KEY TAKEAWAYS

- Inflation expectations, the yield curve, and stock market volatility have raised the bar for a September rate hike.

- The Fed has a tall task ahead to justify a September rate hike, but it nonetheless remains a possibility.

- We believe the Fed will wait until December 2015 or possibly even early 2016, as there appears little downside risk to holding off.

Click here to download a PDF of this report.

BONDS TO FED: DO NOT RAISE RATES

Last week’s jobs report was just the sort of “not too hot, not too cold” result that kept a possible Federal Reserve (Fed) rate hike on the table at the conclusion of next week’s Fed meeting. Bond market internals indicate that a Fed rate hike this month would be ill-advised given inflation expectations near a post-recession low, the disparity between short- and long-term bond prices, and of course, market volatility. Fed fund futures, one of the more reliable measures to gauge the probability of future Fed rate changes, reflect an approximate 25% chance of a September 2015 rate hike. While small, one-in-four is still respectable odds.

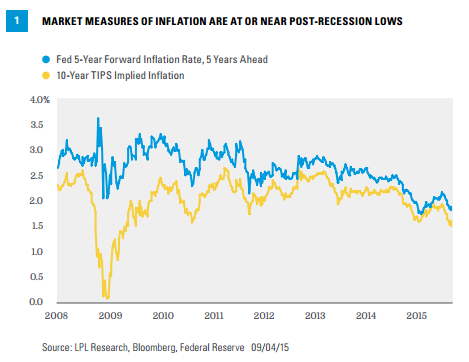

INFLATION EXPECTATIONS

If the Fed does raise rates this month it will have to articulate what it sees in the pipeline that could lead to higher inflation in the face of declining market-based measures of inflation expectations [Figure 1]. Both the break-even inflation rate implied by 10-year Treasury Inflation-Protected Securities (TIPS) and the Fed’s implied five-year inflation rate, five years from now, are at or very near post-recession lows. Not only is the level of inflation expectations low, but expectations have fallen sharply, by 0.4% since the end of June 2015, after rising gradually over the first half of 2015. The renewed decline in oil prices is a significant contributor to the deceleration, but the fall in the Fed’s measure, which is less sensitive to oil prices, corroborates the view that longer-term inflation expectations have been falling as concerns about global economic growth have risen.

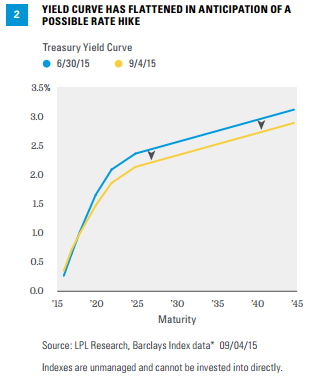

THE SHORT AND LONG OF IT

The disparity between short- and long-term bond prices also reflects the different forces impacting the bond market. On a year-to-date basis through September 4, 2015, short-term high-quality bonds have outperformed long-term high-quality bonds; but since the end of June 2015, long-term bonds have outperformed their short-term counterparts by just over 2%,* a significant disparity over a short period of time. The yield curve has flattened in response [Figure 2], as long-term yields declined while short-term yields increased slightly in response to Fed rate hike risks. A flatter yield curve is usually a signal of slower growth and a message from the bond market that a rate hike at this stage may hinder economic growth.

The disparity between short- and intermediate-term bonds serves as a reminder of the different forces impacting different parts of the bond market. While Fed rate hikes are usually assumed to boost bond yields across all maturities, that hasn’t been the case over the summer as inflation and growth concerns have helped push long-term bond yields lower over the summer. Therefore, long-term bond yields may not necessarily fall further if the Fed raises rates on September 17, 2015. In early August 2015, comments from Atlanta Fed President Lockhart indicated that the economy was healthy enough to withstand a rate hike, leading to bond yields temporarily spiking higher across the maturity spectrum. The pace of rate hikes may ultimately determine how much long-term yields move higher, if at all, in response to a first rate hike. We still believe all bond yields are likely headed higher as bond valuations remain very expensive by historical standards. Fed rate hikes may motivate investors to demand higher risk premiums (i.e., higher yields) to compensate for future rate hike risks.

