KEY TAKEAWAYS

- The year-to-date performance advantage of high-yield bonds relative to Treasuries (based on the Barclays High Yield and Treasury indexes) has been reduced to a very narrow margin following rising oil-related default fears.

- We find current market-default expectations, which imply a 15% default rate over one year, overly pessimistic.

- Few bond maturities come due through the end of 2016, a key factor that will likely support a low-default environment for high-yield bonds overall.

Click here to download a PDF of this report.

HIGH-YIELD OIL SLICK

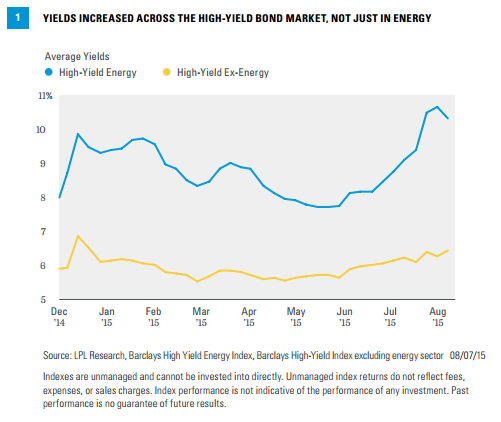

Lower oil prices, the nemesis of the high-yield bond market over the past year, pressured high-yield bond prices lower in recent weeks. The drop in oil prices once again raised the threat of rising default risk, as energy-related companies comprise roughly 15% of the high-yield bond market. Although the energy sector has borne the brunt of recent weakness, all segments of this market witnessed price declines since the end of June 2015, translating to higher yields across the high-yield market [Figure 1]. The average yield of the high-yield energy sector increased sharply, but even the broader high-yield bond market witnessed an increase in the average yield by 0.8% since the start of June.

The rise in the average yield of energy-related issuers broke above 10% and is indicative of widespread defaults. The current average yield spread (to comparable maturity Treasuries) of the high-yield energy sector is 8.7%, higher than the levels witnessed during prior bouts of oil-related default fears in January and again in March of 2015.

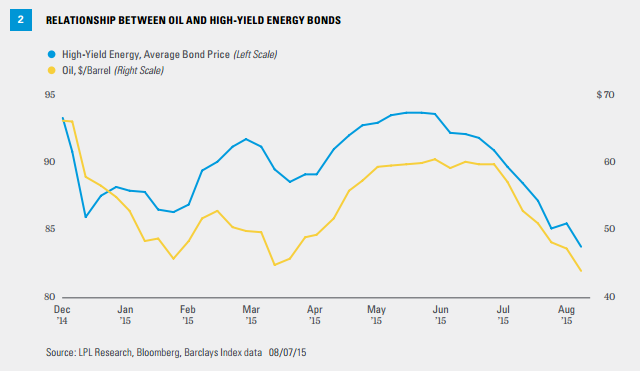

The relationship between high-yield energy issuers and oil prices is fairly clear [Figure 2] but four other factors are likely contributing to the heavier price toll compared with earlier in the year.

- Mixed economic data. Economic reports over June and July were more mixed relative to consensus forecasts, compared with the rebound evident through most of May. Additionally, lingering doubts over the strength of China’s economy, China’s equity market sell-off, and the decline in global commodity prices (not just oil) raised questions over the strength of economic growth.

- Federal Reserve (Fed) rate hike fears. Prospects of a first Fed rate hike coming as soon as September increased recently, but bond reaction suggests this timing may be ill-advised. The yield curve flattened as long-term yields fell while short-term yields actually rose-a sign the bond market views a potential September rate hike as a hindrance to economic growth.

- Low summer liquidity. High-yield bonds are one of the less liquid bond sectors, but summer trading conditions can often lead to exaggerated price movements as liquidity deteriorates.

- Lower inflation expectations. The decline in oil has, of course, led to lower inflation expectations. In addition, the complete lack of any wage pressures in the past two monthly employment reports, as well as a very benign reading on the quarterly Employment Cost Index, has led to lower expectations for inflation and growth.

All four factors above have acted as a headwind to the high-yield bond market, in addition to default fears over energy, and help explain why the recent episode of oil price declines is having a greater impact compared with earlier in 2015. Additionally, the longer the price of oil stays near recent lows, the longer and heavier the burden on less profitable companies. At some point, weaker energy companies may simply run out of cash and declare bankruptcy.

WHAT’S PRICED IN?

