A WILD WEEK IN REVIEW

John Lynch Chief Investment Strategist, LPL Financial

Barry Gilbert, PhD, CFA Asset Allocation Strategist, LPL Financial

KEY TAKEAWAYS

- A December ISM report last week showed U.S. manufacturing health fell to a two-year low.

- The bulk of data recently has been encouraging, however, especially an excellent December jobs report.

- We still see a solid U.S. economy struggling with the trade tensions, but far from recessionary territory.

Economic data has been under a microscope since the Federal Reserve (Fed) emphasized its allegiance to data dependency after raising interest rates in December. The Fed’s rate hike and Fed Chair Jerome Powell’s post-meeting press conference rhetoric spooked investors, who have been bombarded with negative headlines about trade, geopolitical squabbles, and a weakening global economy.

Last week’s economic headlines whipsawed investors looking for direction. Still, we see a common thread in the data: a solid economy struggling with the impact of trade tensions, but far from recessionary territory.

A BLOWOUT JOBS REPORT

Friday was the highlight of the week for U.S. stocks, helped by a strong December jobs report and Powell’s comments on the Fed’s patience and flexibility. To investors’ credit, there was little in the jobs data to fret about. Nonfarm payrolls grew by 312,000 last month, beating the median consensus estimate for a 184,000 increase by a very healthy margin. The unemployment rate did tick up, but for the right reason: The labor force participation rate rose, indicating that more participates were enticed by solid labor market conditions to enter the workforce. Many of these new entrants are initially unemployed. Average hourly earnings grew 3.2% year over year in December, the fastest pace of the cycle, and the measure’s third straight month above 3%.

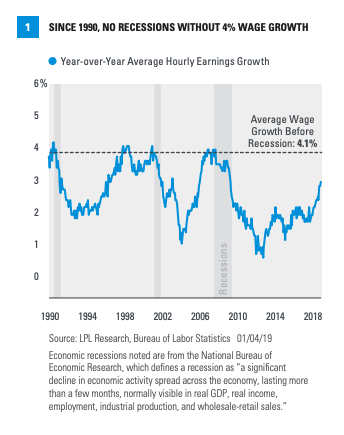

To us, wage growth is still the most important metric to watch in jobs data these days, especially as recessionary fears increase and anxiety around Fed policy remains high. Current wage growth is modest and healthy, but below excessive levels that have historically preceded economic recessions. Since 1990, wage growth reached an average of 4.1% before an economic recession began. In fact, since 1970, no recession has started with wage growth below 4% [Figure 1].

WHERE DO WE GO FROM HERE?

The current pace of wage growth aligns with evidence of manageable inflationary pressures we’ve seen in other measures. Consumer and producer prices have been growing at a slightly above-average pace for the cycle, and core personal consumption expenditures have increased at a pace around the Fed’s 2% target for several months. Slowing global economic data have sparked fears of inflation falling to dangerously low levels, but for now, we see no indications of this happening.

MANUFACTURING DISAPPOINTS

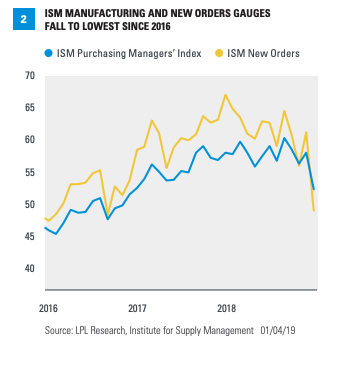

Friday’s upbeat attitude was a stark reversal from earlier in the week, when the Institute for Supply Management’s (ISM) manufacturing Purchasing Managers Index (PMI), a gauge of U.S. manufacturing health, fell to the lowest level in two years. Although the level of activity was near average for the cycle, the magnitude of December’s decline from the prior month was striking: The drop was the ISM PMI’s biggest since October 2008. Such a decline was also largely unexpected. December’s ISM reading came in 3.4 points below the median consensus estimate, the biggest miss for the gauge since January 2014, and below even the lowest consensus estimate recorded.

Last month’s fallout in manufacturing activity was largely due to lower domestic demand. The ISM New Orders Index, which measures both domestic and international demand for U.S. goods, slid the most since anuary 2014. ISM’s gauge of export orders actually climbed last month, even though new export orders have hovered around a two-year low since October 2018 [Figure 2].

Markets interpreted the disappointing ISM PMI report as a jarring sign that a global slowdown in manufacturing may have bled into domestic factories and could have significant ramifications for domestic economic trends. Data last week showed the official Chinese manufacturing PMI slipped to 49.4, the third-lowest level of the current economic cycle and squarly in contradiction territory (below 50). Meanwhile, the broader Caixin Manufacturing PMI measure came in at 49.7, its first sub-50 reading since 2016, with particular weakness in new export orders. WHile China’s manufacturing sector has slowly deteriorated for the past serveral months, the level of weakness combined with anecdotal evidence of slowing growth in corporate America made ISM’s report especially impactful on investor sentiment.

To us, the unexpected severity of U.S. manufacturing’s decline is a sign that the intangible effects of trade tensions are still difficult to quantify. Last year, we warned that U.S. manufacturing may become especially susceptible to future weakness from trade tensions as international demand waned. The most recent ISM data confirmed that demand is weakening as corporations curb orders and shed plans for expansion in light of ongoing trade tensions. Dwindling corporate demand has been most evident in a recent slowdown in capital expenditures.

But to be fair, the headline data is still well into expansionary territory (above 50), and there are still several tailwinds for manufacturing. We expect fiscal stimulus and growing corporate profits to increase business investment, which will likely benefit manufacturing.

The silver lining in this? Deteriorating headline data and financial market volitilty could force an agreement between the U.S. and China, as neither side wants to see its own economy flounder. We expect that agreement to come soon, and when that happens, the tailwinds may prevail.

CONCLUSION

Investors are understandably anxious these days, and they’ve been scouring recent economic reports for recessionary signs. While some of the last week’s reports were disappointing, we still believe the odds of an upcoming recession are low. To us, last week’s divergence in data paints a tale of two economic narratives. We see continued evidence of a strong consumer empowered by looser tax policy, a robust labor market, and midestly accelerating wages, contrasted with corporations increasingly delaying investment as they wait for greater clarity on global ecomonic conditions.

Because of this, we still see trade tensions as the primary roadblock to U.S. corporate health. However, the bulk of economic data we’ve seen over the past few months has been encouraging, and the excellent December jobs report is just the latest evidence pointing to a still solid economy.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

Any economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing involves risk including loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

RES 62652 0119 | For Public Use | Tracking #1-808684 (Exp. 01/20)