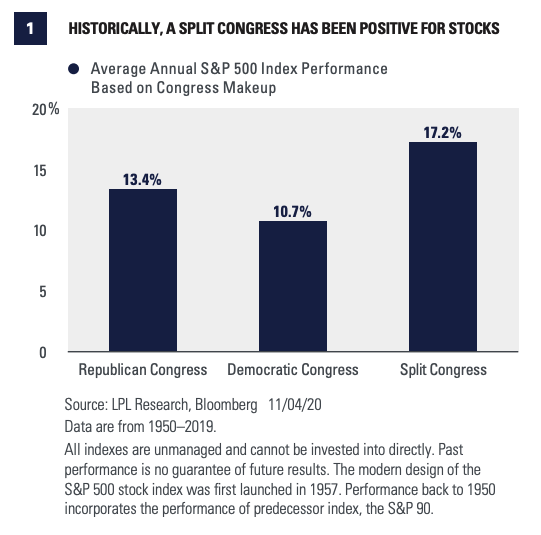

The makeup of the Senate—favored to remain in Republican control—has significant policy implications. Our focus is on what appears will be the most likely outcome— a Congress split between a Republican Senate and Democratic House of Representatives with Joe Biden as president—which we view as market-friendly. History shows that stock returns have been strongest with Congress split, which we expect in 2021 [Figure 1].

Taking a New Course

Perhaps the most important implication of divided government is that it likely takes President-elect Biden’s large proposed tax increases off the table. The corporate tax changes Biden has proposed—now very unlikely to happen—would potentially cut S&P 500 earnings by 10% or more in 2021. Smaller targeted tax increases might still be possible to fund a scaled-down version of Biden’s green energy and infrastructure investment programs, but big and broad tax increases are probably off the table. Biden might reduce or eliminate tariffs, which could grease the wheels of global trade and provide a boost to earnings.

A fifth COVID-19 relief bill may be the first priority for the new administration, but a package would have to be smaller than previously discussed to get through the likely Republican-controlled Senate. With a vaccine likely coming soon, Republican Senators may balk at a trillion-dollar package, so we could get something less than that either in the lame-duck session of Congress or after Inauguration Day.

Possible investment implications of the new political landscape include:

- Financial services. The regulatory environment for financial companies may be tougher under a Biden administration, but probably not materially so without the support of a Democratic-controlled Congress. Prospects for less fiscal stimulus remove a potential catalyst for higher interest rates.

- Healthcare. A split Congress adds significant hurdles for major healthcare reform, a big positive for the healthcare sector. A public option to compete with private health insurers could have been very damaging for publicly traded managed care organizations, though drug price regulations—which we see as manageable—are likely.

- Technology. We view technology companies as big beneficiaries of a split Congress, as the regulatory environment was expected to be much tougher in a Democratic-sweep scenario. This includes digital media and e-commerce as well.

- Growth overvalue. Given the incrementally tougher interest rate outlook for financials and tailwinds for technology and internet stocks, a split Congress may favor growth. However, a vaccine-fueled boost to economic growth may support value stocks.

- Emerging markets equities. A potentially weaker US dollar and less contentious global trade environment may support emerging markets, notably China. Developed international equities may also get a boost and help limit the drag from recently implemented COVID-19-related lockdowns in the region.

- Municipal bonds. Divided government may limit aid to states and local governments, and if individual tax rates aren’t raised, it would remove a likely positive catalyst for tax-exempt fixed income.

Fed’s Pedal to the Metal

With a divided government, we may not be able to count on another large fiscal stimulus package to steer the economy out of trouble if conditions deteriorate. That leaves the Fed as potentially the only game in town if COVID-19 causes further financial and economic stress. Some potential responses to support the economy may include more bond purchases, additional lending facilities, or a change in messaging that could lengthen the period of time the central bank is expected to maintain its accommodative policy stance. We do not expect the Fed to consider a negative interest rate policy, which has met with limited success in Europe and Japan.

ECONOMY: A NEW START

The US economy was improving nicely early in 2020 after a modest slowdown in the fourth quarter of 2019, and then it skidded to an abrupt stop in the face of COVID-19. The pandemic ended the longest economic expansion ever, lasting more than 10 years. The ensuing recession was unique—we didn’t see the usual extremes like excessive spending or over-leverage that have been the hallmarks of the end of past economic cycles. This recession was caused mainly by the government closing businesses and people staying home in response to COVID-19.

