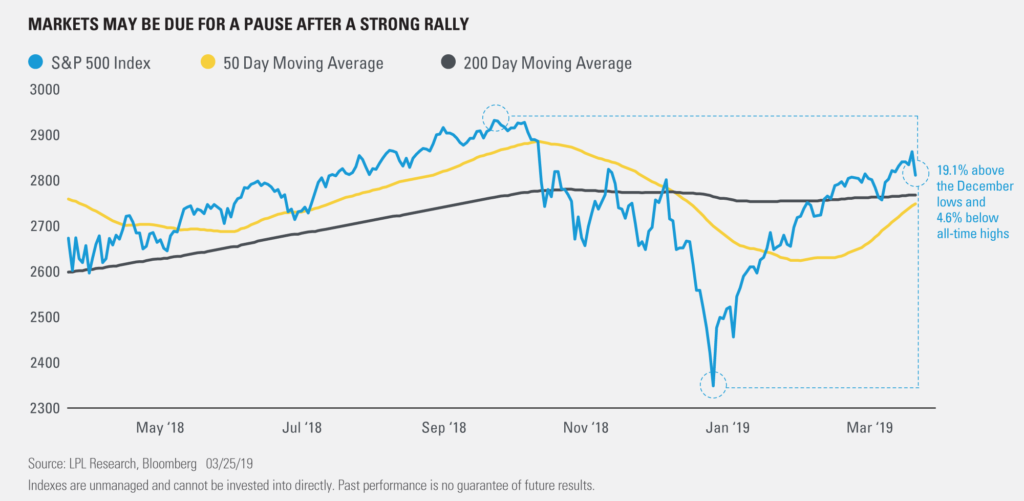

Stocks have had quite a run since the December 24 lows, with the S&P 500 Index up 19% to within 5% of last year’s record highs. Given this move in stocks, we believe it is prudent to readjust domestic equity allocations back to market weight.

“Our decision to bring our domestic equities allocation hack to market weight is driven more recent stock market strength than any deterioration in market fundamentals,” said LPL Chief Investment Strategist John Lynch. “Fundamentals for the U.S. economy remain sold despite the first quarter soft patch.”

The sluggish start to the year has several causes, including trade uncertainty, slower growth overseas, and the government shutdown. However, this is consistent with previous first-quarter readings this cycle, and some temporary headwinds are expected to clear, setting up a pickup in growth in the second quarter.

These factors have led to substantial reductions in expectations for 2019 earnings growth for the S&P 500. We are maintaining our 2019 earnings per share S&P 500 estimate of $172.50, representing about 6% growth. When we initiated this forecast, it was 3% below Wall Street’s consensus. Over the past several months, consensus estimates have fallen to 2.5% below our estimate, which we believe may be overly pessimistic. Solid economic growth and clarity on trade may result in earnings closer to our estimate.

Technical analysis also points to a more cautious near-term outlook, though we do not expect a retest of the December 2018 lows. Given the significant run-up, along with expected weakness in first-quarter gross domestic product and corporate profits, a consolidation of these gains may be in order before U.S. sticks may make another run back to the highs. On further weakness, we would look for the 50- and 200-day moving averages to act as support in the 2725 to 2750 range.

Look for more on this recommendation asset allocation change in this week’s Weekly Market Commentary, due out later today.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

For Public Use | Tracking # 1-835504 (Exp. 03/20)