KEY TAKEAWAYS

- We continue to expect roughly flat bond returns for 2015, as the choppy market environment witnessed over the first half of 2015 continues.

- The challenging, low-return environment confronting bond investors is likely to persist.

Click here to download a PDF of this report.

HAMMER FLAT: MIDYEAR BOND MARKET OUTLOOK

Anthony Valeri, CFA Fixed Income & Investment Strategist, LPL Financial

Colin Allen Senior Research Analyst, LPL Financial

We still expect a modest rise in bond yields over the course of 2015; but an increase of 0.25% to 0.50% in the 10-year Treasury yield, the lower half of our initial forecast, appears more likely due to the persistence of low inflation. An increase of 0.75% in 10-year Treasury yields is possible, but a low probability, in our view. Disappointing first quarter economic growth and a later start to Federal Reserve (Fed) rate hikes, with a slower pace of additional hikes likely, mitigates the risk of a greater rise in interest rates.

CROSSED WIRES

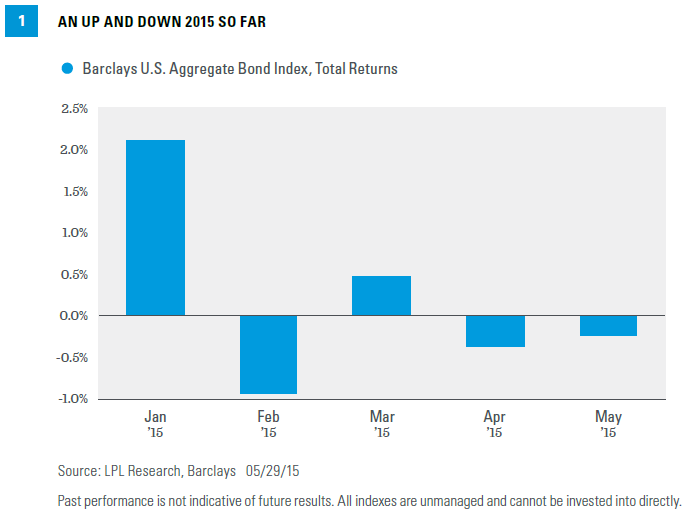

Cross currents continue to buffer the bond market, leading to a push and pull on bond prices [Figure 1]. Concerns over a sluggish start for the U.S. economy in 2015 have recently given way to better growth expectations over the second half. European economic growth is on the path to improvement but durability is uncertain. Fading U.S. dollar strength, along with oil price stability, bodes well for a better economic performance and higher inflation expectations; however, here too uncertainty lingers over the permanence of recent stability. Ultimately we expect better economic performance to persevere, which coupled with the onset of Fed rate hikes, may lead to a modest rise in bond yields.

SAFETY FIRST

Aside from challenging fundamental factors, valuations remain expensive across the bond market. The inflation-adjusted yield of the 10-year Treasury note remains depressed relative to the historical average. This is especially noteworthy over the past 10 years — a period of generally expensive bond valuations [Figure 2]. Although inflation may increase only slowly, it reflects just how expensive high-quality bonds are. The lesser the inflation-adjusted yield, the more expensive valuations are, and vice versa. Even if interest rates remain stable and do not rise, expensive valuations suggest caution when investing in bonds.

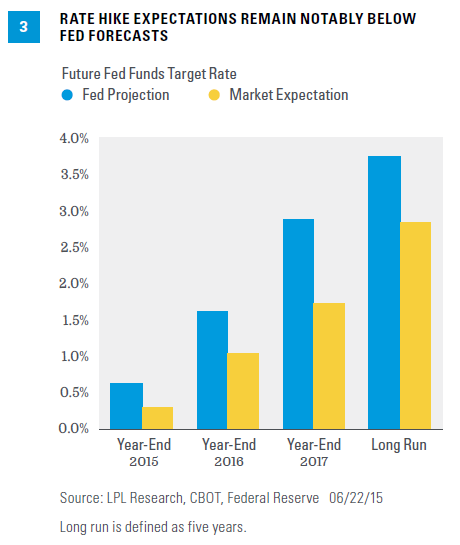

A market-friendly Fed is largely factored into current market pricing, as Fed rate hike expectations remain notably below official Fed forecasts [Figure 3]. The fed funds futures market expects not only a later start to rate hikes, but also a slower pace of rate increases.

Futures also indicate the Fed may not return to a normal 3.75% overnight borrowing rate over the next 10 years. Such implied expectations are overly pessimistic in our view, but also illustrate the sharp contrast between market expectations and Fed guidance on future rate increases. A near-term return to a recession, which we view as unlikely, would probably be needed to reduce Fed expectations further. In sum, much of the good news about a slow and gradual pace of rate hikes is largely factored into current bond prices. Therefore, further bond price gains from dovish Fed expectations are unlikely and remove — or at least greatly reduce — another source of potential bond market strength.

INCORPORATING INTERNATIONAL FACTORS

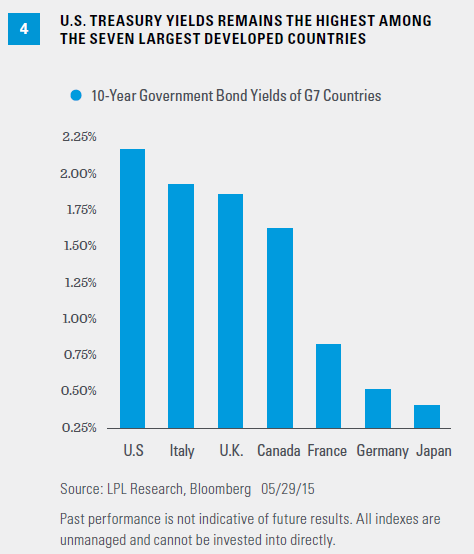

Beauty is in the eye of the beholder, and overseas demand is likely to stay elevated as yield differentials between U.S. Treasuries and overseas government bonds remain near all-time historically wide levels [Figure 4]. The rise in longer-term interest rates may be restrained by foreign demand, which continues to look to U.S. Treasuries for additional yield.

