KEY TAKEAWAYS

- The outcome of this week’s Fed meeting is unlikely to materially alter the total return environment for fixed income investors.

- High-quality bonds can still provide gains and diversification benefits during periods of rising rates.

- A challenging low-return environment still confronts investors.

Click here to download a PDF of this report.

FED: KICK OFF OR PUNT?

Will the Federal Reserve (Fed) kick off an interest rate hike campaign this week or will the Fed punt and wait for another day? Similar to the start of football season, the start of Fed rate hikes has been widely telegraphed and long anticipated. Unlike the NFL season, 11 years have passed since the start of a Fed rate hike campaign and 9 years since the last interest rate increase. For good reasons, investors are nervous, but this week’s Fed decision is hardly a game-breaker.

Multiple dynamics could affect how offensive or defensive the Fed’s strategy may be at the conclusion of this week’s meeting on Thursday, September 17. (See the Weekly Economic Commentary, “How Much, How Far, How Fast, Not When?” for more on this week’s Fed meeting.) The Fed’s official statement, summary of economic projections, and Fed Chair Janet Yellen’s press conference comprise the three components of the Fed’s game-day schedule. Arguably this trio can be considered the defense, offense, and special teams of the Fed.

- Fed statement. The Fed carefully chooses its words to send a nuanced message intended not to rattle financial markets. The last Fed statement at the conclusion of the July 2015 meeting was dovish, or market friendly, with a tone suggesting little hurry to raise interest rates. The Fed’s statement has been defensive as of late but that may change. As always, the statement’s approximately 500 words will be carefully parsed to determine whether the Fed is closer to hiking (or lowering) interest rates, or simply content to let the clock run and observe the economy a while longer.

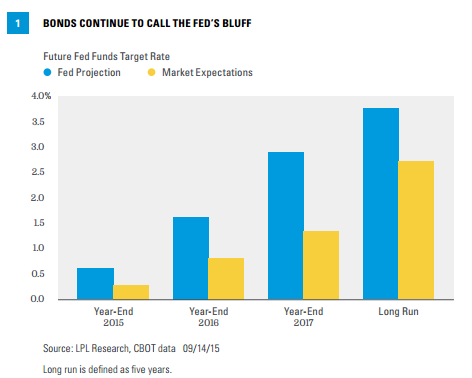

- Summary of Economic Projections (SEP). Every three months, Fed meetings conclude with Fed officials’ forecasts of economic growth, inflation, and the year-end fed fund target rate for coming years. Projections of the year-end fed fund target rate, known as the “dots plot,” indicate the possible pace of future interest rate hikes. Here, the Fed has been more offensive, outlining a pace of rate hikes that has been higher than what the market anticipates [Figure 1], as measured by futures. A gap persists even as the Fed shifted rate forecasts lower. This week the Fed may modestly lower near-term rate hike expectations due to the decline in oil prices, strong dollar, and China uncertainty, suggesting a slower pace of rate hikes to start, but perhaps picking up steam in years three through five as the “long run” gap between market and Fed expectations narrows but remains wide.

- Yellen’s press conference. Thirty minutes after the release of the Fed statement and SEP, the press conference can add more meaning to the Fed’s game plan than printed words and numbers. Yellen’s comments and Q&A session may reveal more about the Fed’s true intent. Yellen’s press conference can strongly influence market sentiment and on more than one occasion has turned a slightly hawkish statement into a more dovish market reaction. Hence, the press conference acts like the “special teams” of the Fed meeting and helps determine the market’s field position as it responds to the Fed statement.

GAUGING MARKET REACTION

How the three components come together will influence bond market reaction, but bonds continue to expect the Fed to play conservatively. (See last week’s Bond Market Perspectives, “Bonds to Fed: Do Not Raise Rates.”) The probability of a first rate hike occurring this week is roughly 25% according to fed fund futures pricing, and we agree that there appears to be little risk for the Fed to punt and wait another three months to assess economic and market signals.

