-

Wage Growth and Recession Fears

Friday’s jobs report for December offered little for investors to complain about with far more jobs created than expected. Nonfarm payrolls grew 312K last month, significantly above the median consensus estimate for a 184K increase. The unemployment rate did tick up, but it is still close to a cycle low.

-

Market Fears and Economic Realities

Recent Federal Reserve (Fed) rhetoric has spooked financial markets, especially as uncertainty has clouded investors’ horizons. But we still believe the fundamental U.S. economic landscape is compelling, and despite market concerns[…]

-

Putting an Extremely Volatile Market in Perspective

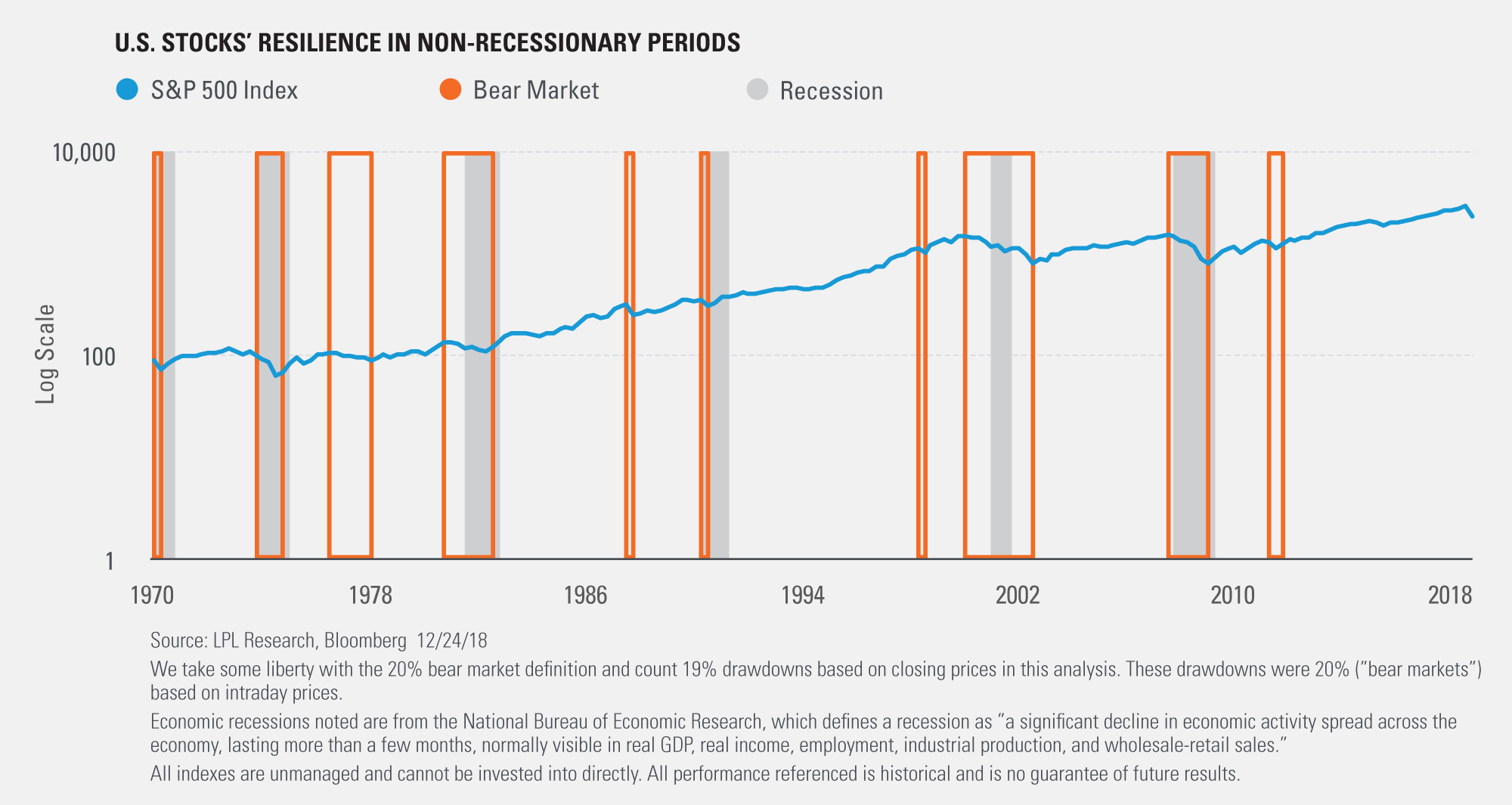

On Monday, the S&P 500 Index came about as close as possible to the technical definition of a bear market without officially registering one (defined as a 20% or larger decline based on closing prices). […]

-

Stocks Tend to Ignore Shutdowns

Next week could gring the third gonverment shutdown of 2018, especially after the fireworks out of Washington yesterday. In a widely watched live TV debate, President Trump sparred with Senate Minority Leader Schumer and House Minority Leader Pelosi regarding funding for the proposed wall on the Mexican border and potentially shutting down the goverment.

-

The Last 2 Times This Happened Led to Bear Markets—Will It Again? | September 13, 2016

After going 43 days without a 1% move (up or down) for the S&P 500, volatility has come back with a big 2.4% drop on Friday and a nice 1.5% bounce back up on Monday.

-

Assessing Friday’s Technical Damage on Equities | September 13, 2016

The S&P 500 Index sold off 2.45% last Friday (September 9, 2016) in what can be described as a major distribution day for market breadth.