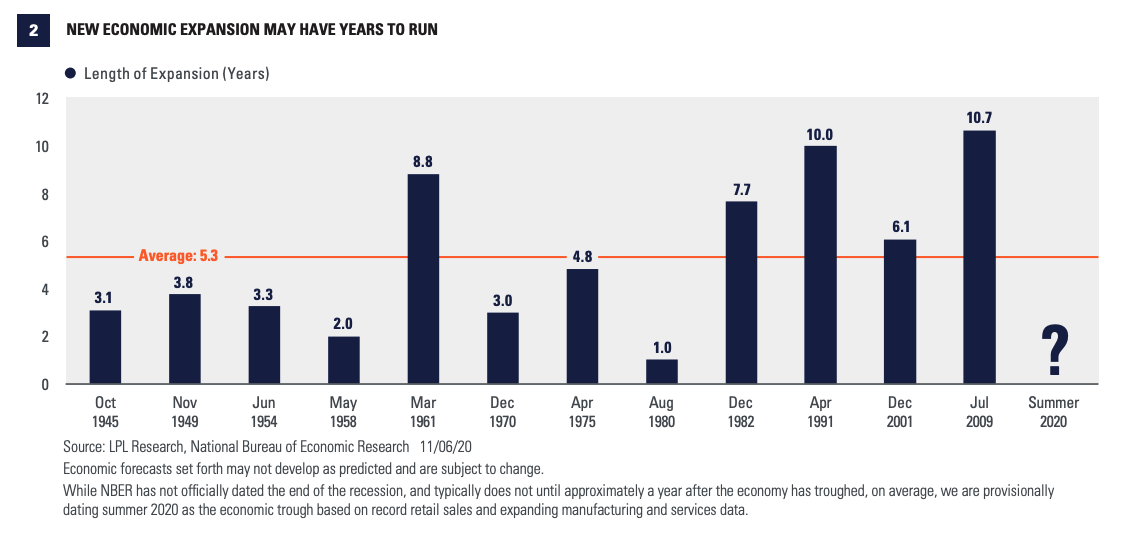

Once the economy began to shift into gear again later in 2020, a new economic expansion likely began. We said this probably would be one of the shortest recessions ever, and although it’s not official as of December 1, 2020, the recession probably lasted less than six months. We believe we are now in the early stages of a new economic cycle.

With an assist from the Fed, high per capita income, and modern banking and business practices, our economy doesn’t have the same booms and busts that developing countries tend to experience, and our economic cycles tend to last longer. Economic expansions since World War II have lasted more than five years on average, with the past four expansions averaging more than eight years. The new expansion may be only a few months old, and with record amounts of monetary and fiscal stimulus firmly in place and a viable vaccine likely to become available in early 2021, we anticipate many more years of growth [Figure 2].

Speeding Up and Slowing Down

After GDP contracted an annualized 5% during the first quarter of 2020 and then a record 30% in the second quarter, the economy revved back up with a 31% jump in the third quarter, bouncing off depressed levels. Efforts to limit COVID-19’s spread, better therapeutics, and optimism over an eventual vaccine helped the economy open back up, but until we have a widely distributed, effective vaccine, many service-oriented parts of the economy will continue to struggle.

This dichotomy that has characterized this recovery may persist well into 2021, as the services part of the economy will be hampered by restrictions, while manufacturing and goods production has moved forward at record speed. Many consumers who can work from home effectively are doing quite well.

Hard-hit services businesses include airlines, hotels, movie theaters, restaurants, and theme parks. About 8 million jobs in the leisure and hospitality industries were lost during the spring lockdowns, according to the US Bureau of Labor Statistics, and only about half of them have come back. Disney already has laid off 32,000 park employees. The impact on these industries will likely be felt beyond 2021.

At the same time, income replacement from the stimulus, a strong housing market, and booming e-commerce activity have remarkably helped drive retail sales to well above their pre-pandemic peak, according to the latest US Census Bureau data. Total US consumer spending surged 41% during the third quarter, on an annualized basis, and has recovered 85% since April 2020 (source: US Department of Commerce). The US consumer has been incredibly resilient during this challenging time.

