Over the past three months, investment-grade (IG) corporate debt has posted its strongest rally in more than two years as investors look for the sweet spot between quality and risk in fixed income.

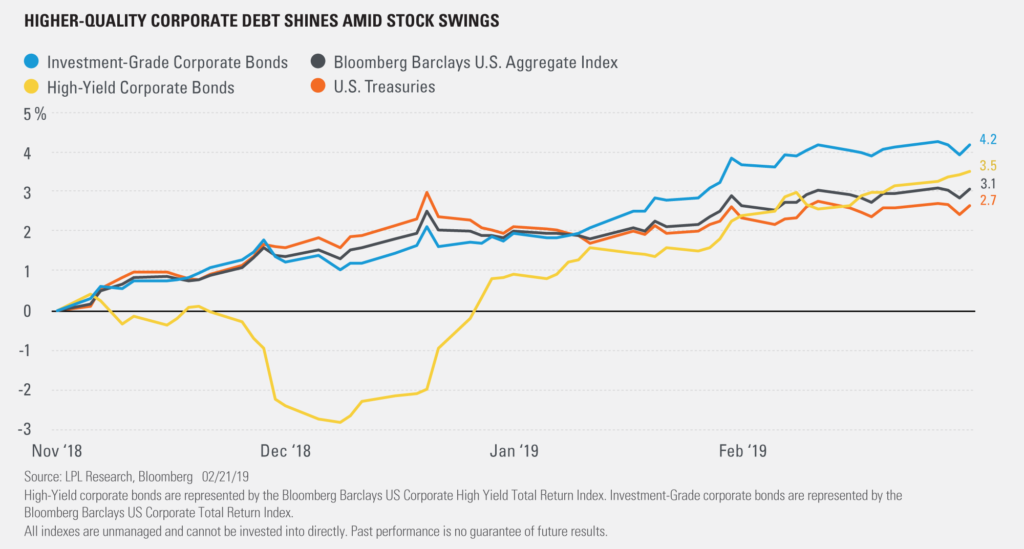

As shown in the LPL Chart of the Day, IG debt has delivered the best performance since the end of November 2018 among major fixed income classes we track.

Higher-quality fixed income benefited from a risk-off environment in late 2018 as the S&P 500 Index slid into an intraday bear market. In January 2019, IG corporate debt posted its biggest monthly gain since March 2016 as investors’ risk appetites resurfaced. Interest rates have also dropped significantly amid the Federal Reserve’s patient approach to tightening, providing extra fuel to the rate-sensitive sector.

IG’s relative outperformance over the past three months has been especially encouraging, as solid IG gains this cycle have mostly been a side effect of even stronger rallies in lower-quality high-yield (HY) corporate debt. IG corporate bonds have rallied 4.2% over the past three months (through February 22), compared to HY corporate bonds’ 3.5% gain over the same period. IG bonds haven’t rallied at least 4% over three months and outperformed HY bonds since 2012.

“We are increasing our focus on Investment Grade corporate debt over High Yield bonds as the business cycle matures,” said LPL Research Chief Investment Strategist John Lynch. “HY has historically provided extra return for higher risk, but we believe IG corporates may provide some potential benefits of added credit exposure while avoiding higher risk.”

About half of the IG sector carries a rating of BBB—one notch above a HY rating. Still, we aren’t concerned about declining credit quality in corporate bonds, as spreads have been historically low and U.S. companies’ balance sheets remain strong.

For more details on our fixed income outlook, check out our Outlook 2019.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

Credit Quality is one of the principal criteria for judging the investment quality of a bond or bond mutual fund. As the term implies, credit quality informs investors of a bond or bond portfolio’s credit worthiness, or risk of default. Credit ratings are published rankings based on detailed financial analyses by a credit bureau specifically as it relates the bond issue’s ability to meet debt obligations. The highest rating is AAA, and the lowest is D. Securities with credit ratings of BBB and above are considered investment grade.

Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk, as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

High yield/junk bonds (grade BB or below) are not investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

For Public Use | Tracking # 1-826313 (Exp. 02/20)