We talked about the sell in May phenomenon in this week’s Weekly Market Commentary, offering some different angles on the widely reported (perhaps clichéd) stock market pattern that is a very popular topic of discussion among investors and the media right now. The numbers say investing in stocks from November through April captures all the returns in a year, and that you don’t miss much if you sit out May through October. Before the streak was broken in the November 2015 to April 2016 period, the S&P 500 was up in November through April for six straight years (starting in April 2010), which has only happened twice before. The longest streak was a record 10 straight in the 1950s.

The two angles we pursued in our latest commentary, the impact of the start to the year and the presidential election cycle, paint a better picture for stocks, and suggest holding stocks right now for the next six months. Small sample sizes and the difficulty explaining the reason for this pattern also suggest sticking with your investment strategy despite the seasonal pattern.

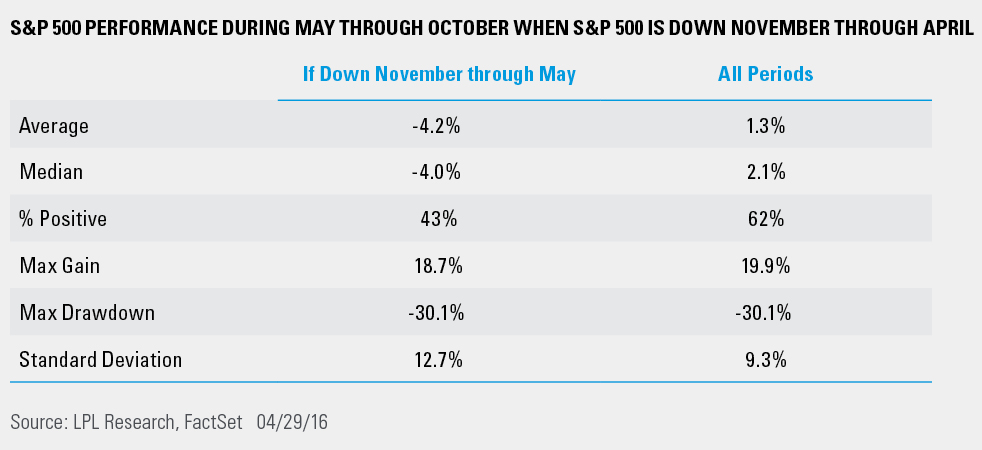

Another angle we found interesting is looking at how effective the “sell in May” strategy is when November through April bucks the trend. In other words, if stocks are down during the November through April period—as they were between November 2015 and April 2016—when the seasonal pattern says they should be up, what does that mean for May through October?

The answer is that stocks can potentially do worse from May through October when this usually bullish six-month November through April period is negative, as shown in the accompanying table. Stocks were only down 0.7% during these last six calendar months, which is not too far from positive territory; but the performance is quite a bit worse compared to the average. So put another check in the pullback column.

Another interesting point is that volatility is also higher after negative returns for stocks between November and April. Based on standard deviation, after a negative November to April, stocks are about 35% more volatile than average for the subsequent the May through October period (12.7% versus 9.3%).

Thus, we typically see more volatility and stock market weakness over the subsequent six months following a negative “best six months of the year.” With many market risks on the horizon (a potential “Brexit,” China’s massive economic transition, a possible central bank policy mistake, among others), the aging business cycle, and political uncertainty coming to the fore in the U.S., this historical pattern may play out again this year. We’ll see.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Stock investing involves risk including loss of principal.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-494450 (Exp. 05/17)