The strong move in stocks continues. The S&P 500 Index has risen nearly 19% (as of February 22) from the December 24 lows, and the Dow Jones Industrial Average (Dow) has posted an incredible nine-week winning streak for the first time since a 10-week stretch back in 1995.

The Dow’s strength at this time of the year is especially impressive. To put it in perspective, the Dow closed up the first eight weeks of 2019—the second-best win streak to start a year, eclipsed only by the 11 consecutive weekly wins that started 1964.

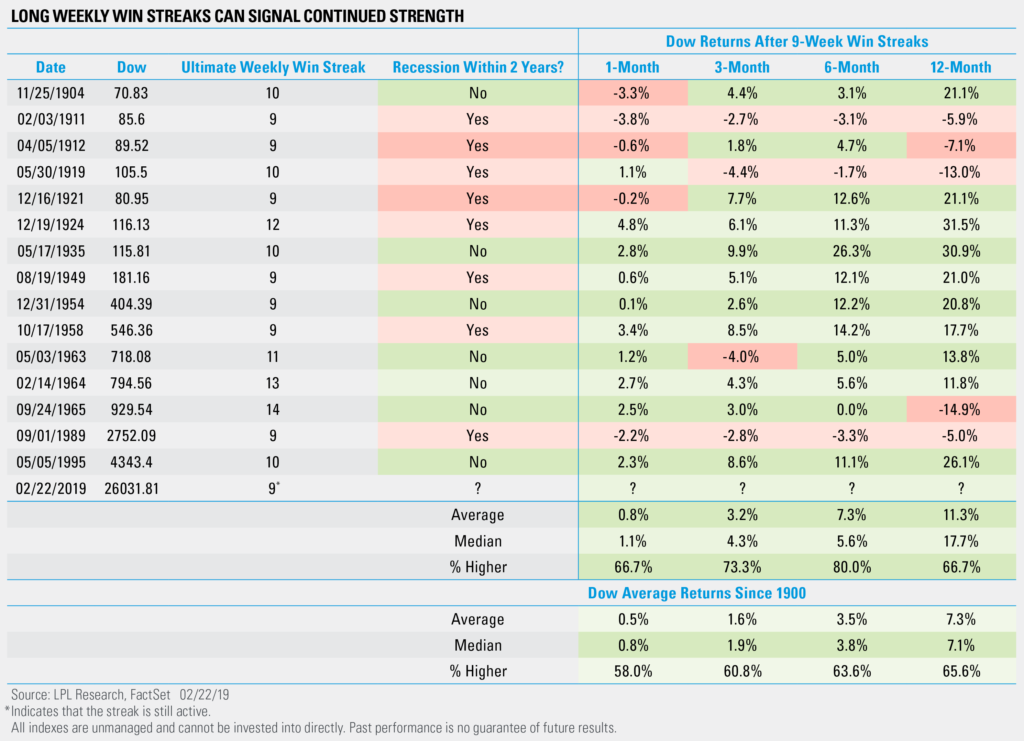

The Dow’s long weekly win streak could mean continued strength ahead. “Long weekly win streaks actually have led to stronger performance,” explained LPL Senior Market Strategist Ryan Detrick. “In fact, there have been 15 other nine-week win streaks since 1900, and a year later the Dow’s median return was nearly 18%. Not bad at all.”

As the LPL Chart of the Day shows, the returns after a nine-week win streak for the Dow are significantly better than its overall average return. A strong Dow has historically foreshadowed economic strength as well: Only twice out of the

Now what? Later today in our Weekly Market Commentary we take a look at the five most frequently asked questions we’ve

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

For Public Use | Tracking # 1-825869 (Exp. 02/20)