Yields near multi-century lows (in some cases) and lower than U.S. bond alternatives keep us away from using high-quality international bonds. We find domestic fixed income opportunities offer better value. Emerging markets debt (EMD) offers a better risk-reward, but we remain neutral. After improvement in the first half of 2015, lower yields and higher valuations suggest total returns may slow. The sector may show greater sensitivity to rising interest rates as well as a potential Fed rate hike late in the year.

A TRICKY ASSEMBLY

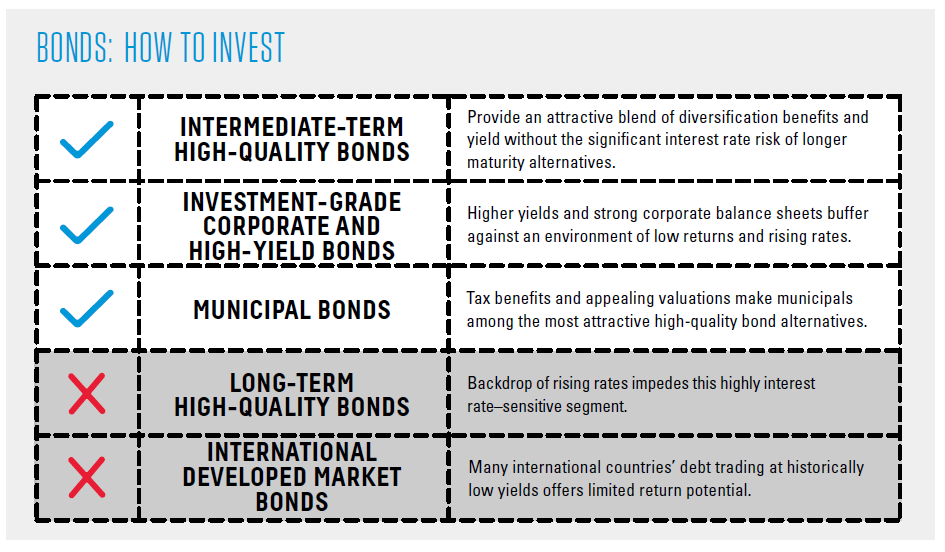

Assembling a portfolio for today’s challenging fixed income environment is difficult at best. A lack of opportunity, high valuations, low yields, and the prospects of rising interest rates argue for a defensive stance. A low-return environment is likely to dominate bond markets for the rest of 2015 and beyond. Managing risks, while positioning for modest returns, will require a delicate balancing act. We believe a combination of higher-yielding bonds along with intermediate-term high-quality bonds is potentially the right pairing for the job.

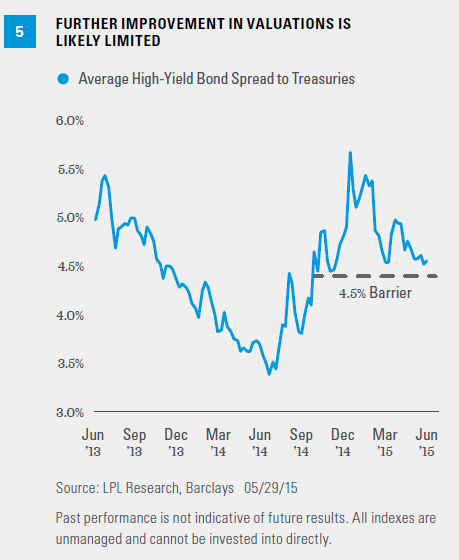

In an environment of low returns, higher-yield investments should remain a focus. Here too, however, some caution is warranted, and yield spreads between high-yield bonds and Treasuries have contracted over the first half of 2015 [Figure 5], as measured by the Barclays High Yield Bond Index and five-year Treasury yield. The average yield spread remains near 4.5%, a level that has halted further improvement among high-yield bonds in the past. Given the prospect of a modest increase in default rates, it is unlikely high-yield bond valuations return to 2014 heights; however, the yield advantage over high-quality bonds remains significant and stands out in a low-yield world. Defaults are likely to remain low by historical comparison, as corporate issuers’ ability to repay debt obligations remains strong.

We continue to find municipal bonds among the more attractive high-quality bond options. Municipal bonds lagged their taxable counterparts over the first five months of 2015, as measured by the Barclays Municipal Bond Index, which returned 0.5% over the time period compared with the 1.2% for the Barclays Aggregate Bond Index. Overall yields remain low by historical comparison, but more attractive valuations might provide better price protection in the event that interest rates rise. During the late April to early May 2015 bond selloff, municipal bonds proved more resilient to rising interest rate pressures.

Intermediate-term bonds provide an attractive blend of diversification benefits and yield without significant interest rate risk, such as that posed by long-term bonds. On the flip side, the significantly lower yield on short-term bonds — coupled with their reduced ability to provide diversification benefits in the event of a stock market selloff — reduces their attractiveness. We remain focused on intermediate-term bonds.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

INDEX DESCRIPTIONS

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

The Barclays U.S. Corporate High-Yield Index measures the market of USD-denominated, noninvestment-grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below, excluding emerging markets debt.

The Barclays Municipal High Yield Bond Index is comprised of bonds with maturities greater than one year, having a par value of at least $3 million issued as part of a transaction size greater than $20 million, and rated no higher than `BB+’ or equivalent by any of the three principal rating agencies. (The long and the short are subindexes of the Municipal Bond Index, based on duration length.)

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-394435