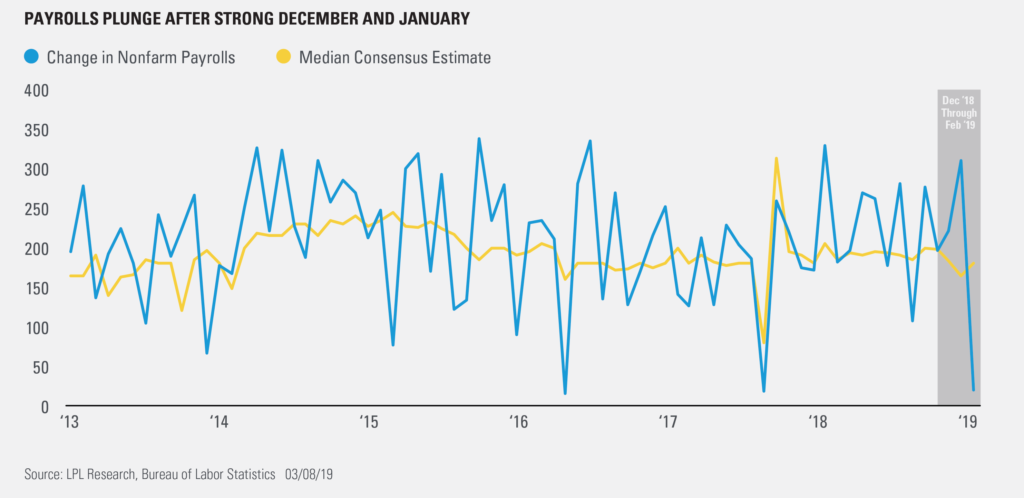

February’s smaller-than-expected jobs gain may put investors on edge, but underlying details show there isn’t much to fret about.

Nonfarm payrolls rose 20K, missing consensus estimates of 180K by the widest margin since March 2015. While the headline number is disappointing, it isn’t as surprising when considering recent strength in payrolls. As shown in the LPL Chart of the Day, January’s payroll gains were revised upwards to 311K for the biggest two-month increase in jobs created in 2.5 years.

There were also signs of weather-related weakness in the February jobs report. About 390K non-agricultural employees were unable to work because of weather conditions last month, the highest total since January 2018 and well above the February average.

“While payroll growth has slowed, job gains over the past few months have been unexpectedly strong,” said LPL Research Chief Investment Strategist John Lynch. “Labor market strength remains a bright spot in the U.S. economy, and wages are growing at a healthy pace.”

Average hourly earnings grew 3.4% year over year, around the fastest pace of the cycle. Wages have been one of the most telling job-market indicators to us, as year-over-year average hourly earnings growth historically has reached 4% before it threatened economic output.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

For Public Use | Tracking # 1-830173 (Exp. 03/20)