Swoosh-Shaped Recovery

We believe a swoosh-shaped recovery is still the most likely scenario—a quick, sharp decline, then a partial snapback, followed by a more gradual recovery. The snapback part of the recovery occurred in the late summer of 2020, and now the next leg of economic growth—likely to take at least a year—may be tougher. We like the swoosh shape over the square root-shaped recovery some have suggested, as it reflects a more favorable latter phase of recovery.

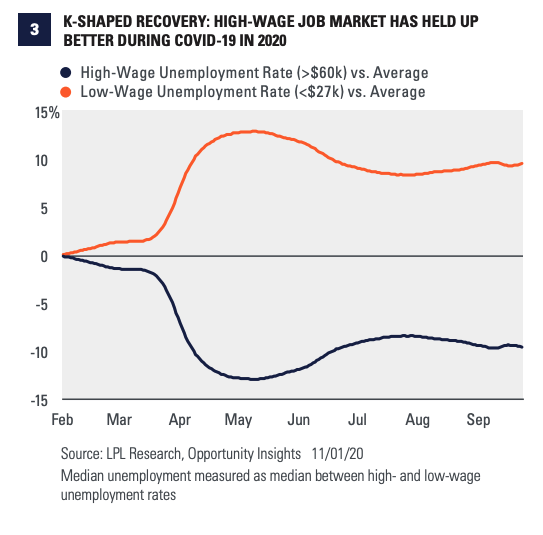

The idea of a K-shaped recovery has gained traction as a way to characterize this economic recovery. If you think about a K, it has one part pointing higher or improving, while the other part is pointing lower, or deteriorating. As is common during recessions and recoveries, parts of the economy have been improving quickly, while other parts are lagging. If you view this also in relation to workers, then this recession and subsequent recovery have widened the divide between the haves and have-nots.

One way to demonstrate this is by breaking the labor market into high- and low-wage employees. The fortunes of high-wage employees (annual salaries greater than $60,000) have been better than those of low-wage employees (less than $27,000 per year) based on the unemployment rates of these two segments [Figure 3], while heading into the recovery they were more similar.

Many of these higher-paying jobs are in industries that are racing ahead, such as technology, digital communications, e-commerce, and residential construction, while lower-paying jobs in areas where social distancing is more difficult, such as restaurants, hotels, airlines, and cruise ships, have been lost and may take much longer to come back.

Continued fiscal support, such as stimulus payments, is needed to help those who are struggling, but a widely available vaccine is needed to help shore up the weaker parts of the economy and lift up the bottom half of the “K.” Even as COVID-19 continues to spread, we expect the economic recovery to continue, bolstered by the stimulus. As the pandemic subsides, restrictions are lifted, and consumers’ daily lives return to something resembling “normal,” the pace of the recovery should pick up speed. We expect this to occur in mid-2021, fueling above-average GDP growth for the full year [Figure 4].

Small Business Holds the Keys

The health of our economy is best gauged by the strength of our small businesses, as they are the economy’s bedrock. Companies with under 500 employees account for more than 95% of US businesses, and they employ about half of the US workforce. With many boots on the ground, small businesses can sometimes spot turning points in the economy before they show up in economic reports—and before many economists and central bankers see them.

Small businesses are quite optimistic about the future of our economy. In September, the Small Business Optimism Index from the National Federation of Independent Business (NFIB) returned to its February peak. This could be one sign of a stronger economy in 2021. As the economic recovery continues, the health of small businesses will go a long way toward determining how robust that recovery will be.

Dollar Downtrend Could Be Lasting

We believe the US dollar is in a major structural downtrend that may potentially continue for years to come. The dollar experienced a historic surge in March 2020 during the height of the lockdowns, as the greenback offers the ultimate safety trade during times of stress. Prior to the surge, the dollar had been weak amid record budget and trade deficits that combined to put pressure on the currency versus major global alternatives. As the economy began to open up and COVID-19 fears began to subside, the dollar once again rolled over and moved lower.

The Fed has made it very clear it plans to stay quite dovish for a very long time, which should be another tailwind for a lower-trending dollar. The dollar has a history of very long cycles, having made major peaks in 1985, 2001, and again in 2017, with years of dollar weakness after the peaks, suggesting another long cycle of dollar weakness may lie ahead.

A potentially weaker dollar would benefit US multinational companies’ profits, boost returns of international investments for dollar-based investors, and potentially provide support for commodities prices.

