KEY TAKEAWAYS

- Q3 GDP results are lagging so far, relative to even lowered expectations; 55% of global GDP still has yet to report results.

- More disappointing results from the Eurozone and Japan could lead to additional QE; however, that may be welcome news for market participants who remain concerned about global growth for 2015 and beyond.

Click here to download a PDF of this report.

GLOBAL GDP TRACKER: FALL 2015 EDITION

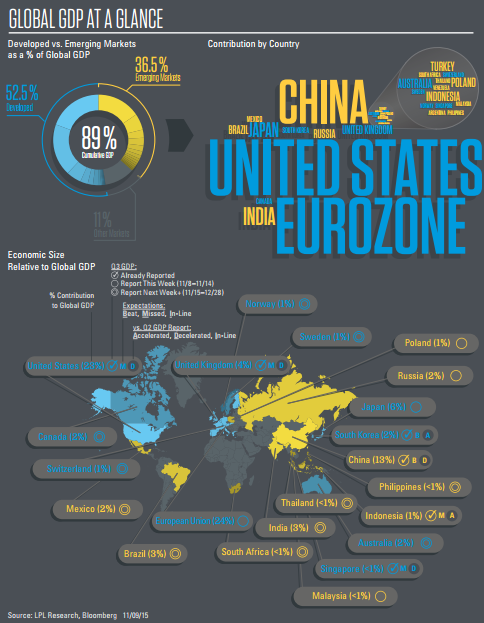

Despite lowered expectations, some high-profile “misses” have occurred on global gross domestic product (GDP) readings for Q3 2015, causing concern for some market participants. The United States (23% of global GDP), China (13%), the United Kingdom (4%), South Korea (2%), Indonesia (1%), and Singapore (less than 1%) have reported Q3 gross domestic product (GDP). Together, those countries account for nearly 45% of global GDP. Third quarter 2015 GDP in three of the six nations beat or matched consensus expectations (China, South Korea, and Singapore), and three of the six countries reported results that either were in-line with or accelerated versus the prior period (South Korea, Indonesia, and Singapore). As a reminder, two-thirds of Q2 GDP reports beat or met expectations, while a similar percentage accelerated from Q1 2015 results; thus, the Q3 GDP results to date are lagging, relative to even lowered expectations. Still, with 55% of global GDP yet to report Q3 2015 results, the reporting season still has not reached the halfway point.

This week (November 8-15, 2015), another six countries are scheduled to report Q3 GDP, including the Eurozone (24% of global GDP), Japan (6%), Russia (2%), Poland (1%), Thailand (less than 1%), and Malaysia (less than 1%). Together, these nations–a nice mix of both developed (Eurozone and Japan) and emerging markets (Russia, Thailand, Poland, and Malaysia)–account for 34% of global GDP. Therefore, by the end of the week, countries representing nearly 80% of global GDP will have reported Q3 data [Figure 1]. Over the second half of November and the first half of December 2015, another 15-20% of global GDP will report on Q3, including (ranked in order of size of economy) Brazil, India, Canada, Australia, Mexico, and Turkey, along with Switzerland, Sweden, Argentina, Norway, South Africa, Denmark, and the Philippines, again providing further insight into both developed and emerging market economies in the third quarter.

EUROPE: SOME MOMENTUM AFTER A HALF-DECADE

According to the consensus of economists, the Eurozone’s GDP is expected to accelerate to 1.7% year over year in Q3 2015 from a 1.5% reading in Q2. While tepid compared with growth in China (6-7%) and even the U.S. (2.5-3%) during the past two quarters, the expected 1.7% gain in GDP in Q3 represents a major acceleration from the 0.5% growth rate posted, on average, in the Eurozone in 2011 through the end of 2014, weighed down by a broken financial transmission mechanism (a lack of ability and willingness of European banks and financial institutions to make loans to businesses and households in Europe) and concerns over the fate of Greece. Currently, the European Central Bank (ECB) is actively engaged in quantitative easing (QE) and, in late October 2015, hinted that it will do more than it has already promised to do (which is to keep doing QE until at least September 2016), perhaps as soon as the next ECB policy meeting in early December 2015. The QE undertaken so far has helped to unstick the Eurozone’s financial transmission mechanism; and the region’s banking sector, though still struggling, is now finally beginning to lend again. Although problems in the Eurozone persist-including high labor costs, low productivity, and inflexible labor markets-the Eurozone appears to finally have some economic momentum after nearly a half-decade of sluggish growth.

JAPAN: THREE ARROWS IN ACTION

Consensus forecasts call for a 0.3% decline in GDP in Japan between Q2 and Q3 2015, after the disappointing 1.2% drop in Q2. The expected lack of a rebound in activity in Q3 is also disappointing, especially considering that the factors that hurt Q2 growth, such as bad weather, were considered temporary. Although consumer spending (60% of GDP in Japan) is expected to bounce back in Q3 after poor weather hurt in Q2, business capital spending (15% of GDP) is expected to remain tepid; trade is also likely to be a drag on growth, given Japan’s large exposure to China’s manufacturing economy.

China is Japan’s biggest customer, with 19% of its exports destined for China. While the Bank of Japan’s (BOJ) massive QE program has helped to lift core inflation in Japan–which now stands at +0.9% year over year [Figure 2]–wage growth in Japan remains weak, and if overall economic growth continues to falter, the BOJ stands ready to do more. In addition, the Japanese government under Prime Minister Abe remains committed to the “Three Arrows” program of using monetary policy (i.e., QE), fiscal policy, and regulatory/legislative reform to boost economic growth and inflation.

CONCLUSION

Despite lowered expectations, there have already been some high-profile “misses” on global readings GDP for Q3 2015. This week provides another chance for Q3 GDP to outpace lowered expectations. Another possible round of disappointments this week in growth in two of the four largest economies in the world–the Eurozone and Japan–may lead to more QE from both the ECB and BOJ in the weeks ahead. However, more on the fiscal policy front from both Japan and the Eurozone would also be welcome news by market participants who remain concerned about global growth prospects in late 2015 and beyond.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security. Any economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

DEFINITIONS

Quantitative easing (QE) refers to the Federal Reserve’s (Fed) current and/or past programs whereby the Fed purchases a set amount of Treasury and/or mortgage-backed securities each month from banks. This inserts more money in the economy (known as easing), which is intended to encourage economic growth.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Core inflation is a measure of inflation that excludes certain items that face volatile price movements. Core inflation eliminates products that can have temporary price shocks because these shocks can diverge from the overall trend of inflation and give a false measure of inflation.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-438370 (Exp.11/16)