The S&P 500 Index sold off 2.45% last Friday (September 9, 2016) in what can be described as a major distribution day for market breadth. In technical analysis, distribution is defined as increased selling of stocks by large institutions on increased volume. A major distribution day is when the ratio of declining issues to advancing issues (called the distribution ratio) is greater than 7:1. Friday’s sell-off had a distribution ratio of 44:1, with 494 companies in the S&P 500 lower for the day. The question remains: When equity markets experience a major distribution day of this magnitude, is it more telling of a reversal and further gains, or a potential continued move lower for stocks? Looking at historical data going back to 2007, when the S&P 500 declining issues for one day were greater than 490, subsequent prices for equities tended to rise.

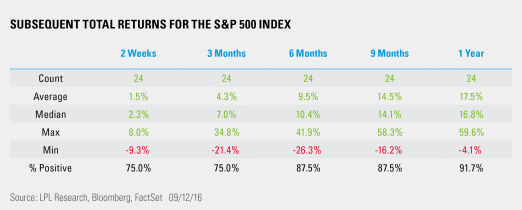

Since 2007, this happened only 24 times. Two weeks later, the S&P 500 was higher 75% of the time, with average and median returns of 1.5% and 2.3%, respectively. After three months, the index was higher 75% of the time, with average and median returns of 4.3% and 7.0%. Going out six months, the index was higher 87.5% of the time, with average and median returns of 9.5% and 10.4%. Looking out one year, the index was higher 91.7% of the time, with average and median returns of 17.5% and 16.8% (see the table below).

Even though the historical data suggest an increased likelihood of stocks moving higher following a major distribution day, the risk of a continued move lower remains. One thing to monitor is whether the S&P 500 begins to exhibit more cases of major distribution days over the next couple of weeks, potentially in clusters. A cluster of major distribution days increases the likelihood of a continued move lower for stocks.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Technical analysis is a methodology for evaluating securities based on statistics generated by market activity, such as past prices, volume and momentum, and is not intended to be used as the sole mechanism for trading decisions. Technical analysts do not attempt to measure a security’s intrinsic value, but instead use charts and other tools to identify patterns and trends. Technical analysis carries inherent risk, chief amongst which is that past performance is not indicative of future results. Technical analysis should be used in conjunction with fundamental analysis within the decision making process and shall include but not be limited to the following considerations: investment thesis, suitability, expected time horizon, and operational factors, such as trading costs are examples.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking #1-534978 (Exp. 09/17)