Germany’s benchmark bund yield is on the cusp of negative territory, a symptom of increased appetite for government debt that could eventually weigh on U.S. rates. The 10-year bund yield, which closed at 0.09% (9 basis points, or bps) February 8, could go negative for the first time since late 2016 as Europe’s biggest economy battles economic weakness and falling inflation.

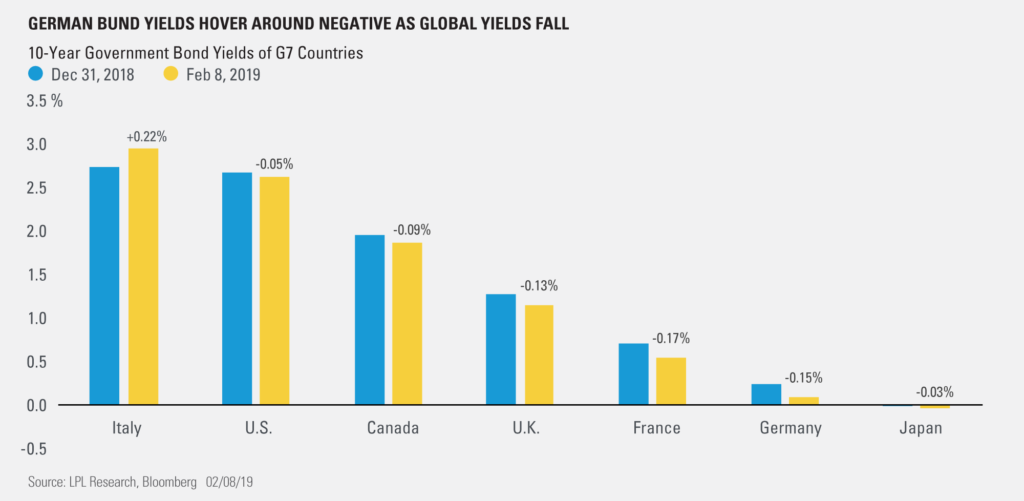

As shown in the LPL Chart of the Day, yields on global sovereign debt have followed suit, declining year-to-date amid intensifying trade and political risks.

Germany’s woes reflect the region’s struggles with tepid growth and political instability amid the European Central Bank’s efforts to pull back accommodative monetary policy. We remain cautious on Europe, but we don’t expect the region’s troubles to materially hinder U.S. growth prospects.

“U.S. government debt is attractively valued for global investors,” said LPL Research Chief Investment Strategist John Lynch. “Even with a Fed pause, we expect slightly higher interest rates this year given our expectations for solid U.S. growth, firm employment, and healthy inflation.”

The global rotation to U.S. debt this year is already evident. The 10-year Treasury yield dropped 5 bps (0.05%) year to date through February 8, and the Federal Reserve’s (Fed) recent commitment to patience on interest rate increases may curb future rate appreciation. Still, U.S. Treasuries will likely be the least impacted by the global growth concerns and geopolitical tensions that we expect will continue to plague Europe.

Bunds could be poised for another shock this week. Germany’s fourth-quarter gross domestic product report is due out February 14 and could show that the economy fell into a recession for the first time since 2013. In the third quarter, the German economy unexpectedly shrank 0.2%, and German manufacturing activity has fallen further since then, hinting that fourth-quarter output data could disappoint again.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

For Public Use | Tracking # 1-821639 (Exp. 02/20)