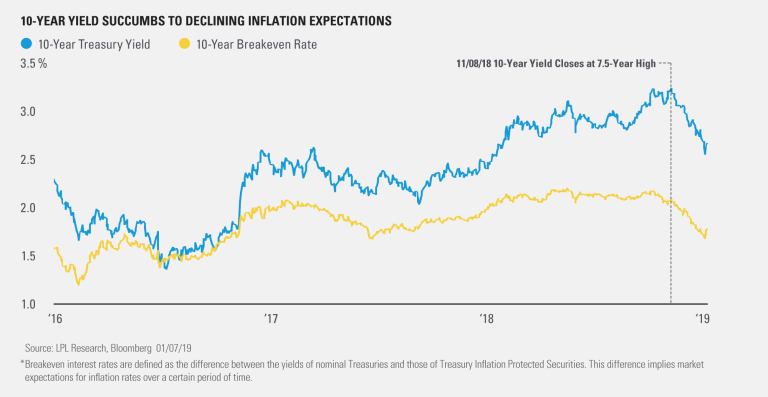

The environment for fixed income investors has been challenging over the last several years, and the struggle has intensified recently. As shown in the LPL Chart of the Day, long-term yields have fallen to 12-month lows, weighed down by plunging inflation expectations as fears of a global slowdown increase.

However, we see a disconnect between current rates and this year’s prospects for economic growth and inflation. As mentioned in our Outlook 2019, Fundamental: How to Focus on What Really Matters in the Markets, we’re forecasting the 10-year Treasury yield will increase from current levels and trade within a range of 3.25—3.75% in 2019.

“Given our expectations for the economy, employment, slightly higher inflation, and balance sheet reduction, we look for market interest rates to move higher in the coming year,” said LPL Research Chief Investment Strategist John Lynch. Investors may have to endure periodic spikes and drops in rates, but we think this range is appropriate given the balance of Federal Reserve (Fed) guidance, U.S. Treasury issuance, wage pressures, and relative valuations.

Although markets may currently be pricing in a pessimistic outlook, we remain optimistic about U.S. economic growth prospects, and recent data show inflation remains at manageable levels. Because of this, we expect the data-dependent Fed to be less aggressive than initially feared as policymakers juggle these factors with the impacts of a stronger U.S. dollar and tepid global growth.

Against this backdrop, we expect near-flat returns for the Bloomberg Barclays U.S. Aggregate Bond Index in 2019. We continue to position portfolios with below-benchmark interest rate sensitivity and above-benchmark credit risk to help manage rising and position for continued economic growth.

As we move further into the business cycle, our bias is increasingly toward higher-quality debt, like investment grade (IG) corporates and mortgage-backed securities (MBS) for suitable investors. We believe IG corporates and MBS may provide some potential benefits from added quality-credit exposure while avoiding some of the

For more of our forecasts, check out our Outlook 2019.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk, as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

Credit Quality is one of the principal criteria for judging the investment quality of a bond or bond mutual fund. As the term implies, credit quality informs investors of a bond or bond portfolio’s credit worthiness, or risk of default. Credit ratings are published rankings based on detailed financial analyses by a credit bureau specifically as it relates the bond issue’s ability to meet debt obligations. The highest rating is AAA, and the lowest is D. Securities with credit ratings of BBB and above are considered investment grade.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Member FINRA/SIPC

For Public Use | Tracking # 1-809142 (Exp. 01/20)