Brexit is getting a lot of headlines these days as the United Kingdom tries to figure out how to exit the European Union (EU).

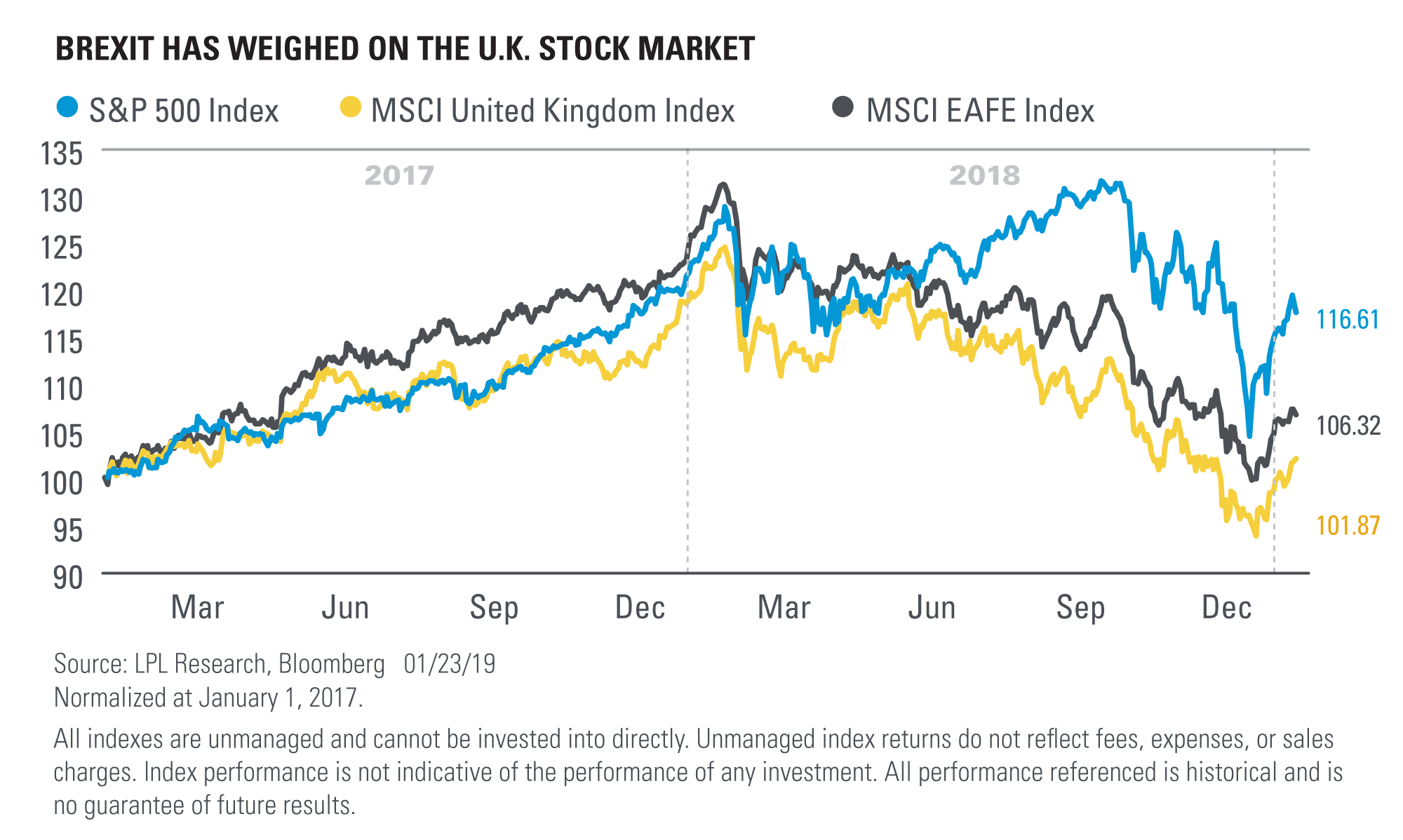

The uncertainty surrounding the British relationship with the rest of Europe has clearly weighed on the U.K. stock market, as shown in the LPL Chart of the Day, and is one of the reasons why the British economy only grew at a 1.4% pace in the fourth quarter of 2018, based on Bloomberg consensus economists’ forecasts for gross domestic product. Consensus forecasts are calling for more of the same in 2019—not enough to get global investors excited.

There are several possible paths for the U.K.-EU relationship after Theresa May’s plan was soundly rejected by the U.K. Parliament last week. One

“Should the U.K. go down the hard Brexit path, the U.K. economy would likely slow further as EU trade uncertainty weighs on consumer sentiment and business investment,” noted LPL Chief Investment Strategist John Lynch. A second referendum on whether Brexit should happen at all is still on the table, as is a delayed agreement that could be reached after March 29, 2019, deadline or even regime change.

Brexit is not the only risk in Europe for global investors to consider. Throughout the continent, a tighter regulatory environment and strict labor laws have restricted business growth, while the rise of populism has added obstacles. These challenges, in part, have made Italy’s debt problem tricker and pushed Germany to the brink of recession. Lackluster economic growth and heightened political risk drive our cautious tactical view on European equities. Because Europe

Emerging market (EM) equities look more attractive to us currently. EM offers stronger economic growth than developed economies and sensitivity to a likely pause in Federal Reserve rate hikes and to potential further weakening in the U.S. dollar, which

More on these topics in this week’s Weekly Market Commentary.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Member FINRA/SIPC

For Public Use | Tracking # 1-815142 (Exp. 01/20)