KEY TAKEAWAYS

- The combination of near record low yields and fair valuations, along with changing seasonal factors, sends mixed messages to municipal investors.

- When viewed over a longer-term context, municipal bonds remain one of the more attractive high-quality bond options in a low-return world.

Click here to download a PDF of this report.

MIXED MESSAGES FROM MUNICIPALS

Low yields coupled with fair valuations send a mixed message from the municipal bond market. The shift from a challenging seasonal period to a more favorable one provides another. The passage of April 15, or April 18 as is the case this year, marks not only the tax deadline but also the end of a challenging seasonal period for municipal bonds. Tax-related selling can often pressure municipal prices as soon as the start of March, but lackluster performance in both stock and bond markets in 2015 limited capital gains that might result in municipal bond sales. As a result, March 2016 municipal bond performance was the strongest March in eight years. Despite a positive month of March, municipals as a whole still lagged the broad high-quality bond market as defined by the Barclays Aggregate Bond Index, providing mixed messages to investors.

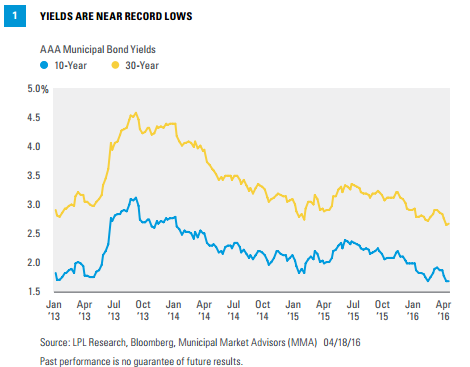

The end of a challenging seasonal period, coupled with the start of a favorable seasonal trend through the end of May, does not warrant high optimism on its own. High-quality municipal bond yields remain near historic lows and near the low end of the range over the past several years [Figure 1]. Average 10- and 30-year AAA municipal bond yields remain below important 2.0% and 3.0% psychological thresholds, respectively, which have limited demand in the past.

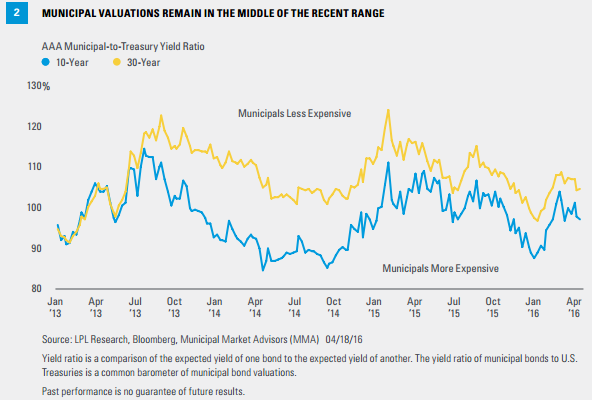

However, more attractive valuations are the potential silver lining of municipals lagging their taxable counterparts during the first quarter of 2016. Valuations are fair to attractive, and are more favorable to investors compared to the start of 2016, partially offsetting the distaste of lower yields. Average AAA municipal-to-Treasury yield ratios remain in the middle of a 3-year range [Figure 2]; but, when viewed over a longer 25-year history, remain attractive. Currently, top-quality municipal bond yields are roughly in-line with their Treasury counterparts, suggesting the tax-exemption benefit of municipal bonds is undervalued.

STILL FAVORABLE SUPPLY & DEMAND

Investor demand for tax-exempt income continues to support the municipal bond market and was a significant factor in municipal resilience in March 2016. According to Investment Company Institute (ICI) data, municipal bond fund inflows have averaged a hefty $1.1 billion per week in 2016, easily surpassing the 2015 pace over the same period. Newly issued bonds over recent weeks often saw yields lowered, with many deals upsized, in response to robust demand.

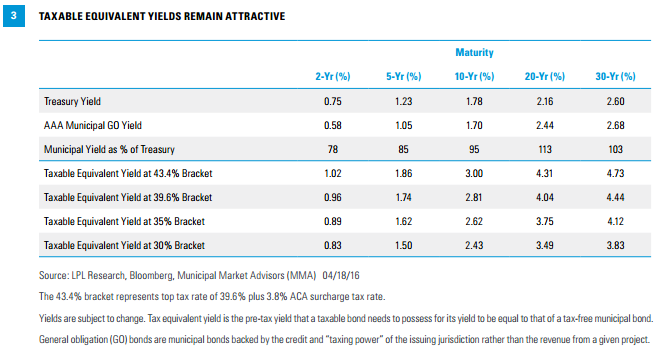

Over the past two weeks, municipal bonds actually outperformed Treasuries* as the approach of tax day increased awareness of municipals’ taxexemption benefit. As highlighted in last week’s Bond Market Perspectives, “The State of States,” the threat of higher taxes continues to linger not only in places like Illinois and Pennsylvania but across the country, as expenses have increased alongside revenue. The potential for higher tax rates keeps municipal bonds on the forefront of investors’ minds. Tax season may have served as a reminder that municipal bonds are the only investment vehicle also exempt from the additional 3.8% tax surcharge on capital gains and dividends due to the Affordable Care Act (ACA). For investors in the top tax bracket, after-tax yields are particularly attractive, but lower tax bracket investors may also benefit [Figure 3].

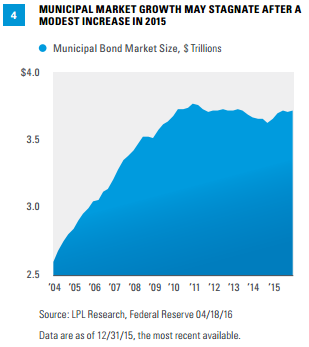

Our long-held thesis of limited supply remains very much intact. In 2015, new issuance increased versus 2014 and led to the first meaningful growth in the size of the overall outstanding municipal bond market since 2009 [Figure 4]. The 2015 increase was easily met by investor demand; but so far, 2016 has witnessed a 12% decline in new issuance.* Growth in the overall municipal market may stagnate once again and could reinforce the favorable supply-demand balance.

*Barclays Municipal Bond Index compared to Barclays Treasury Index.

*According to The Bond Buyer 03/31/16.

CONCLUSION

Among municipal bonds, low yields offset fair valuations and, along with a change in seasonal factors, send mixed messages to municipal bond investors. On a longer-term basis, however, valuations remain attractive and the favorable supply-demand balance is expected to remain in place as debt issuance capacity remains restrained. Investors should keep return expectations in check, but we continue to find municipal bonds one of the more attractive high-quality bond sectors in what seems likely to remain a low-return world.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

INDEX DESCRIPTIONS

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

The Barclays U.S. Municipal Index covers the USD-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds.

The Barclays U.S. Treasury Index is an unmanaged index of public debt obligations of the U.S. Treasury with a remaining maturity of one year or more. The index does not include T-bills (due to the maturity constraint), zero coupon bonds (strips), or Treasury Inflation-Protected Securities (TIPS).

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-489316 (Exp. 04/17)