Market Update

- Equity advance continues, oil gets OPEC boost. U.S. stocks are set to build on a strong finish to last week, with modest gains this morning that will likely push the S&P 500 to another record high, at least on an intraday basis. The major indexes advanced nearly 1% on Friday following the strong jobs report, led by financials (+1.9%), while countercyclical utilities (-1.4%) and telecom were the only two sectors to end in the red. Investors will be looking ahead to retail earnings this week. Overseas, the Shanghai Composite rose nearly 1% even amid gloomy Chinese trade data as investors anticipate fresh stimulus from the Bank of China, while Japan’s Nikkei advanced 2.4% on the strong U.S. job news. Elsewhere, WTI crude oil is enjoying a 2% bounce on renewed talk of a production freeze by some OPEC members, COMEX gold is soft to start the week, and the 10-year Treasury yield is up to 1.61%.

Macro View

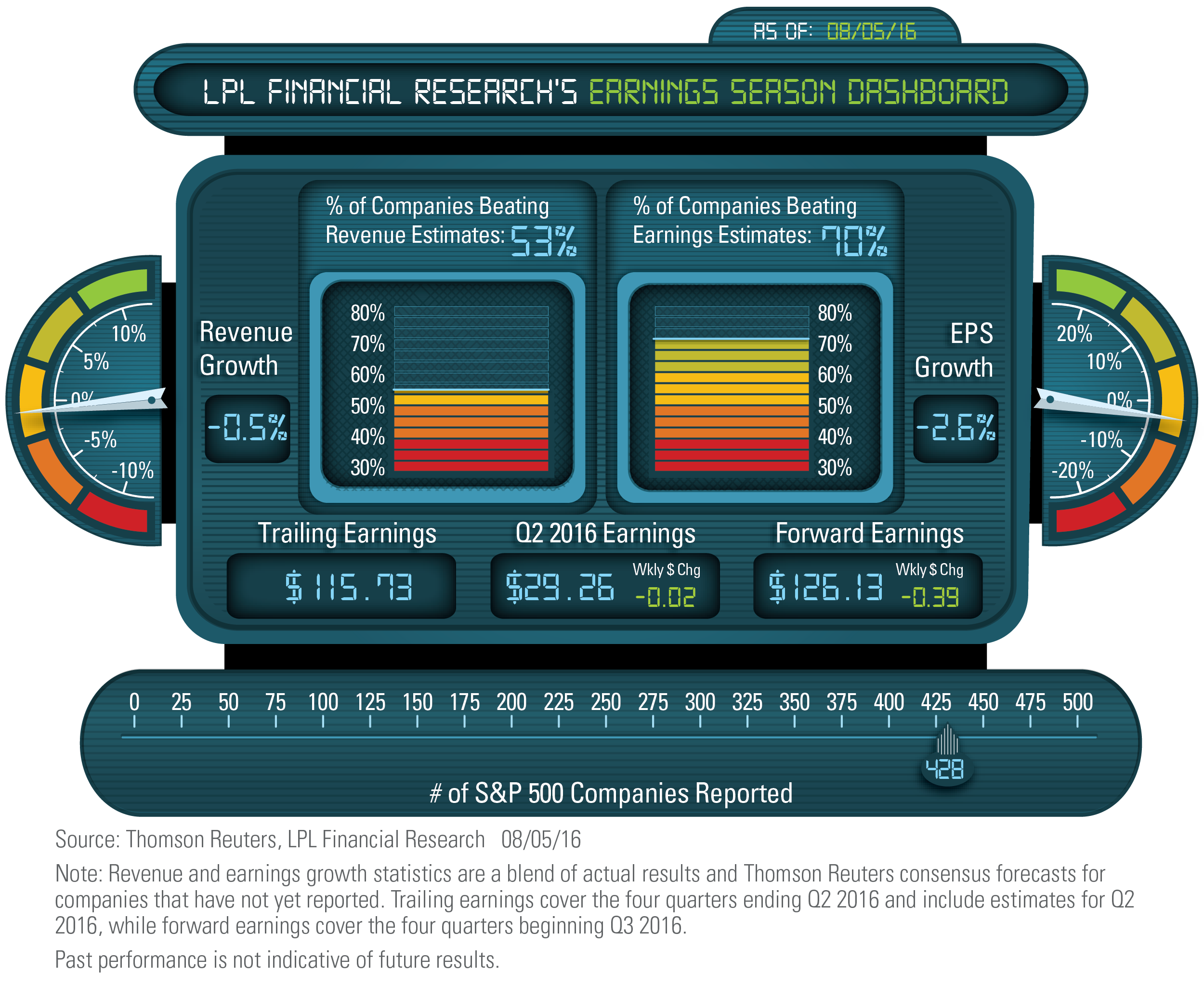

- Second quarter earnings season has been okay but we were hoping for more. With about 85% of S&P 500 companies having reported second quarter results, S&P 500 earnings are tracking to a 2.6% year-over-year decline, which means the earnings recession is poised to continue. Although the numbers for the quarter were not great, there have been some encouraging signs, including solid results from the technology sector and resilient forward estimates overall. In this week’s Weekly Market Commentary, due out later today, we provide an overview of the earnings season and discuss prospects for a second half earnings rebound. Later this month we will update our Corporate Beige Book barometer, an analysis of the topics covered in companies’ earnings conference calls.

