MARKET FEARS AND ECONOMIC REALITIES

John Lynch Chief Investment Strategist, LPL Financial

Barry Gilbert, PhD, CFA Asset Allocation Strategist, LPL Financial

KEY TAKEAWAYS

- Increased uncertainty around policy risks has contributed to sharp market declines.

- Growth expectations continue to hold steady in the U.S. and have declined only modestly globally.

- Several risks still in play could weigh on markets, but the broader economic context remains supportive.

Market participants’ evaluation of increasing policy uncertainty has contributed to sharp equity market declines over the last quarter. The list of policy issues raising concerns has been broad: the Federal Reserve (Fed); trade policy; looming Brexit deadlines; lack of fiscal response to slowing growth abroad; worries about a slowing fiscal impact at home; tightening labor markets; partisan political bickering; a government shutdown; and executive branch turnover, to name a few. We don’t believe that any of these factors individually is currently a serious threat. Collectively, they have tipped market sentiment toward a brooding sense of uncertainty.

But while the downside risks are real, these concerns have had little impact on aggregate hard economic context still points to moderate growth and overall stability in 2019.

FORECASTS HOLDING STEADY

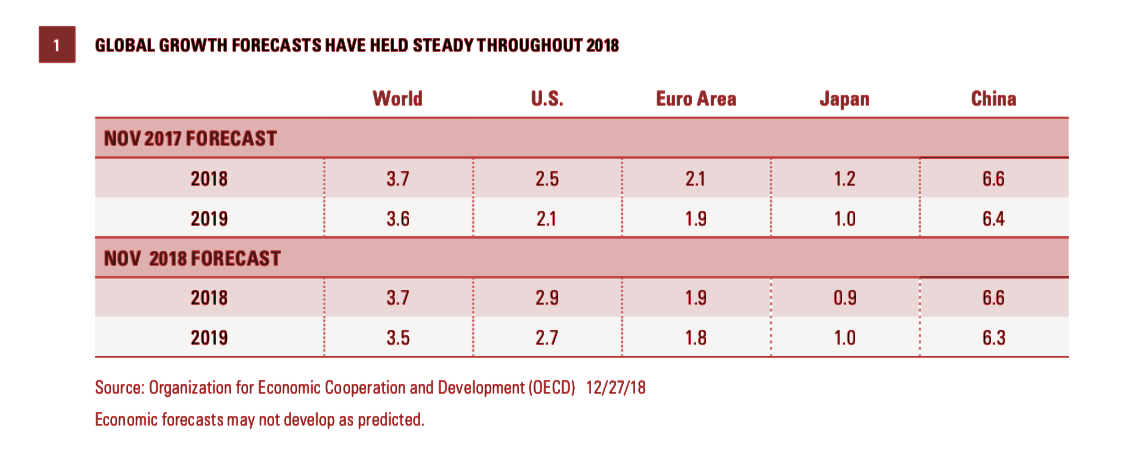

Looking back over the last year, we see that global growth forecasts for 2019 have not shifted significantly. We surveyed a range of institutional economic forecasts for 2019, and compared forecasts made at the end of 2017 with the same forecasts at the end of 2018. They all told a similar story. A typical case: Organization for Economic Cooperation and Development (OECD) forecasts from November 2017 and November 2018 saw 2019 global growth expectations falling just 0.1% [Figure 1]. That’s a small decline but not insignificant on a global scale, although concerns about downside risks have increased. 2019 expectations for the U.S. actually picked up over the same period. And 2018 followed suit. 2018 growth was in line with the 2017 forecast, with an upside surprise in the U.S. offsetting downside surprises in other developed markets.

UPSIDE PROSPECTS IN THE UNITED STATES

Even though uncertainty has clouded investors’ horizons as of late, we still believe the U.S. economic landscape is compelling. In 2019, we expect U.S. gross domestic product (GDP) growth of 2.5—2.75%, near consensus but with an upside bias. While slower than the near 3% growth expected for 2018 (with fourth quarter numbers still to come), it’s still above the 2.3% average growth for the expansion and well removed from recession.

We see several drivers of continued above-trend growth next year. Overall, we believe the combination of lower individual and business tax rates, immediate expensing provisions in the tax law, repatriation, reduced regulation, and increased government spending will help support business and consumer spending. These factors should more than compensate for slowing global growth, disappointing housing growth, and uncertainty from trade and budget deficits.

A key to our forecast is a pickup in capital expenditures (CapEx), which we think will be aided by steady corporate profit growth and fiscal incentives for business spending. Despite a second-half slowdown, business spending was robust in 2018, and surveys suggest that CapEx may grow at a solid rate of about 7% in the year ahead. Increased CapEx may help lay the foundation for improved productivity, which will be important in 2019, as rising output per worker helps offset inflationary pressures. We also expect current consumer patterns to persist as wages continued to grow at a healthy pace and low tax rates buoy spending.

While inflation concerns may surface at times, we expect inflationary pressures to remain at manageable levels next year. We’ll continue to watch wage growth closely to gauge the state of inflation, as it’s hard to have a sustainable inflationary threat without the participation of wages. With wage growth trending near 3% annually, we believe there is still plenty of time before the economy overheats, and we see no signs of wages and prices slipping into deflationary territory.

