The Federal Reserve (Fed) has doubled down on its patient stance. Policymakers signaled a complete pause in policy at the conclusion of the Fed’s March meeting, with a nod to a slowing pace of growth and global uncertainty.

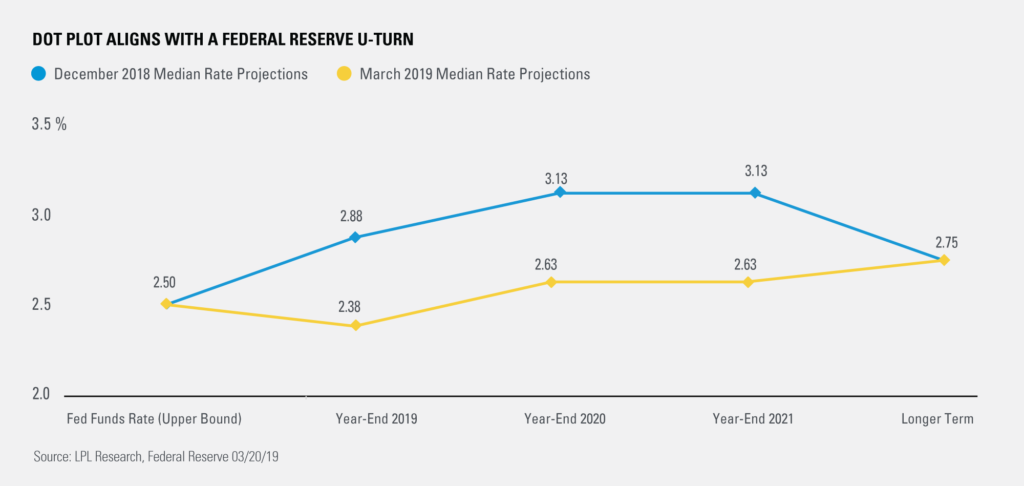

As shown in the LPL Chart of the Day, Fed voting members projected (via the latest “dot plot”) unchanged to slightly lower interest rates this year, with one more rate hike in 2020 or later to lift the long-term rate to 2.75%.

Policymakers also lowered their gross domestic product growth projections to 2.1% for 2019 and 1.9% for 2020, while Fed Chair Jerome Powell acknowledged that global weakness could be a notable headwind to the U.S. economy.

Policymakers also lowered their gross domestic product growth projections to 2.1% for 2019 and 1.9% for 2020, while Fed Chair Jerome Powell acknowledged that global weakness could be a notable headwind to the U.S. economy.

Still, Powell conveyed significant faith in U.S. economic fundamentals, noting in his press conference that “it’s a great time to be patient,” as the labor market remains strong, confidence has improved back to encouraging levels, and the outlook remains positive.

“Powell and the Fed delivered a balanced message to U.S. investors, indicating that the lack of clarity warrants a patient stance,” said LPL Research Chief Investment Strategist John Lynch. “We side with the Fed here in thinking that underlying economic conditions remain solid, with evidence of a slowdown at the beginning of this year from near-term temporary headwinds.”

Powell hinted that interest rates are in the “broad range” of neutral, or the point where policy is neither accommodative nor restrictive to output. That doesn’t mean that rates have hit a short-term ceiling, though. We wouldn’t be surprised if stabilizing U.S. growth and higher inflation lead to a rate hike in the second half of 2019. The Fed’s current projections give few indications of that happening, likely because of policymakers’ hesitance to pass judgment on the U.S. economy amid mixed signals from data. Because of this, we expect the Fed to carefully communicate any change in stance to investors.

The Fed also announced it would start reducing the pace of its balance-sheet runoff in May, and end the runoff entirely in September. Powell reiterated that interest rate changes are the Fed’s primary policy tool, but a larger balance sheet could help buoy risk assets and capital investments.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

For Public Use | Tracking # 1-834262 (Exp. 03/20)