Market Update

- Markets tick higher to begin week. Following a week which saw remarkably little change in the S&P 500, U.S. equities are slightly higher to begin a week full of economic data and earnings. Of note last week, was the continued recent outperformance of growth, as the Nasdaqgained 1.3%, while the Dow Jones Industrial Average lost ground every day, to end the week lower by 0.7%. In Asia, stocks finished mixed with the Nikkei moving up slightly, while the Shanghai Composite lost nearly 1% following mixed PMI data. In afternoon trading, European markets are being dragged lower by bank stocks despite the European Banking Authority giving the industry a broadly healthy prognosis in its latest stress test. Finally,Treasuries are giving up some of last week’s strong gains as the yield on the 10-year Note is up 0.04% to 1.50%, the dollar is flat following a sharp fall on Friday, and both WTI crude oil and COMEX gold are moving lower.

Macro View

- Week ahead: Post Brexit data on jobs, ISM, vehicle sales, key China data, and the Olympics begin. July readings on the labor market, ISM for manufacturing, and vehicle sales dominate this week’s busy U.S. data calendar. Overseas, the Bank of England’s meeting will be key, as the central bank may respond to Brexit with a rate cut. The Summer Olympics begin on Friday, August 5th in Rio.

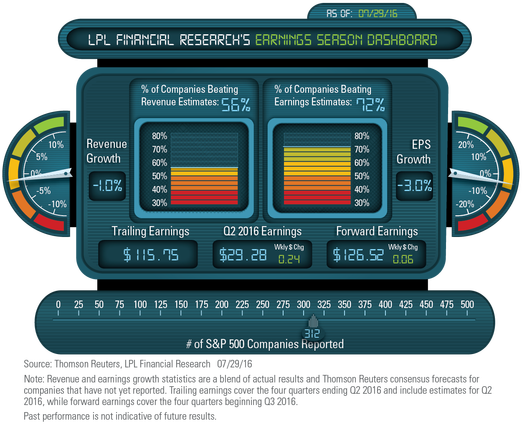

- Earnings remain steady heading into last big week.With 312 S&P 500 companies having reported, second quarter 2016 earnings held steady at -3.0% growth year over year last week, the same as the prior week. Consumer discretionary has exhibited the most growth, while technology has shown the largest upward revision versus start of quarter estimates, and technology and industrials have had the largest upside surprise. This week is the last major week of earnings season, with 120 companies reporting.

- European stress test. The European Banking Authority (EBA) issued its annual stress test of 51 major banks late Friday afternoon. There was no formal “pass/fail” criteria, but two banks (one from Italy, one from Ireland) clearly failed by any practical measure. A more detailed discussion of this test will be on our blog today.

- China sneezes and did South Korea get a cold? China’s official manufacturing PMI was released at 49.9, below the 50 that was expected from the previous month. Normally, a 0.1 disappointment would not be particularly meaningful; but in this case it puts China’s manufacturing technically in contraction, granted ever so slightly. In a possibly related release, South Korean exports fell more than -10% year over year, compared to an estimate of a -6.7% decline. South Korea is a major producer of ships, drill rigs, and other heavy construction equipment. It’s not surprising that weakness in the global heavy industries shows up in both countries. On the other hand, China’s private sector Caixin manufacturing index was 50.6, up from 48.6 in the prior month.

- Great month for equities. The S&P 500 closed down 0.1% last week, ending the four week win streak. It was still a great month for equities though, as the S&P 500 gained 3.6% for the best July since 2013, which gained 4.9%, and the best overall month since March added 6.6%. The monthly win streak remained intact though, as the S&P 500 is now up five months in a row for the first time in two years. It hasn’t made it to six straight since early 2013. Tech, materials, and consumer discretionary led, while consumer staples, utilities, and energy all finished in the red and lagged.

- Get ready for August. In the Weekly Market Commentary(out later today), we take a closer look at seasonality and the overall sentiment backdrop. Just as July has historically been one of the stronger summer months, August and September tend to be two months that have seen weakness recently. With the S&P 500 in one of the tightest 11-day ranges ever, the odds that August sees more volatility are rather high. Turning to the sentiment backdrop, things are looking much different than they did earlier this year. As we noted at the time, sentiment near the February lows was consistent with past major market lows and now after a greater than 20% rally and new all-time highs in the S&P 500, we’ve seen a distinct shift in bullish sentiment.

- See you in September? In the Weekly Economic Commentary, we’ll examine what the Fed will be digesting in the way of data, financial market conditions, and events between now and the next Federal Open Market Committee (FOMC) meeting in mid-September as it decides whether or not to raise rates in September, wait until December, or defer until 2017.

Monitoring the Week Ahead

Monday

- ISM: Mfg. (July)

Tuesday

- Vehicle Sales (July)

- Australia: Reserve Bank of Australia Meeting (Rate Cut Expected)

- China: Caixin Services PMI (July)

- Japan: Cabinet of Japan (Decision on Fiscal Stimulus Package)

Wednesday

- ADP Employment (July)

- ISM: Non-Mfg. (July)

Thursday

- Challenger Job Cut Announcements (July)

- Kaplan (Hawk)

- UK: Bank of England Meeting (Rate Cut Expected)

Friday

- Employment Report (July)

- Indonesia: GDP (Q2)

Click Here for our detailed Weekly Economic Calendar

Important Disclosures

Past performance is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly.

Stock investing involves risk including loss of principal.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Treasury inflation-protected securities (TIPS) help eliminate inflation risk to your portfolio, as the principal is adjusted semiannually for inflation based on the Consumer Price Index (CPI)—while providing a real rate of return guaranteed by the U.S. government. However, a few things you need to be aware of is that the CPI might not accurately match the general inflation rate; so the principal balance on TIPS may not keep pace with the actual rate of inflation. The real interest yields on TIPS may rise, especially if there is a sharp spike in interest rates. If so, the rate of return on TIPS could lag behind other types of inflation-protected securities, like floating rate notes and T-bills. TIPs do not pay the inflation-adjusted balance until maturity, and the accrued principal on TIPS could decline, if there is deflation.

Bank loans are loans issued by below investment-grade companies for short-term funding purposes with higher yield than short-term debt and involve risk.

Because of its narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, disease, and regulatory developments.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Investing in foreign and emerging markets debt securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical and regulatory risk, and risk associated with varying settlement standards.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

Investing in real estate/REITs involves special risks such as potential illiquidity and may not be suitable for all investors. There is no assurance that the investment objectives of this program will be attained.

Currency risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged.

Technical Analysis is a methodology for evaluating securities based on statistics generated by market activity, such as past prices, volume and momentum, and is not intended to be used as the sole mechanism for trading decisions. Technical analysts do not attempt to measure a security’s intrinsic value, but instead use charts and other tools to identify patterns and trends. Technical analysis carries inherent risk, chief amongst which is that past performance is not indicative of future results. Technical Analysis should be used in conjunction with Fundamental Analysis within the decision making process and shall include but not be limited to the following considerations: investment thesis, suitability, expected time horizon, and operational factors, such as trading costs are examples.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-521548