FIRST QUARTER 2016 IN REVIEW

Volatility Spikes, but Equities Prove Resilient

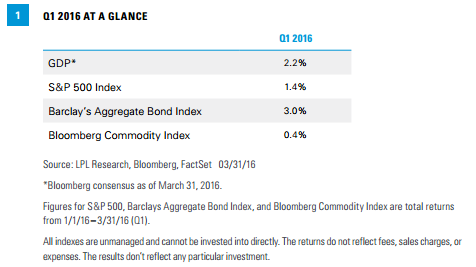

- U.S. economy weathers market volatility as labor market improves and manufacturing steadies. Based on data received so far, first quarter 2016 real gross domestic product (GDP) growth is tracking at 1.5 - 2.0%, following 1.4% growth in the fourth quarter of 2015 and 2.0% growth in the third. Concern about global economic weakness and tightening financial conditions prompted the Federal Reserve (Fed) to delay further rate hikes and lower its internal forecast from four 25 basis point (0.25%) rate hikes in 2016 to just two. Fed policy and a sharp oil rebound have helped stabilize financial conditions. Consumer strength continues to lead the economy on solid labor market gains. Services sector growth slowed over the quarter but remains healthy, while manufacturing, still in contraction, has shown signs of greater stability.

- Stocks erase losses, finish in the green. The S&P 500 Index posted a 1.4% total return during the quarter, rallying off the February low of -10.2%. The quarter was marked by extreme volatility as concerns over the global economy, corporate profits, commodity prices, and currency fluctuations weighed heavily on investor sentiment. The market put in a “double bottom” on February 11 before rallying significantly on the reversal in oil prices, further policy accommodation abroad, and a pause by the Fed in its move toward normalized interest rates. Unlike the rally in the fourth quarter of 2015, this one has been broad based, with 8 of the 10 GICS sectors in positive territory on a year-to-date basis.

- Bonds have standout first quarter but pace is unsustainable. After a challenging end to 2015, fixed income markets enjoyed a strong start to 2016. Interest rates fell across most of the maturity spectrum over the quarter. The overall decline in interest rates led to a 3.0% return for the Barclays Aggregate, the index’s largest quarterly return since 2011. The overall decline in rates benefited longer-dated fixed income more so than shorter-dated. Economically sensitive, lower-credit quality sectors also rallied, with high-yield returning 3.4% and bank loans 1.8%. An increase in inflation expectations was a tailwind for Treasury Inflation-Protected Securities (TIPS), which had an impressive 4.5% return during the quarter. International fixed income also had a strong quarter: emerging markets debt returned 5.2%, hedged foreign 4.2%, and unhedged foreign - boosted by a decline in the U.S. dollar - returned 9.1% during the quarter.

- Oil bounced back in the first quarter as production declines in the U.S. began to materialize. WTI crude oil rose by 3.4%, while the broader Bloomberg Commodity Index increased by 0.4%. Oil production in the U.S. declined markedly and certain OPEC and non-OPEC members agreed to discuss a production freeze in early April. The U.S. dollar’s bullish trend dissipated and the Trade Weighted Dollar Index returned -4.1%. Agricultural commodities benefited from a stronger Brazilian real and a broadly weaker U.S. dollar.

- The HFRX Systematic Diversified led index gains (3.4%), despite March trend reversals. Strong January and February returns from the HFRX Systematic Diversified Index supported the category’s quarterly performance, with short oil, long gold, and long Treasury positioning positively contributing. Long/short strategies declined with the broader market in the first six weeks of the quarter and saw limited participation in the strong March rally, leading to a 2.9% quarterly loss for the HFRX Equity Hedge Index.

Click here to download a PDF of this report.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

Past performance is not indicative of future results.

The economic forecasts set forth in the presentation may not develop as predicted.

Stock investing entails risk including loss of principal.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Alternative strategies may not be suitable for all investors. The management of alternative investments may accelerate the velocity of potential losses.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, geopolitical events, and regulatory developments.

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all of private and public consumption, government outlays, investments, and exports less imports that occur within a defined territory.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

The Bloomberg Commodity Index is calculated on an excess return basis and composed of futures contracts on 22 physical commodities. It reflects the return of underlying commodity futures price movements.

The HFRX Equity Market Neutral Index strategies employ sophisticated quantitative techniques of analyzing price data to ascertain information about future price movement and relationships between securities, select securities for purchase and sale. These can include both factor-based and statistical arbitrage/trading strategies. Factor-based investment strategies include strategies in which the investment thesis is predicated on the systematic analysis of common relationships between securities. In many but not all cases, portfolios are constructed to be neutral to one or multiple variables, such as broader equity markets in dollar or beta terms, and leverage is frequently employed to enhance the return profile of the positions identified. Statistical arbitrage/trading strategies consist of strategies in which the investment thesis is predicated on exploiting pricing anomalies that may occur as a function of expected mean reversion inherent in security prices; high frequency techniques may be employed and trading strategies may also be employed on the basis on technical analysis or opportunistically to exploit new information the investment manager believes has not been fully, completely, or accurately discounted into current security prices. Equity market neutral strategies typically maintain characteristic net equity market exposure no greater than 10% long or short.

This research material has been prepared by LPL Financial LLC.

Tracking #1-485396 (Exp. 05/16)