KEY TAKEAWAYS

- Municipal bonds have started 2016 on a strong note, despite lagging Treasuries.

- High-yield municipal bonds have managed to avoid the problems of the taxable high-yield bond market as the two remain structurally different.

- Although municipal valuations have become more attractive, historically low yields and a challenging seasonal period augur for a slowdown.

Click here to download a PDF of this report.

MUNICIPAL CHECK-IN

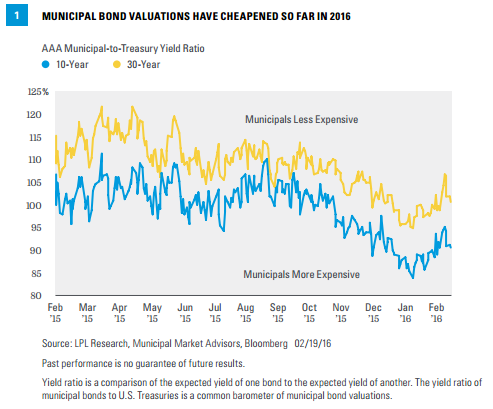

Municipal bonds have failed to keep pace with Treasury strength so far in 2016, but performance has been robust. The Barclays Municipal Index has returned 1.6% year to date (as of February 18, 2016) versus 3.1% for the Barclays Treasury Index. A performance gap is often typical during periods of falling rates in response to market stress as investors flock to top-quality U.S. Treasuries, but municipal bonds still benefited from high-quality bond strength. In response, municipal valuations relative to Treasuries cheapened, as indicated by average AAA municipal-to-Treasury yield ratios [Figure 1].

MATCHING A RECORD LOW

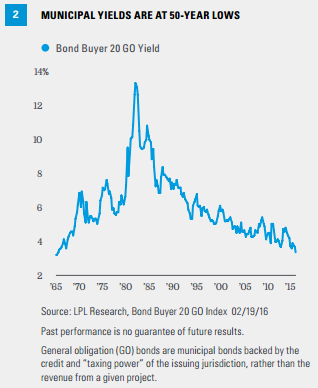

Although valuations are more attractive now, municipal yields are at or near 50-year lows [Figure 2], according to the Bond Buyer 20 Index of general obligation (GO) bonds. Looking strictly at top-rated AAA GO yields, average 10- and 30-year yields are 1.8% and 2.8%, respectively, below the 2% and 3% levels that have often worked to restrain demand in the past. Investors may once again find the lower yields unappealing and demand may soften. Lower yields also provide less of a buffer if interest rates turn higher, even if the prospect of higher rates is reduced due to recent market volatility and increasing expectations that the Federal Reserve (Fed) will take a slower approach to raising interest rates than recently forecast by the Fed in December 2015.

The drop of the 10-year yield to start 2016 (down 0.6% over the first six weeks of 2016) indicates that additional high-quality price gains may be hard to achieve, absent severe additional market stress. Treasuries finished last week (February 15-19, 2016) broadly unchanged. Yields may not revert higher soon, however, as our analysis shows that periods of extreme Treasury gains, like the one experienced recently, do not necessarily reverse over the short term (see our Bond Market Perspectives, “How Extreme It Is”).

SUPPLY

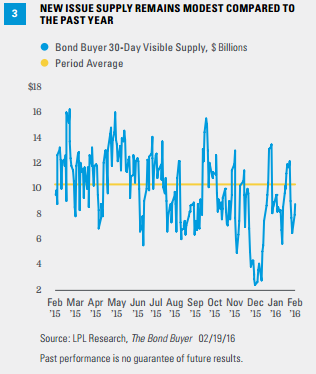

Supply suggests any weakness may be limited. New issuance has been modest for most of 2016; and although supply for the week of February 22, 2016, is expected to be a more average level of $8 billion, the 30-day projected volume remains relatively modest at approximately $9 billion [Figure 3]. Compared with the past year, the forward calendar looks relatively modest.

Low yields may bring in more sellers, which could increase secondary market supply, as opposed to the new issue market, and offset low new issue supply. This could pose an additional challenge; but with overall demand for tax-exempt interest income high, secondary supply would have to increase rapidly, which we view as unlikely given lingering investor concerns.

