KEY TAKEAWAYS

- Presidential election years have had very little impact on interest rates and the bond market.

- Classic drivers of bond yields, most notably the Fed, hold much greater influence over the course of interest rates and potential bond market returns.

Click here to download a PDF of this report.

Much work has been done on potential election year impacts for the stock market, but little on interest rates and the bond market. Uncertainty over the winner of the presidential election and potential policy and legislative changes are closely scrutinized for potential financial market impacts. Historical trends in the stock market are often a popular conversation topic, but those looking for similar election trends in the bond market will be disappointed. The Federal Reserve (Fed) has frequently been a dominant driver of bond performance during presidential election years, leaving election results to have little lasting impact.

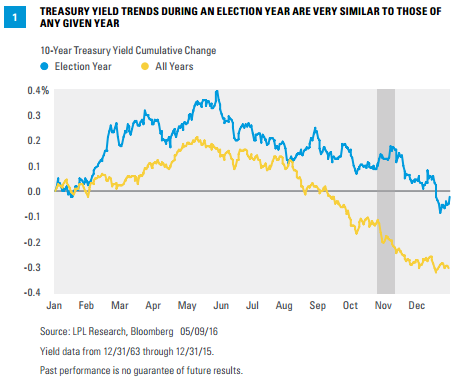

The path of bond yields during a presidential election year is very similar to the historical pattern for any given year [Figure 1]. Treasury yields have a seasonal bias to rise in early February and drift higher through mid-May before slowly decreasing through year-end. The presidential election year pattern is very similar, although with greater volatility given a more limited data set. The sharp drop in the 10-year Treasury yield during December of election years is strongly influenced by a 1.6% yield decline in 2008 from mid-November through the end of December.

Two notable deviations from the average annual pattern are evident, however, one of which occurs coincidentally from late October through early November—almost spot on election time (shaded area of Figure 1). The seasonal tendency is for yields to decline starting in late October through November; but during election years, the tendency is for an increase in Treasury yields. The election year blip in 10-year yields is minor and totals less than 0.1% (on average). An increase in Treasury yields essentially reflects some uncertainty ahead of the presidential election in the form of a slight yield rise, but little more than that as investors refocus on fundamental drivers.

The only other notable disparity occurs in the first half of August when yields rise modestly, on average, during election years and decline in all other years. Much of this increase is accounted for by Fed interest rate hikes in 1980, 1984, and 1988, which helped push Treasury yields higher in August of those years.

LED BY THE FED

The Fed, therefore, has been the major driver of bond yields during election years. In the 13 presidential election years from 1964 on, the Fed has raised interest rates 8 times. In two of those years the Fed also lowered interest rates. In 1996, the Fed cut interest rates in January, but bond yields were pressured upward in anticipation of a Fed rate hike that ultimately came following the first Fed meeting of 1997. In three presidential election years, the Fed only lowered interest rates. In sum, the Fed has been active during presidential election years and rate hikes have been more common than rate cuts. This is reflected in the slightly higher trajectory of the seasonal yield pattern in Figure 1. Fed policy, therefore, has been a bigger driver of bond yields, and hence returns, during election years.

DÉJÀ VU IN 2016

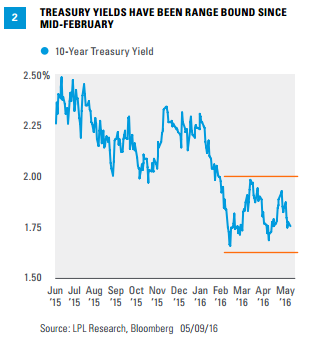

Once again, the prospect of Fed rate hikes is on the horizon in a presidential election year. So far, 2016 has been anything but typical, with a sharp drop in bond yields to start the year as growth concerns, oil price fears, and overseas weakness caused the Fed to rethink rate hike expectations. In early 2016, highquality bond prices rose and yields fell in response to the likelihood of fewer rate hikes in early 2016. But the 10-year Treasury yield has been broadly range bound since mid-February [Figure 2], suggesting another catalyst is needed now that market and Fed rate hike expectations are more closely aligned.

The catalyst to push bond prices and yields out of the current range will likely come from the Fed or the global economy, not the elections. Classic drivers of interest rates—the Fed, economic growth, and inflation—should continue to be the primary driver of bond yields, with potentially little coming from the election other than the very modest yield fluctuations around election time. For our thoughts on the potential stock market impact of the election, please see this week’s Weekly Market Commentary.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-496258 (Exp. 05/17)