The summer strength of long-term bonds, despite the Fed rate hike headwinds facing short-term bonds, pushed the overall high-quality bond market, as measured by the Barclays Aggregate Bond Index, back into positive territory for 2015. Still, at a 0.6% total return through September 4, 2015, high-quality bond returns remain very low and are likely to continue to face a challenging environment.

*As measured by the Barclays 1-3 Year Government/Credit Index and Barclays Long-Term Government/Credit Index.

STOCK MARKET VOLATILITY

Recent stock market swings, both domestically and overseas, pose another challenge for the Fed. We believe China’s stock market gyrations and slowing economy are unlikely to materially impact the U.S. economy. Nonetheless, such swings do reveal investor uncertainty about potential headwinds for corporate profits and the global economy. Here too, the Fed would need to provide justification for a rate hike amid financial markets flashing caution.

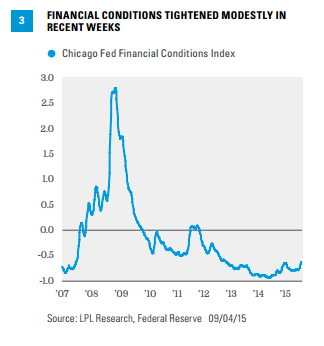

Despite stock market declines, bond price movements have been subdued, which also adds to the Fed’s burden of proof. Between August 18, 2015, when the stock correction began, and September 4, 2015, U.S. stocks (as measured by the S&P 500) are down 8.6% while the 10-year Treasury yield is down a mere 0.07% to 2.12%. The absence of a significant move lower in interest rates has led to tighter financial conditions [Figure 3]. All else equal, tighter financial conditions can weigh on the economy, but overall financial conditions, although tighter, remain market friendly. The Chicago Fed Financial Conditions Index, a broad measure of financial stress, is back to early January 2015 levels but is still well below late 2011 levels, when European debt fears posed a greater threat.

CONCLUSION

Inflation expectations, the yield curve, and stock market volatility have all raised the bar for a September rate hike. The European Central Bank (ECB) has already given a nod to global market volatility and growth concerns by easing terms on eligible bonds for its bond buying program, which is set to run through at least September 2016. While central banks are independent, the ECB’s action could also place added indirect pressure on the Fed. Taken together, the Fed has a tall task ahead to justify a September rate hike, but it nonetheless remains a possibility. We believe the Fed will wait until December 2015 or possibly even early 2016, as there appears little downside risk to holding off.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Treasury Inflation-Protected Securities (TIPS) help eliminate inflation risk to your portfolio, as the principal is adjusted semiannually for inflation based on the Consumer Price Index (CPI)-while providing a real rate of return guaranteed by the U.S. government. However, a few things you need to be aware of is that the CPI might not accurately match the general inflation rate; so the principal balance on TIPS may not keep pace with the actual rate of inflation. The real interest yields on TIPS may rise, especially if there is a sharp spike in interest rates. If so, the rate of return on TIPS could lag behind other types of inflation-protected securities, like floating rate notes and T-bills. TIPS do not pay the inflation-adjusted balance until maturity, and the accrued principal on TIPS could decline, if there is deflation.

Investing in foreign fixed income securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with foreign market settlement. Investing in emerging markets may accentuate these risks.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

The Barclays 1-3 Year Government/Credit Bond Index is a market value-weighted performance benchmark for government and corporate fixed-rate debt issues with maturities between one and three years.

The Barclays Long-Term Government/Credit Bond Index is an unmanaged index that includes fixed-rate debt issues rated investment grade or higher by Moody’s, Standard & Poor’s, or Fitch, in order. Long-term indexes include bonds with maturities of 10 years or longer.

The Chicago Fed Financial Conditions Index provides a comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets, and the banking systems.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-418200 (Exp. 09/16)