We’ve been hearing a lot of debate about the U.S. economy’s ability to withstand rising interest rates.

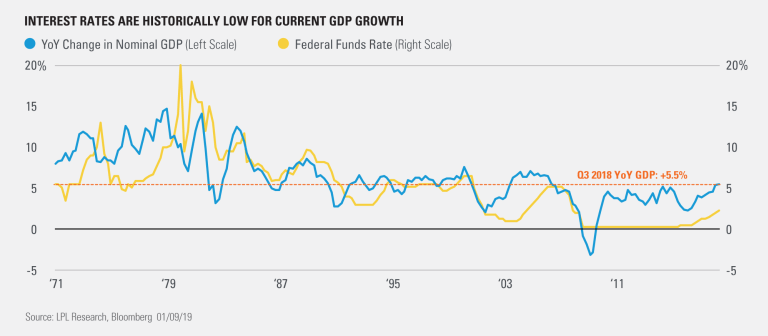

However, as shown in the LPL Chart of the Day, current interest rates are historically low relative to the robust output growth we’ve seen recently, proving that the Federal Reserve’s (Fed) path of increasing interest rates isn’t unusually cavalier given economic strength.

Nominal gross domestic product (GDP), or GDP without removing the inflation component, grew 5.5% year over year through the end of the third quarter, the fastest pace since the third quarter of 2006. In contrast, the fed funds rate was 2.25% on the upper end at the end of the quarter, for a spread of 3.25%. Since the end of 1970, the spread between nominal GDP growth and the upper bound Fed funds rate has been about 1.2%, signaling that the Fed still has ample room for hikes based on output growth.

“The Fed is raising interest rates gradually to keep inflation near the target for price stability and maintain a tight labor market,” said LPL Research Chief Investment Strategist John Lynch. “We still believe the fundamental U.S. economic landscape is compelling, and despite market concerns, monetary policy remains accommodative and the Fed’s plans are data-dependent.”

Of course, we have yet to see the final fourth-quarter GDP numbers. While we believe GDP growth moderated last quarter, we don’t expect significant slowing based on the

We also don’t expect the current pace of interest rate hikes to threaten this cycle. As we covered on the blog earlier this month, inflation-adjusted rates are also well below levels that preceded economic recessions.

Still, the economic environment is complex, and the U.S. economy’s solid progress has contrasted with tepid global growth for most of this cycle. As mentioned in our Outlook 2019, FUNDAMENTAL: How to Focus on What Really Matters in the Markets, we expect the data-dependent Fed to be less aggressive

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Member FINRA/SIPC

For Public Use | Tracking # 1-810303 (Exp. 01/20)