Although not our base case, we think the odds of a potential double-dip recession, two recessions spaced closely together, may increase as we move into 2022. Recessions are necessary to flush out the excesses. Given many industries and people haven’t felt this latest recession, that flushing process didn’t fully take place this time around, making this recession atypical—and opening the possibility of another short-lived recession down the road.

The length of this recession—we think about six months—was also unusual. The previous shortest recession ever was six months in the early 1980s, which was followed by a weak expansion and then a double-dip recession starting about a year later. Historically, the average recession has lasted about one year, which suggests that perhaps more time may have been needed for the economy to properly reset.

STOCKS: EARNINGS REBOUND MAY SPARK 2021 GAINS

Strong Earnings May Help Stocks’ Valuations

Expect Stocks to Grow Into Their Valuations

Awaiting Style Rotation

Warming Up to Small Caps

Tech Leadership Poised to Continue

Emerging Markets Growth Stands Out

BONDS: STAYING IN THEIR LANE

Interest Rates

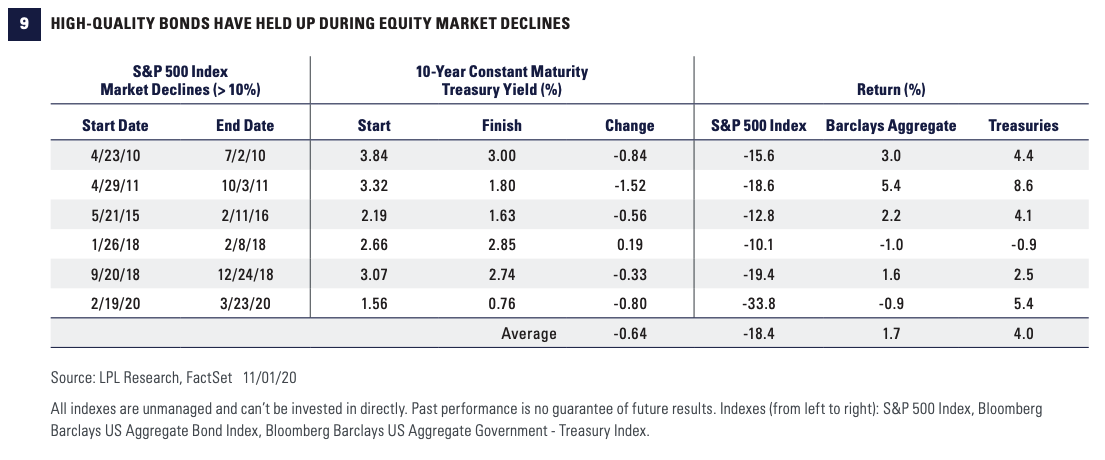

The Case For Quality Bonds: Diversification

Position For Rising Rates

THE FED IN THE DRIVER’S SEAT

Fed policy influences short-term rates, which anchor longer-term rates to a degree, but longer-term rates can still move quite a lot while short-term rates hold steady. The Fed can also influence longer-term rates through its bond-buying program, known as quantitative easing, although if investors see the additional Fed support as a positive sign for the economy, rates can actually push higher during periods of bond purchases, as happened the last cycle.

Current expectations are that the Fed will not raise rates for some time. The median Federal Open Market Committee (FOMC) member “dot plot” forecast doesn’t show an initial rate hike until after 2023. The Fed’s updated policy framework, announced in August 2020, also points to the Fed is on hold for some time. The new framework shifts the Fed’s inflation target from simply 2% to a long-term average of 2%, allowing inflation potentially to run higher if it has run lower for an extended period, as it has in the recent year. In the wake of the Great Recession, the Fed did not raise its policy rate for seven years after lowering it to near 0%.

INFLATION IN THE BACK SEAT

The massive fiscal and monetary stimulus may set the table for a meaningful pickup in inflation down the line, but beliefs were similar in 2009. We believe the near-term inflationary pressures may be limited and that a healthy economy remains a precondition for a meaningful upside surprise in the future. In the near term, slack in the labor market and spare industrial capacity are likely to remain in play at least through 2021, taking some key drivers of inflation out of play.

THE JOURNEY CONTINUES

2020 has been an extraordinary year filled with uncertainty and unexpected challenges that will stay with us for a long time. But looking at 2020 market performance—and ignoring the path to getting there—it was not that unusual a year at all. For long-term investors, 2020 was another year of making steady progress toward long-term investing goals.

