The December jobs report showed

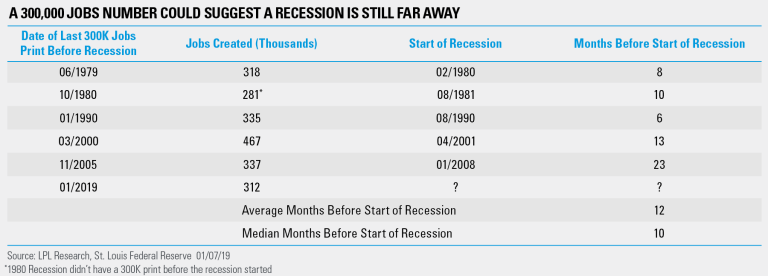

What does a 300,000 monthly print tell us? First things first: Be aware that the labor market is constantly growing—so 300,000 jobs last month isn’t the same as 300,000 jobs back in the mid-1980s. In fact, the total number of employed people is about 50% higher now than it was then. Still, 300,000 jobs is an impressive increase and one that could suggest that a recession is still a long way off. “The most recent jobs figure could be a great sign that a recession is still a long way off, as the previous two cycles didn’t see recessions begin until 13 and 23 months after the last 300,000 print,” explained LPL Senior Market Strategist Ryan Detrick.

As the LPL Chart of the Day shows, looking at the previous five cycles, it took an average of 12 months after the last 300,000 jobs print before a recession started—with the last two cycles actually taking longer. We remain in the camp that we probably won’t have a recession in 2019, and this is another potential bullet point to support that.

For more thoughts on the recent economic data, please be sure to read our Weekly Economic Commentary due out later today.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Member FINRA/SIPC

For Public Use | Tracking # 1-808677 (Exp. 01/20)