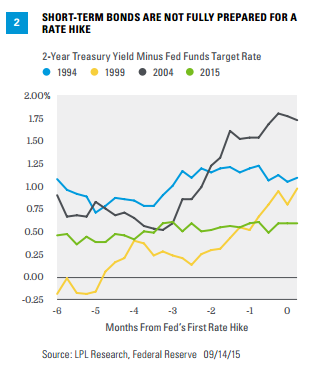

Bonds remain priced expensively and are not prepared if the Fed takes an offensive approach with rate hikes. The wider the gap between the two-year Treasury yield and the prevailing overnight fed funds target rate, the greater the buffer against possible interest rate hikes. The current gap is very limited compared with prior rate hike periods [Figure 2], suggesting short-term bonds may bear the brunt of weakness if a rate hike occurs this week. The two-year Treasury yield has increased in 2015 but at a much slower pace compared with prior periods. Part of this is due to the Fed’s anticipated go-slow approach, but historically, short-term yields have moved more in lockstep with Fed rate hikes. Alternatively, the lack of a rate hike but tough talk from the Fed that a rate hike may occur in October 2015 could still pressure shorter-term bond prices.

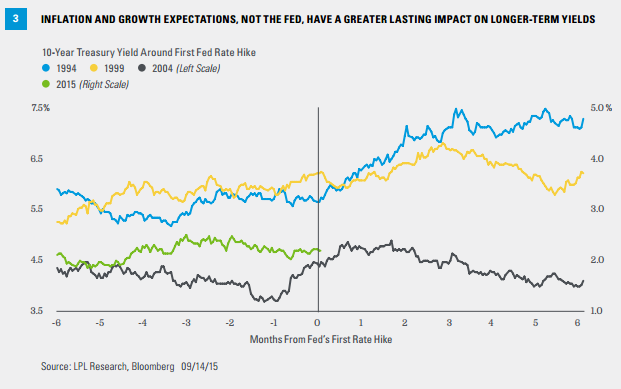

Reaction from intermediate- to long-term bonds may be more complex partially due to their greater sensitivity to inflation and economic growth expectations, rather than Fed rate hikes. The 10-year Treasury yield has fluctuated in 2015 but remains not far from its level at the start of the year, not unlike 2004 [Figure 3]. The 10-year Treasury yield was relatively range bound in 1994 before an aggressive and unexpected first rate hike by the Fed pushed the 10-year yield steadily higher. Such an aggressive campaign by the Fed is highly unlikely now but shows potential risks if the pace of Fed rate hikes is higher than expected. The 1999 and 2004 periods together reveal that while intermediate- to longer-term bonds did rise and hurt bondholders, the increase was relatively brief.

A rate hike coupled with hawkish rhetoric could actually lead to lower 10- and 30-year Treasury yields, with high-yield bonds and emerging markets debt (EMD) prices suffering greater weakness, if investors view the Fed as out of touch with low inflation, the implications of a strong dollar, and China uncertainty. In this scenario, a rate hike could be viewed as calling the wrong play. Conversely, no rate hike and a relatively balanced statement could provide additional tailwinds to high-yield bonds and EMD as each sector recovers from August weakness.

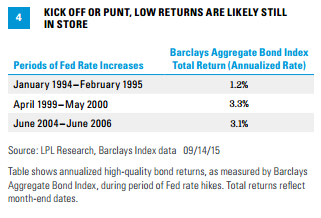

Once Fed rate hikes begin, either now, in December 2015, or in early 2016, the longer-term implications for the bond market are unlikely to be materially changed. A challenging low-return environment still confronts investors. Bonds can still provide gains and diversification benefits during periods of rising rates, but today’s total return environment is likely to be similar to prior periods of high-quality bond returns during Fed rate hikes [Figure 4].

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Investing in foreign fixed income securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with foreign market settlement. Investing in emerging markets may accentuate these risks.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-420569 (Exp. 09/16)