All eyes are on the Federal Reserve’s (Fed) interest rate announcement and press conference today for signals on future policy after a volatile December.

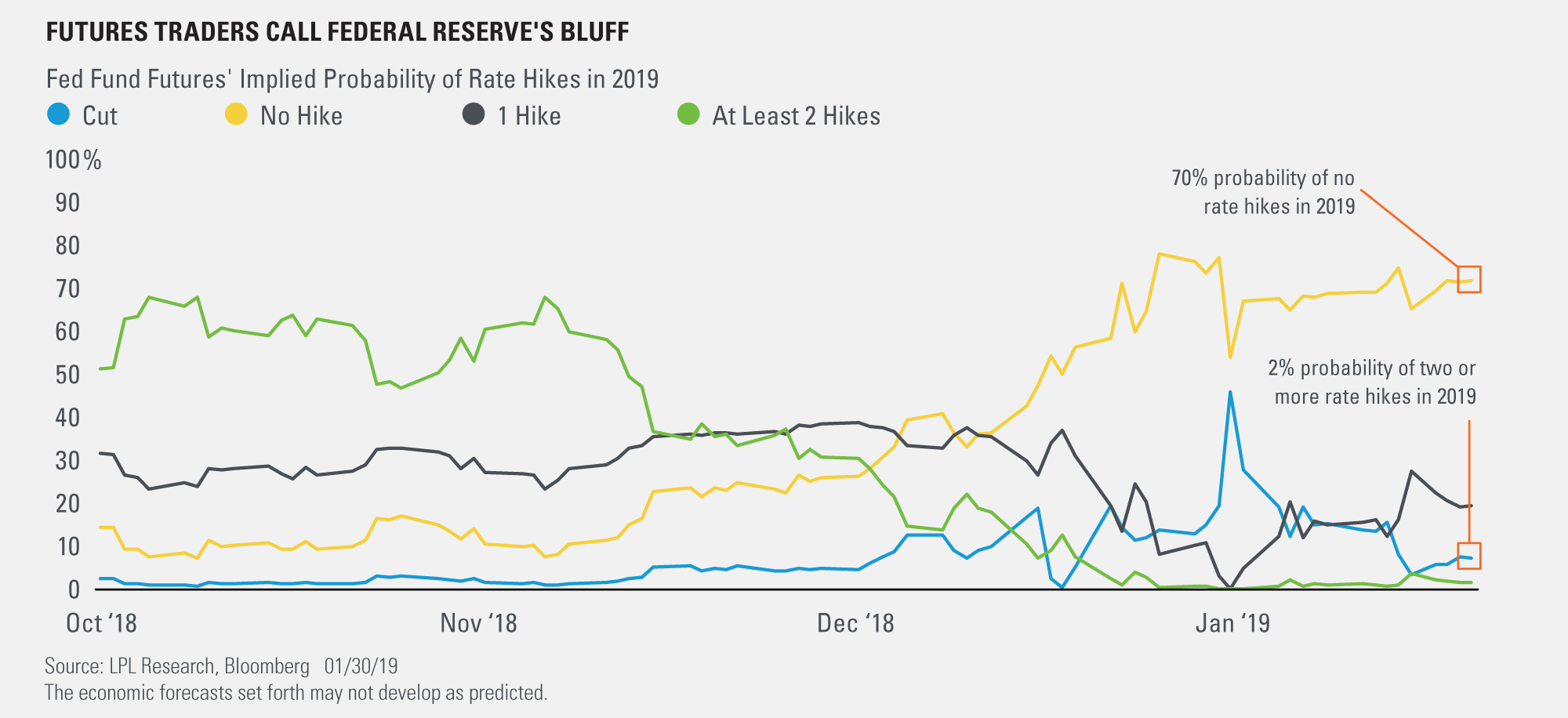

Markets have increasingly positioned for a pause in the Fed’s gradual rate hike path as global headwinds intensify, defying policymakers’ projections for two rate hikes in 2019. As shown in the LPL Chart of the Day, fed fund futures are pricing in about a 70% probability that the Fed will keep rates unchanged for the rest of the year.

While we expect one (maybe two) rate hikes this year, we also anticipate the Fed will likely err on the side of caution as the global macroeconomic has become environment has become more challenging.

“We believe the domestic economy is strong enough to support continued gradual rate hikes,” said LPL Research Chief Investment Strategist John Lynch. “However, the Fed is likely to show the flexibility markets are seeking as it balances solid U.S. fundamentals against slower global growth and trade risk.”

Other details we’ll be watching today include:

- Powell’s tone. Fed Chair Jerome Powell is still working on finding the right tone to persude markets that the Fed will be responsive to circumstances even as it tries to contain risks of late-cycle inflation. While Powell’s messaging hasn’t always soothed markets, we think his pragmatic approach is appropriate given the complicated nature of the domestic and global economies, and we don’t expect him to deviate from it.

- Economic context. Investors will be focused on Powell’s comments on the state of the U.S. economy, especially in the absence of economic data during the goverment shutdown. The Fed won’t update its economic projections until March.

- Balance sheet plans. The Fed’s balance-sheet normalization, meaning proceeds from maturing bonds purchased under quantitative easing are not reinvested, came under scrutiny after Powell said in the December press conference that the unwind is on “automatic pilot.” In our view, investors’ nervousness around the balance sheet is largely driven by sentiment, as global liquidity remains healthy. On January 4, Powell effectively walked back his “autopilot” comment by saying the Fed will be flexible with all of its policy tools, including the balance sheet. Since then, there has been speculation that the Fed will slow, pause, or even end its asset sales.

For more of our thoughts on today’s Fed events, check out the most recent Weekly Economic Commentary.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Member FINRA/SIPC

For Public Use | Tracking # 1-817062 (Exp. 01/20)