- Tech has been the clear highlight of earnings season.Technology has produced the biggest upside surprise of any sector in the second quarter, while second half estimates have been revised higher—the only sector besides utilities that can make that claim. The sector has benefited from powerful shifts toward mobile and cloud computing, as well as the continued strength in ecommerce. With each passing day, these growth areas become a bigger share of sector revenue and, with their better profit margins, improve the profitability and growth profile of the sector, which remains one of our favorites.

- Chinese trade disappoints. Both Chinese imports and exports came in less than expected. Exports, which say more about the rest of the world than China itself, fell -4.4%, versus expectations of a -3.5% decline. Imports, which are more a function of Chinese domestic consumption, fell -12.5%, versus expectations of a -7% decline. All numbers are annual declines. Some of the weakness is due to lower commodity prices over the past year. Still, these are not good numbers from China as it seeks to rebalance its economy.

- The low, and in many cases negative, interest rate environment in Europe has been highly detrimental to bank profitability and health. In this week’s Weekly Economic Commentary, due out later today, we note that although banks everywhere are important to a country’s economic system, in Europe, banks are even more important to the system. Europe’s capital markets are underdeveloped compared to the U.S., and European banks shoulder a greater role in distributing credit to the economy. We also note that recently there has been an increase in bank lending, after nearly three years of declines. Importantly, European bank stocks typically appreciate in value approximately one year after lending increases.

- Week ahead. This week, the summer doldrums kick in, as it’s a quiet week for the Federal Reserve Bank (Fed) and the only economic reports of note are the June Job Openings and Labor Turnover Survey (JOLTS) report and the July retail sales data. It’s equally quiet in Europe this week; but it’s a busy week in China, as it begins to report its July activity and inflation data. There are a few second tier central bank meetings next week (Mexico, South Korea, Philippines) but the most important one is likely to be the Reserve Bank of India’s meeting on Tuesday.

- Over the last month, the LPL Financial Current Conditions Index (CCI) rose 33 points to 212. The CCIhas now rebounded well off of its January lows and remains in the range it has held for most of the current expansion. The sizable move higher is largely due to a sharp decline in the VIX (a measure of market volatility) as concerns over the market impact of the U.K.’s referendum vote to leave the EU declined. Shipping traffic and falling credit spreads also made meaningful contributions to the increase, while slower retail sales was a modest detractor. View the CCI.

Monitoring the Week Ahead

Monday

- China: CPI (Jul)

- Japan: Economy Watchers Survey (Jul)

Tuesday

- NFIB Small Business Optimism Index (Jul)

- Productivity (Q2)

- India: Reserve Bank of India Meeting

- China: New Loan Growth and Money Supply (Jul)

- Japan: Machine Tool Orders (Jul)

Wednesday

- JOLTS (Jun)

- Monthly Budget Statement (Jul)

Thursday

- South Korea: Central Bank Meeting (No Change Expected)

- China: Industrial Production (Jul)

- China: Retail Sales (Jul)

- China: Fixed Asset Investment (Jul)

Friday

- Retail Sales (Jul)

- Consumer Sentiment and Inflation Expectations (H1 Aug)

- Eurozone: GDP (Q2-Revised)

Sunday

- Japan: GDP (Q2)

Click Here for our detailed Weekly Economic Calendar

Important Disclosures

Past performance is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly.

Stock investing involves risk including loss of principal.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Treasury inflation-protected securities (TIPS) help eliminate inflation risk to your portfolio, as the principal is adjusted semiannually for inflation based on the Consumer Price Index (CPI)—while providing a real rate of return guaranteed by the U.S. government. However, a few things you need to be aware of is that the CPI might not accurately match the general inflation rate; so the principal balance on TIPS may not keep pace with the actual rate of inflation. The real interest yields on TIPS may rise, especially if there is a sharp spike in interest rates. If so, the rate of return on TIPS could lag behind other types of inflation-protected securities, like floating rate notes and T-bills. TIPs do not pay the inflation-adjusted balance until maturity, and the accrued principal on TIPS could decline, if there is deflation.

Bank loans are loans issued by below investment-grade companies for short-term funding purposes with higher yield than short-term debt and involve risk.

Because of its narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, disease, and regulatory developments.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Investing in foreign and emerging markets debt securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical and regulatory risk, and risk associated with varying settlement standards.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

Investing in real estate/REITs involves special risks such as potential illiquidity and may not be suitable for all investors. There is no assurance that the investment objectives of this program will be attained.

Currency risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged.

Technical Analysis is a methodology for evaluating securities based on statistics generated by market activity, such as past prices, volume and momentum, and is not intended to be used as the sole mechanism for trading decisions. Technical analysts do not attempt to measure a security’s intrinsic value, but instead use charts and other tools to identify patterns and trends. Technical analysis carries inherent risk, chief amongst which is that past performance is not indicative of future results. Technical Analysis should be used in conjunction with Fundamental Analysis within the decision making process and shall include but not be limited to the following considerations: investment thesis, suitability, expected time horizon, and operational factors, such as trading costs are examples.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-523717