The S&P 500 Index is off to its best start in years, but this is on the heels of the worst year for stocks since 2008. The trifecta of crashing oil prices, confusion from Federal Reserve (Fed), and trade issues with China all pushed equities lower by 14% during the usually bullish fourth quarter last year, and in the process made December the worst month of the year for the first time, according to data going back to 1950.

Here’s the catch: Investors have had blindfolds on trying to hide from all of the bad news, but maybe it’s time to remove the blindfolds. “Like Sandra Bullock in Bird Box, sometimes it’s better to keep that blindfold on in order to survive. But eventually, there is a time to remove the blindfold and look around. We think investors should consider that, as many potential

Consider the following:

- Since Fed Chair Jerome Powell used the word “patient” last week when referring to the Fed’s approach to hiking interest rates, stocks have gained five straight days. There had been a big disconnect between what the Fed was saying and what markets believed. That seems to have been alleviated now.

- Oil prices have stabilized after crashing in the fourth quarter of 2018. OPEC is doing what it can to stabilize the commodity, and things appear to have calmed down substantially.

- S. trade talks with China are continuing, and we think there’s a good chance there could be come type of deal over the coming months, as the pressure is mounting on both sides to find a resolution.

- Following the 2.7% sell-off in the S&P 500 December 24, stocks have gained more that 10% in 10 days. You have to go back to July 2009 to find the last time stocks were up that much in 10 days. That wasn’t the worst time to be long stocks.

- Valuations have dropped significantly, and historically this has been a bullish event. Please read our recent Weekly Market Commentary for more thoughts here.

- The S&P 500 was up nearly 3% after the first five trading days in 2019. Since 1950, when the S&P 500 was up more than 1.1% after the first five days of the year, each of those years closed higher 23 out of 23 times before 2018. Yes, 2018 ended that incredible streak (along with many other tried and true historical market records). Still, a good start to a year potentially can be a sign of a strong year.

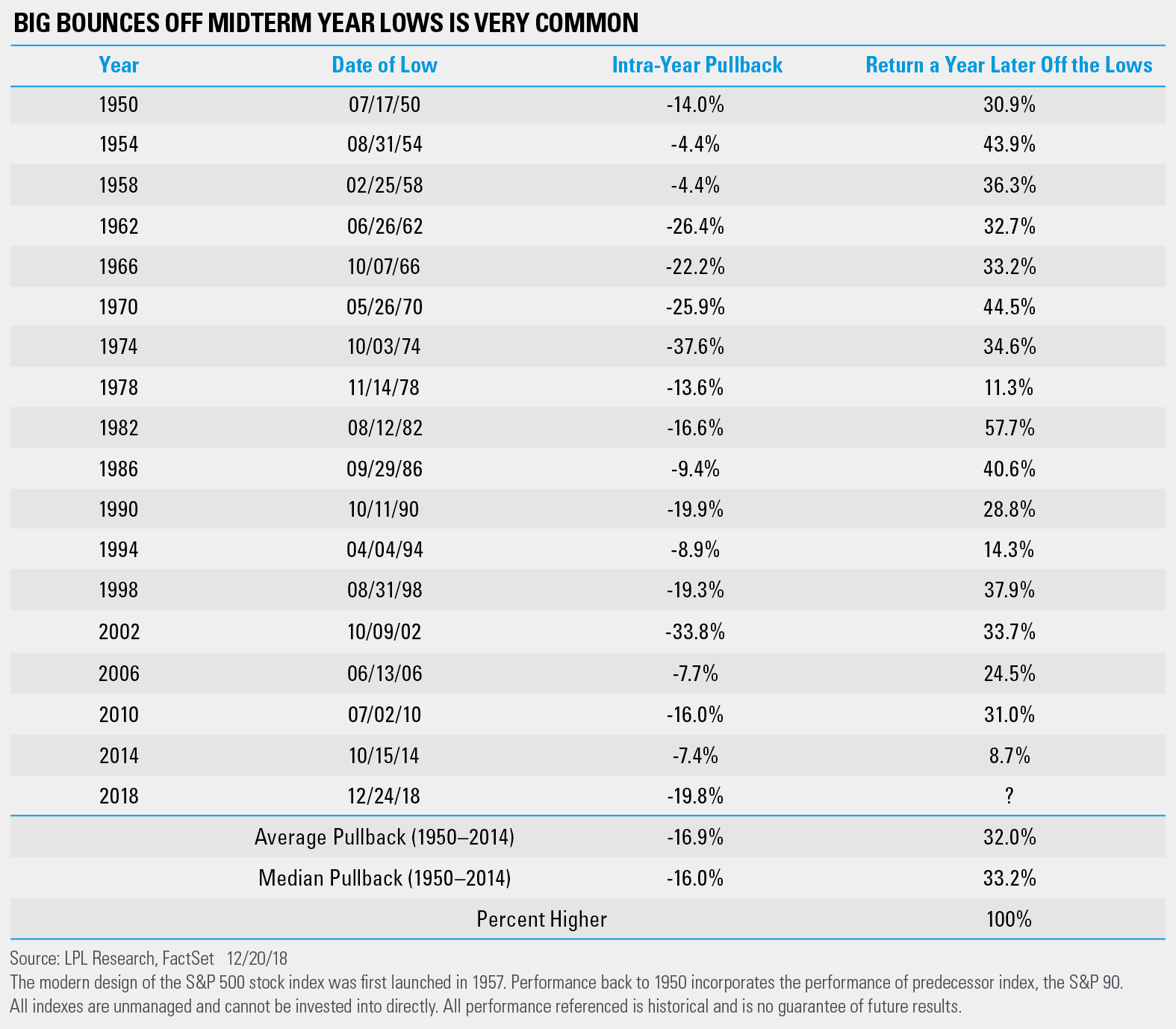

The LPL Chart of the Day offers another reason to remove the blindfolds and look at some of the positives. The chart shows that after a midterm election year low (as in 2018), the S&P 500 has been higher a year later every time going back to 1950. We now know the S&P 500 low in 2018 was December 24, and history suggests there is a good chance stocks will be higher (maybe much higher) by the same time this year.

Last, Bird Box was a great movie, but if you are trying a #BirdBoxChallenge, everyone at CollaborativeWEALTH wishes you luck and safety!

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank /Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Member FINRA/SIPC

For Public Use | Tracking # 1-810904 (Exp. 01/20)