High-yield energy-related default expectations may have gone too far. Energy-related defaults are indeed rising in 2015 and total 12 through the first 6 months of 2015, according to Moody’s. This amounts to a default rate of 3%, based upon the number of issuers in the Barclays High Yield Energy Index. However, based upon an average price of 84 cents on the dollar, a 6.75% coupon interest rate, and current Treasury yields, the implied default rate on the high-yield energy sector is 15% over a one-year time frame. We view such a big acceleration in defaults as unrealistic. Over a 5-year time horizon, market-implied pricing indicates a 55% cumulative probability of default among energy-related issuers. The high-yield bond market has basically priced in a significantly negative outcome that may not materialize. In our view, still lower oil prices would likely be needed to warrant such a dismal outcome.

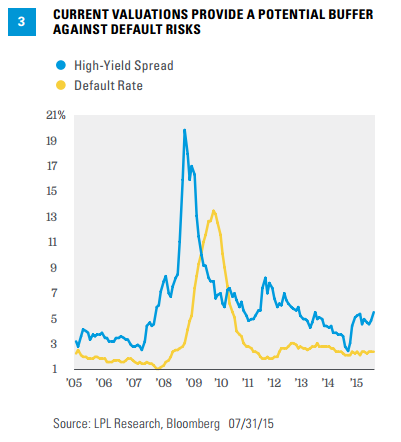

The average yield spread of high-yield bonds is near 6% and provides a substantial cushion against default risk [Figure 3]. The gap between the current level of defaults and the average yield spread is near its widest level since late June 2013 during the taper-tantrum sell-off. Prior to that occasion, late 2011 through early 2012 presented a cushion, as European debt-related fears pushed yield spreads wider and high-yield bond valuations cheaper. In both cases, high-yield bonds outperformed over the remainder of each calendar year. Due to the lower level of yields and the fact that defaults have likely bottomed and are gradually moving higher, we do not envision high-yield bonds having the upside potential of 2012 or 2013. Still cheaper valuations may provide an opportunity for fixed income investors in a challenging low-return world.

CONCLUSION

Defaults are likely to continue to rise over coming months and into 2016 as energy companies come under pressure, but current default expectations are overly pessimistic in our view. Economic data did become more mixed over June and July but still has not changed our expectations for 3.0% gross domestic product (GDP) growth over the second half of 2015.* And consensus forecasts have so far not shown any revisions to the 2.3% growth rate of the second quarter. Expectations of widespread defaults in the high-yield energy sector are unlikely to materialize unless oil prices fall further and substantially below $40. Aside from the energy sector, very few bond maturities come due through the end of 2016, a key factor that will likely support a low-default environment for high-yield bonds overall. The summer pullback has impacted all segments of high-yield bonds and may provide an opportunity for investors.

*As noted in the Outlook 2015, LPL Research expects GDP to expand at a rate of 3% or higher, which matches the average growth rate of the past 50 years. This is based on contributions from consumer spending, business capital spending, and housing, which are poised to advance at historically average or better growth rates in 2015. Net exports and the government sector should trail behind.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Because of its narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Investing in foreign fixed income securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with foreign market settlement. Investing in emerging markets may accentuate these risks.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets, as well as weather, geopolitical events, and regulatory developments.

DEFINITIONS

The Bureau of Labor Statistics’ (BLS) Employment Cost Index (ECI) is a quarterly release which gives information on the costs of labor for businesses in the United States.

Moody’s is an independent, unaffiliated research company that rates fixed income securities. Moody’s assigns ratings on the basis of risk and the borrower’s ability to make interest payments.

High-yield spread is the yield differential between the average yield of high-yield bonds and the average yield of comparable maturity Treasury bonds.

INDEX DESCRIPTIONS

The Barclays Capital High Yield Index covers the universe of publicly issued debt obligations rated below investment grade. Bonds must be rated below investment grade or high yield (Ba1/BB+ or lower), by at least two of the following ratings agencies: Moody’s, S&P, and Fitch. Bonds must also have at least one year to maturity, have at least $150 million in par value outstanding, and must be U.S. dollar denominated and nonconvertible. Bonds issued by countries designated as emerging markets are excluded.

The Barclays U.S. Treasury Index is an unmanaged index of public debt obligations of the U.S. Treasury with a remaining maturity of one year or more. The index does not include T-bills (due to the maturity constraint), zero coupon bonds (strips), or Treasury Inflation-Protected Securities (TIPS).

The Barclays High Yield Energy Index covers the universe of domestic publicly issued debt obligations rated below investment grade related to the generation and supply of energy. Bonds must be rated below investment grade or high yield (Ba1/BB+ or lower), by at least two of the following ratings agencies: Moody’s, S&P, and Fitch. Bonds must also have at least one year to maturity, have at least $150 million in par value outstanding.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-409180 (Exp. 08/16)