Friday’s jobs report for December offered little for investors to complain about with far more jobs created than expected. Nonfarm payrolls grew 312K last month, significantly above the median consensus estimate for a 184K increase. The unemployment rate did tick up, but it is still close to a cycle low.

To us, wage growth is the most important metric to watch in jobs data these days, especially as recessionary fears increase and anxiety around Federal Reserve (Fed) policy remains high. Average hourly earnings grew 3.2% year over year in December, the fastest pace of the cycle, and the measure’s third straight month above 3%.

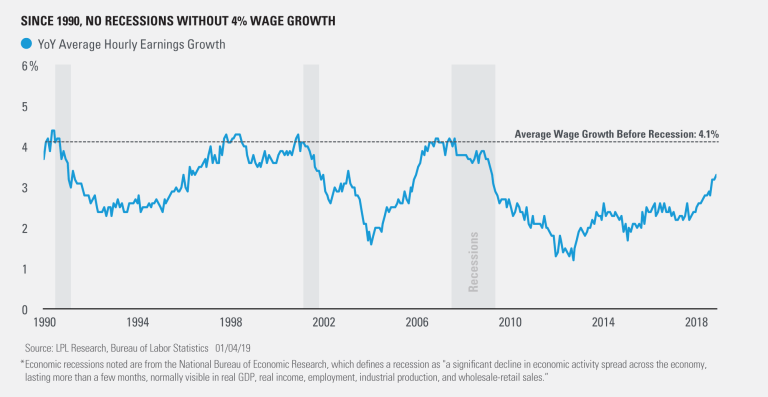

As shown in the LPL Chart of the Day, current wage growth is moderate and healthy, but below excessive levels that have historically preceded economic recessions. Since 1990, wage growth has reached an average of 4.1% before an economic recession began. In fact, since 1970, no recession has started without wage growth exceeding 4%.

“We are primarily watching wage growth to gauge inflationary trends,” and said LPL Research Chief Investment Strategist John Lynch. “Wages represent about 70% of business costs, so it’s hard to have an inflationary threat in either direction without the participation of wages.”

The current pace of wage growth aligns with evidence of manageable inflationary pressures we’ve seen in other measures. Consumer and producer prices have been growing at a slightly above-average pace for the cycle, and core personal consumption expenditures have increased at a pace around the Fed’s 2% target for several months.

Still, investors are understandably anxious these days, and they’re scrutinizing recent economic reports for recessionary signs amid an ongoing U.S.-China trade dispute and signs of slowing global demand. However, we still see a low probability of a recession this year, and this jobs report reinforces our view that U.S. economic fundamentals remain compelling. We believe trade tensions have been the primary weight on recent economic data, and we expect a U.S.-China trade agreement soon.

For more of our thoughts on this week’s economic developments check out next week’s Weekly Economic Commentary, which will be published on Monday.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

Please see the Outlook 2019: FUNDAMENTAL: How to Focus on What Really Matters in the Markets for additional description and disclosure

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Member FINRA/SIPC

For Public Use | Tracking # 1-808164 (Exp. 01/20)