On Friday afternoon, July 29, the European Banking Agency (EBA) released the results of its latest stress test of major European Banks. The goal of these tests is to determine if the institutions in question could survive an economic slowdown, recession, or similar macroeconomic event. This survival is determined by the impact of an event on a bank’s Common Equity Tier 1 (CET1); this represents the capital that banks must hold to protect themselves from unexpected losses. Banks found to have inadequate capital can be forced to suspend dividends, raise additional capital, or take other measures to improve their financial health.

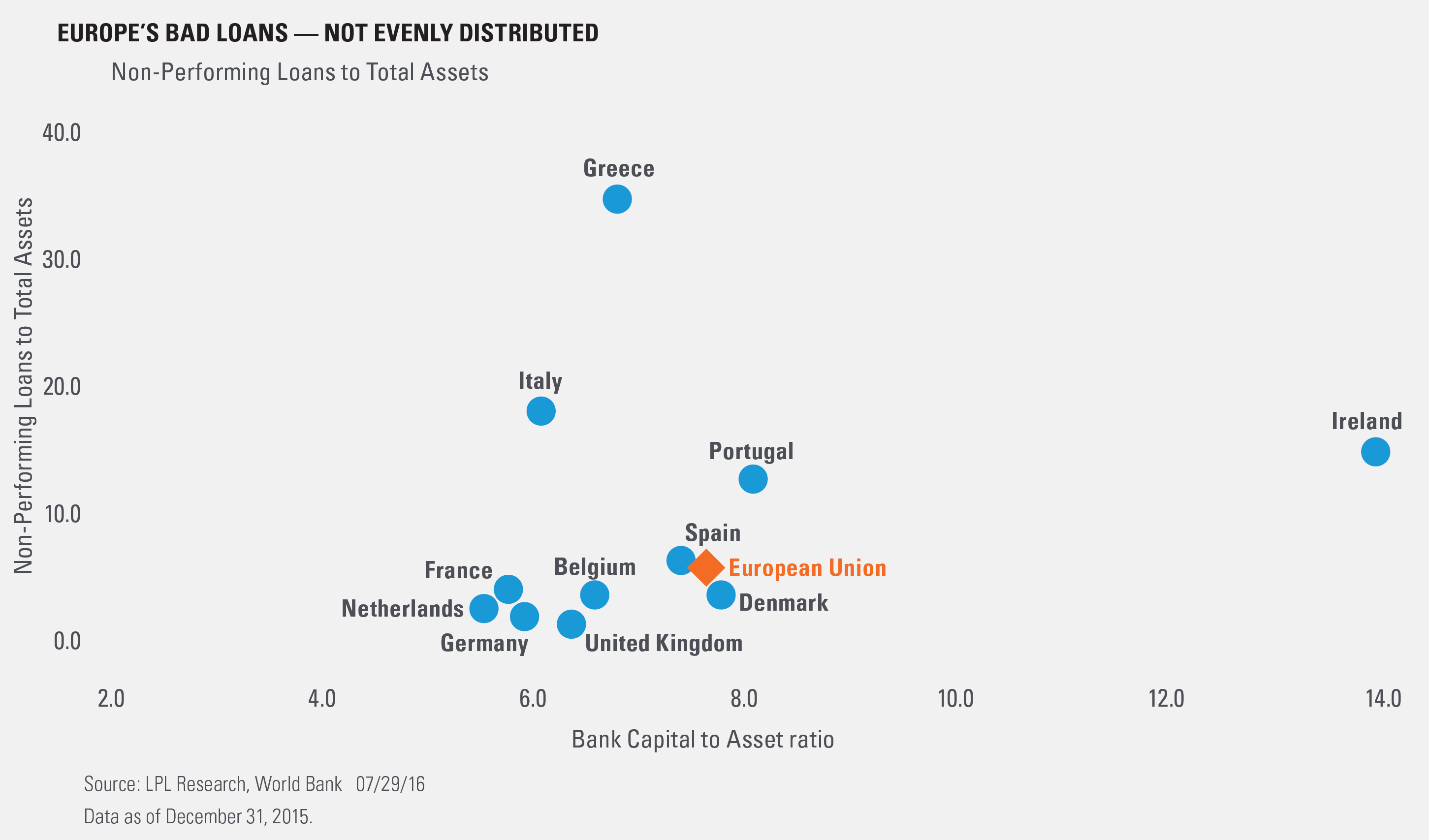

This is the third such test in three years; each one has focused on a different aspect of bank health. This year’s test revolved around loans, which are assets on a bank’s balance sheet. Many European banks have a problem with “bad loans,” usually referred to as non-performing loans (NPL). But the size of the NPL problem varies greatly by country, as does the percentage CET1 relative to total assets [Figure 1]. The latest test assumed that a bank would have to write off a substantial portion of these loans. It has been the periphery of Europe, places like Greece and Spain, which has been the major source of stress for the European financial markets. More recently Italy, one of the original six nations in the institutions that preceded the EU, has had its banking system come under scrutiny.

Technically, this round of testing had no formal “pass or fail” grade. However, looking at what would ultimately be considered an acceptable level of capital after accounting for bad loans, two banks, one Italian and one Irish, clearly failed. The Italian bank has already made provisions to sell off its bad loans for one-third of their face value and is expected to raise additional equity once the loan sale is complete.

After the financial crisis of 2008, European regulatory agencies created rules stating that any bank needing government assistance could only receive it after its equity and debt holders also contribute to the loss. This “bail in” policy seeks to ensure that taxpayers are not the first source of funds to shore up bad banks. This latest round of stress tests will help European regulators determine which banks, if any, need to be bailed in.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

International and emerging markets investing involves special risks, such as currency fluctuation and political instability, and may not be suitable for all investors.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking #1-521738 (Exp. 08/17)