Jobless claims have dropped to a 49-year low. Based on historical trends, this could signal that a U.S. economic recession is further off than many expect.

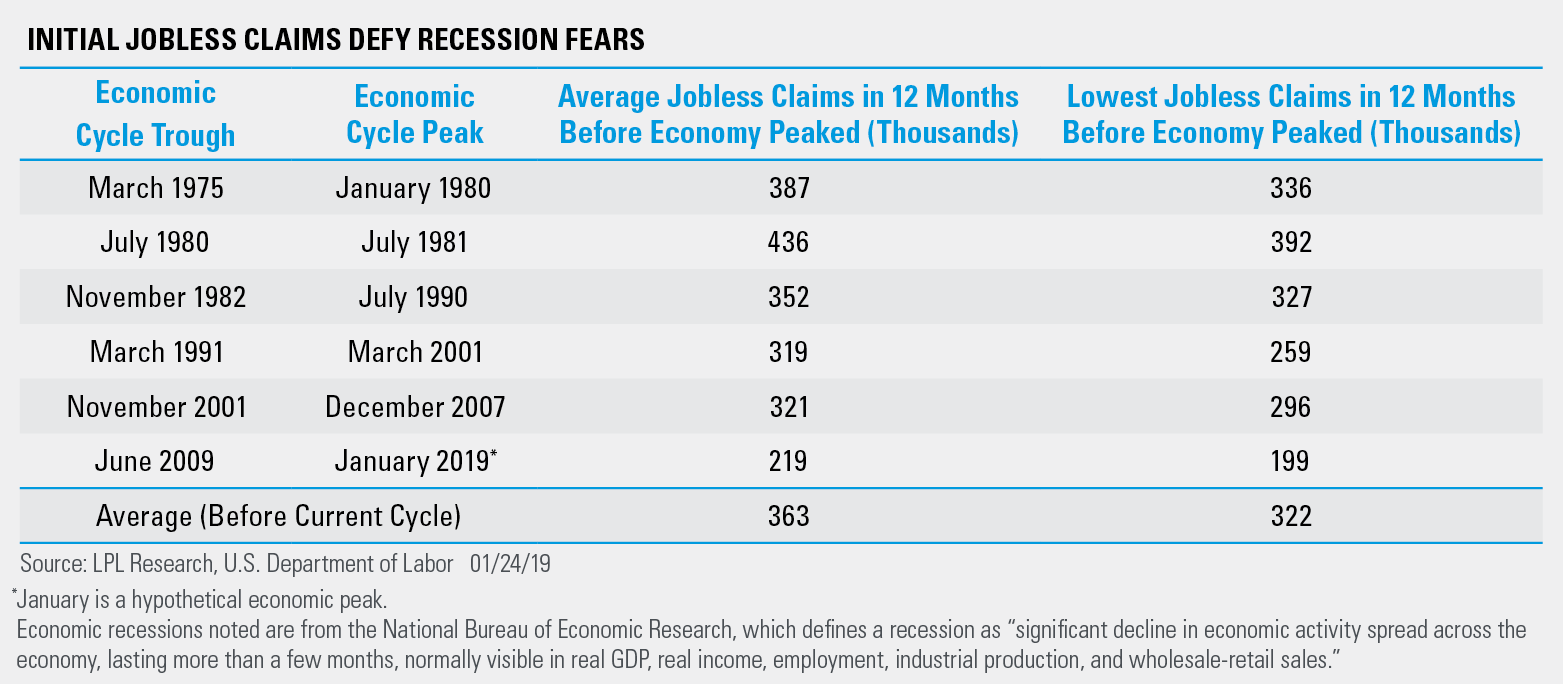

Data released January 24 showed jobless claims fell to 199K in the week ending January 18, the lowest number since 1969 and for below consensus estimates of 218K. As shown in the LPL Chart of the Day, current jobless claims have been significantly lower than those in the 12-month periods preceding each recession since the early 1970s.

Jobless claims have fallen out of the spotlight as the economic cycle has matured, but they could prove important again as investors’ recessionary fears increase. While most labor-market data serve as lagging indicators of U.S. economic health, jobless claims are a leading indicator. Historically, a 75-100K increase in claims over a 26-week period has been associated with a recession.

“Last week’s jobless claims print was particularly impressive given the partial government shutdown and weakening corporate sentiment,” said LPL Research Chief Investment Strategist John Lynch. “The U.S. labor market remains strong and will help buoy consumer health and output growth this year.”

Other predictive data sets have signaled U.S. recessionary odds are low. Data last week showed the Conference Board’s Leading Economic Index (LEI), based on 10 leading economic indicators (like jobless claims, manufacturers’ new orders, and stock prices), grew 4.3% year-over-year in December. In contrast, the LEI has turned negative year-over-year before all economic recessions since 1970. Because of its solid predictive ability, the LEI is a component of our Recession Watch Dashboard.

U.S. investors have been dealing with a dearth of economic data recently, but the upcoming week is packed with economic events, like the Federal Reserve’s (Fed) rate announcement on Wednesday, January 30, and the January jobs report on Friday, February 1. For more analysis on the Fed’s next moves, check out this week’s Weekly Economic Commentary.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Member FINRA/SIPC

For Public Use | Tracking # 1-816015 (Exp. 01/20)