2021 may offer similar market performance, although we believe it will offer a smoother path and an economic environment that may simply feel better. Markets are always looking ahead, and even back in March 2020—early in the COVID-19 crisis—they began to respond to the economy and corporate America to power forward, even if the timing was uncertain. Whether we’re looking at earnings or economic data, we’ve exceeded those early expectations to date. 2021 is about continuing to follow that course and maintaining the momentum.

If our base-case—or something close to it—plays out, then years from now market participants may look at the market landscapes in 2020 and 2021 and conclude they had a lot of similarities. Market conditions within each year may have been remarkably different, but in the end, they were just another leg on the journey.

Outlook 2021: Powering Forward was designed to help you navigate a year in which economic conditions may continue to improve dramatically. Understanding the road immediately ahead is essential for navigating its twists and turns, but it will be thoughtful planning and sound financial advice that will keep us on the journey.

GENERAL DISCLOSURES

The opinions, statements, and forecasts presented herein are general information only and are not intended to provide specific investment advice or recommendations for any individual. It does not take into account the specific investment objectives, tax, and financial condition, or particular needs of any specific person. There is no assurance that the strategies or techniques discussed are suitable for all investors or will be successful. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Any forward-looking statements including the economic forecasts herein may not develop as predicted and are subject to change based on future market and other conditions. All performance referenced is historical and is no guarantee of future results.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All index data from FactSet.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

GENERAL DEFINITIONS:

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of the private and public consumption, government outlays, investments, and exports fewer imports that occur within a defined territory.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with a lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share are generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Bloomberg Barclays U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

EQUITY RISK:

Investing in stock includes numerous specific risks including the fluctuation of dividend, loss of principal, and potential illiquidity of the investment in a falling market. Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies. Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time. The prices of small and mid-cap stocks are generally more volatile than large-cap stocks.

EQUITY DEFINITIONS:

Cyclical stocks typically relate to equity securities of companies whose price is affected by ups and downs in the overall economy and that sell discretionary items that consumers may buy more of during an economic expansion but cut back on during a recession. Counter-cyclical stocks tend to move in the opposite direction from the overall economy and with consumer staples which people continue to demand even during a downturn.

A growth stock is a share in a company that is anticipated to grow at a rate significantly above the average for the market due to capital appreciation.

A value stock is anticipated to grow above the average for the market due to trading at a lower price relative to its fundamentals, such as dividends, earnings, or sales.

Large-cap stocks are issued by corporations with a market capitalization of $10 billion or more, and small-cap stocks are issued by corporations with a market capitalization between $250 million and $2 billion.

FIXED INCOME RISKS:

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Bond yields are subject to change. Certain call or special redemption features may exist which could impact yield. Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk, as well as additional risks based on the quality of the issuer, coupon rate, price, yield, maturity, and redemption features. Mortgage-backed securities are subject to credit, default, prepayment, extension, market, and interest rate risk.

FIXED INCOME DEFINITIONS:

Credit quality is one of the principal criteria for judging the investment quality of a bond or bond mutual fund. As the term implies, credit quality informs investors of a bond or bond portfolio’s creditworthiness or risk of default. Credit ratings are published rankings based on detailed financial analyses by a credit bureau specifically as it relates to the bond issue’s ability to meet debt obligations. The highest rating is AAA, and the lowest is D. Securities with credit ratings of BBB and above are considered investment grade. The credit spread is the yield on corporate bonds less the yield on comparable maturity Treasury debt. This is a market-based estimate of the amount of fear in the bond market. BBB-rated bonds are the lowest quality bonds that are considered investment-grade, rather than high-yield. They best reflect the stresses across the quality spectrum.

The Bloomberg Barclays Aggregate US Bond Index represents securities that are SEC-registered, taxable, and dollar-denominated. The index covers the US investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

International debt securities involve special additional risks. These risks include, but are not limited to, currency risk, geopolitical and regulatory risk, and risk associated with varying settlement standards. These risks are often heightened for investments in emerging markets. High yield/junk bonds (grade BB or below) are not investment-grade securities and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Municipal bonds are subject to availability and change in price. They are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply. If sold prior to maturity, capital gains tax could apply.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL is not an affiliate of and makes no representation with respect to such an entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-17646-1020 | For Public Use | Tracking #1-05078306 (Exp. 12/21)