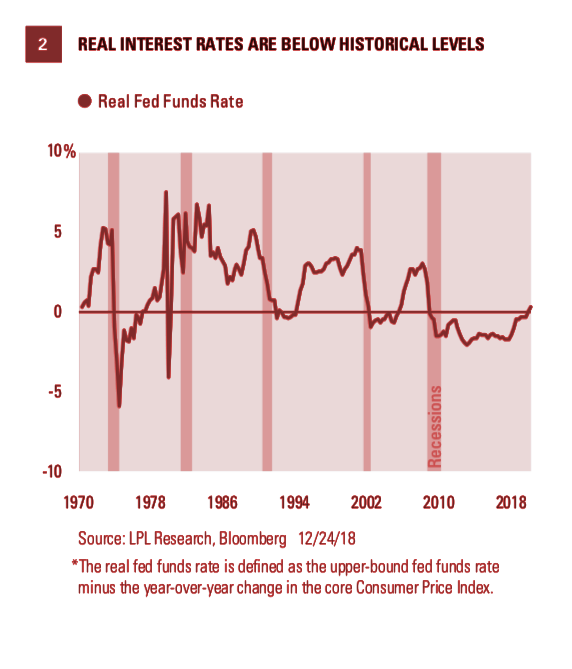

Of course, the Fed’s policy plans may determine the course of the domestic economy. We expect the Fed to continue on its gradual path with two interest rate hikes in 2019, which is in line with policymakers’ December projects. Investors have understandably become more anxious about the Fed’s plans as Fed Chair Jerome Powell and other Fed members have publicly said that rates are approaching neutral, or the point where policy is neither supporting nor restricting overall growth. That rhetoric has spooked the markets recently, but the Fed has clearly communicated its dependence on economic data for policy decisions, and its flexibility to change policy based on economic conditions. Inflation-adjusted rates, while rising, still remain historically low. Currently, the real fed funds rate sits at 0.3% (based on year-over-year core Consumer Price Index growth of 2.2%), below the 1.3% real interest rate we’ve averaged since the end of 1970 [Figure 2]. During that same period, the real interest rate reached an average high of 4.2% before the U.S. economy entered a recession, significantly above where rates are today. The U.S. economy is strong enough to operate at current rates, and we expect the Fed to be pragmatic and flexible enough to guide the U.S. economy to a soft landing down the road.

Right now, the Fed’s gradual approach has kept inflation near the target for price stability as part of its dual mandate (along with full employment). If we were to see runaway inflation, we might expect more aggressive rate hikes from the Fed, which can slow down the economy much more and create the potential for a shock. However, inflation remains well contained with recent downside surprises leaving core inflation below the Fed’s 2% target. We expect wage pressure, economic growth, and the impact from tariffs to push inflation higher in 2019, but even at levels slightly above target, we believe the Fed would be able to put rate hikes on pause midyear in response to tightening financial conditions.

RISKS FROM UNCERTAINTY AND LOWER ASSET PRICES REMAIN

While we believe the market might be mispricing the economic impact of late-year uncertainty, the mispricing itself comes with some danger. Economies are prone to virtuous and vicious cycles of confidence. For example, expansionary fiscal policy can be a temporary spur to growth just on the prospect of faster economic growth. Expectations can lead to increased economic activity, which reinforces confidence. By contrast, trade policy uncertainty can lead to delayed capital investment, a trend for which there’s already some anecdotal survey evidence, which can lead to slower growth and greater uncertainty. Declines in stock prices and home prices can have a similar impact on consumer activity. While we know that prices are volatile, experiencing a downturn in major asset prices can lead to a decreased sense of financial well-being, which can restrain spending and further reduce asset prices. While some kind of shock usually starts a potential downturn, a shift in confidence is often needed to give it more energy, helping to turn lowered expectations into economic reality. We do not believe that current confidence has fundamentally shifted due to rising uncertainty and its impact on asset prices, but we do see increased but reversible vulnerability.

CONCLUSION

REcent sharp market declines have created one of the most challenging market environments to navigate since the end of the Great Recession. Since markets are forward-looking and tend to be leading indicators of economic activity, understanding what the broader economic context means always requires understanding what’s priced into expectations. While we did expect rising later-cycle volatility in 2018, we did not expect the confluence of policy missteps that drove recent market declines. When these kinds of events happen, the challenge is to make the right call on whether markets are telling us something we don’t know (as happened in 2008-2009), whether there’s been a dislocation between market fears and economic realities (as happened in 2011 and 2015-2016). While we are concerned that recent market declines and their underlying causes are degrading confidence, we believe stimulus-supported fundamentals remain strong enough to ultimately anchor confidence and give markets a chance to rebound, with a caution that markets may grow increasingly impatient with unsteady leadership from global fiscal and monetary policymakers.

IMPORTANT DISCLOSURES

Please see the Outlook 2019: FUNDAMENTAL: How to Focus on What Really Matters in the Markets for additional description and disclosure.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

Any economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Investing involves risk including loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

RES 59800 1218 | For Public Use | Tracking #1-806338 (Exp. 12/19)