Today, the Federal Reserve (Fed) kicks off its second two-day meeting of 2019, and financial markets have high expectations for the outcome.

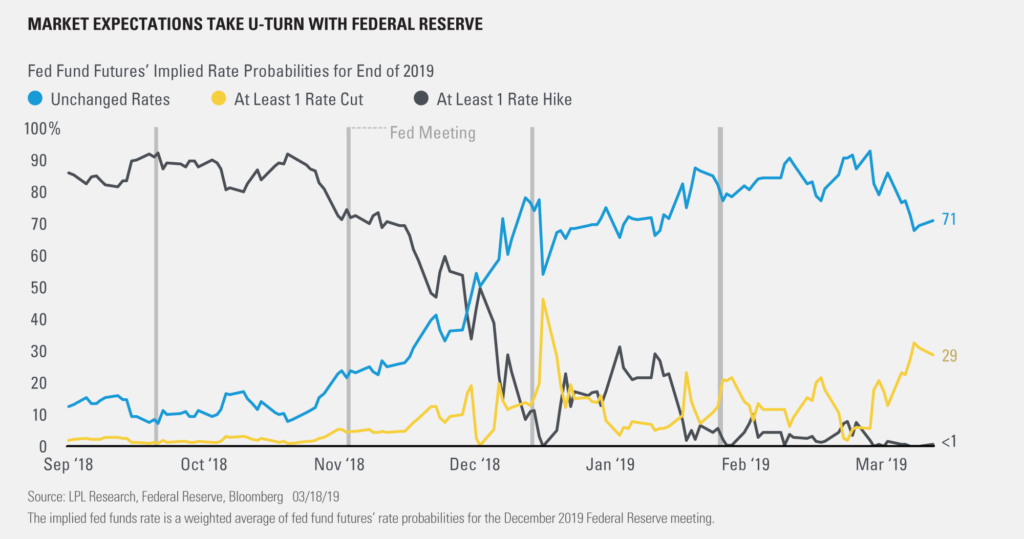

The Fed will likely hold off on the pause in rate hikes this week, and market participants are overwhelmingly expecting the Fed to keep rates unchanged and reiterate a commit to flexibility down the road. As shown in the LPL Chart of the Day, futures traders are pricing in a 71% probability of a stagnant fed funds rate through the end of 2019 and a 29% chance of a rate cut.

Beyond the rate announcement, Fed Chair Jerome Powell could give more color on future policy, as the Fed is slated to update its “dot plot” (or policymakers’ rate projections) at this meeting. Powell could also provide more commentary on the Fed’s balance-sheet reduction plans, which could change with the Fed’s new flexible stance.

“Powell may be tasked with a difficult balancing act in his press conference as he weighs in on slowing, but sound U.S. data and tenuous global affairs,” said LPL Research Chief Investment Strategist John Lynch. “Which we don’t think policymakers should bow to markets in deciding on policy, the Fed’s acknowledgement of global clarity is especially important these days.”

Markets are extra sensitive to Fed commentary these days as pockets of the U.S. economy weaken along with signs of a global slowdown. The S&P 500 Index has closed up or down at least 1.5% on each of the past two Fed announcement days, the first time that’s happened since October 2011. U.S. stocks are also nearing record highs once again as investors price in a cautious scenario for policy, considering the macroeconomic environment hasn’t changed much since the Fed paused rate hikes in January.

We don’t anticipate the Fed’s patient tone will change much in this meeting, and we expect the Fed’s dot plot to either project unchanged or slightly higher interest rates through the end of 2019. Fundamentally, we see the bulk of global tensions as the product of near-term headwinds. As these headwinds subside, U.S. growth could stabilize and inflation could pick up modestly. If this happens, the Fed may hike once in the second half of the year after carefully communicating a change in stance to markets.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

For Public Use | Tracking # 1-833486 (Exp. 03/20)