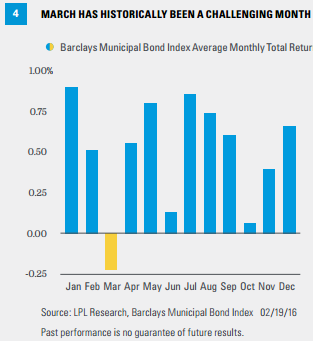

March has historically been a difficult month for the municipal market. A difficult seasonal period for bonds overall and tax-related selling ahead of the April 15 tax deadline are the two primary reasons. In fact, March is the only month in which the Barclays Municipal Bond Index has averaged a negative return since 1990 [Figure 4]. Given the difficult stock market environment in 2015, capital gains-related selling may be more muted than past years and mitigate the potential threat to the municipal bond market.

TAX-FREE VERSUS TAXABLE HIGH-YIELD

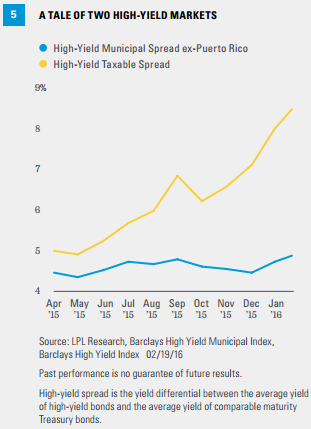

Municipal high-yield, though similar in name, has managed to avoid the turbulence of the taxable high-yield corporate bond market. The average yield advantage of municipal high-yield bonds to the AAA national average municipal bond yield has increased since the middle of 2015, when high-yield taxable concerns began to grow. However, it only increased by roughly 0.5% according to the Barclays High Yield Municipal Index, compared with a greater than 3% rise in the taxable high-yield bond market, as measured by the Barclays High Yield Index average yield advantage to the five-year Treasury yield [Figure 5].

The resilience of the municipal high-yield market speaks to its inherently better credit quality. The default rate on below-investment-grade municipal bonds has historically averaged 20% of taxable high-yield bonds.* Municipal high-yield bonds do not have the energy-related exposure that has plagued the taxable high-yield bond market. Aside from Puerto Rico and isolated problem issuers, the municipal market continues to benefit from an expanding economy and gradual improvement in the financial health of state and local governments. Through the first six weeks of 2016, the number of municipal defaults is running roughly half of the already low 2014 and 2015 levels,** a sharp contrast to rising defaults in the taxable high-yield market.

CONCLUSION

Recent Treasury strength, prompted by a flight to safety at the beginning of 2016, has left municipal bonds looking attractive on a relative basis. However, yields are at or near long-term lows and a challenging time of year may limit additional capital appreciation. Municipal strength is therefore likely to slow. Limited supply, lingering economic uncertainty, and a Fed that seems to be taking a more gradual pace of interest rate hikes suggest near-term weakness, if any, may be limited.

*According to Moody’s Long-Term Default Study.

**According to Municipal Securities Rulemaking Board (MSRB) filing and Municipal Market Advisors (MMA) data.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

The credit ratings are published rankings based on detailed financial analyses by a credit bureau specifically as it relates the bond issue’s ability to meet debt obligations. The highest rating is AAA, and the lowest is D. Securities with credit ratings of BBB and above are considered investment grade.

High-yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

INDEX DEFINITIONS

The Barclays U.S. Municipal Index covers the USD-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds.

The Barclays Municipal High Yield Bond Index is comprised of bonds with maturities greater than one-year, having a par value of at least $3 million issued as part of a transaction size greater than $20 million, and rated no higher than ‘BB+’ or equivalent by any of the three principal rating agencies.

The Barclays U.S. Treasury Index is an unmanaged index of public debt obligations of the U.S. Treasury with a remaining maturity of one year or more. The index does not include T-bills (due to the maturity constraint), zero coupon bonds (strips), or Treasury Inflation-Protected Securities (TIPS).

The Barclays U.S. Corporate High Yield Index measures the market of USD-denominated, noninvestment-grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below, excluding emerging market debt.

The Bond Buyer 20 Index is a representation of municipal bond trends based on a portfolio of 20 general obligation bonds that mature in 20 years. The index is based on a survey of municipal bond traders rather than actual prices or yields. It is published by The Bond Buyer, a daily financial publication.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-470981 (Exp. 02/17)