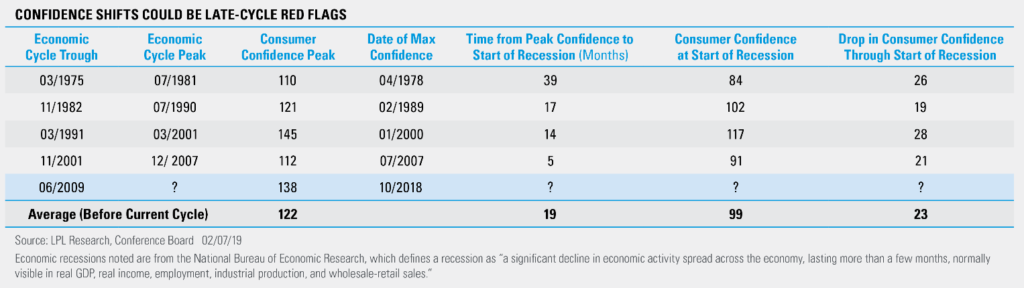

Four months ago, the Conference Board’s Consumer Confidence Index reached an 18-year high. Since then, consumer sentiment has deteriorated rapidly, leading some investors to wonder if a drop in confidence could eventually lead to a downturn.

As shown in the LPL Chart of the Day, the U.S. economy has entered a recession an average of 19 months after a peak in consumer confidence, and a drop in sentiment has been a warning sign for past economic cycles. While confidence shifts can be meaningful obstacles to economic activity, we think the severity of the current decline is due, in part, to temporary factors such as the government shutdown, and the pieces are still in place for sentiment to stabilize.

Over the past several months, U.S. consumer sentiment has had to weather increasing trade risk, a 35-day government shutdown, disconcerting headlines on geopolitical issues, a slowdown in global growth, and a near bear market in the S&P 500 Index. Many of these headwinds have understandably chilled confidence, and their collective impact can be intimidating.

However, we think these headwinds will subside in the near term, if they haven’t already. Trade tensions have had a widespread effect on corporate sentiment and economic activity, but we expect a U.S.-China trade resolution soon, which could help. Government shutdowns, especially when prolonged, have historically dampened consumer sentiment, but economic activity typically has rebounded quickly after shutdowns.

“While the current environment is uncomfortable, the steep drop in confidence is exaggerated given favorable economic conditions,” said LPL Research Chief Investment Strategist John Lynch. “We expect strong fundamentals to prevail over the near-term headwinds.”

We believe solid fundamentals are especially important this late in the business cycle. The bulk of economic data we’ve seen lately has been sound, corporate earnings are at record levels, and policy is still accommodative. We also have yet to see any alarming signs of late-cycle excesses or “red flags,” which have doomed expansions in the past.

For more of our thoughts on the recent drop in sentiment, check out our most recent Weekly Economic Commentary.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

For Public Use | Tracking # 1-821069 (Exp. 02/20)