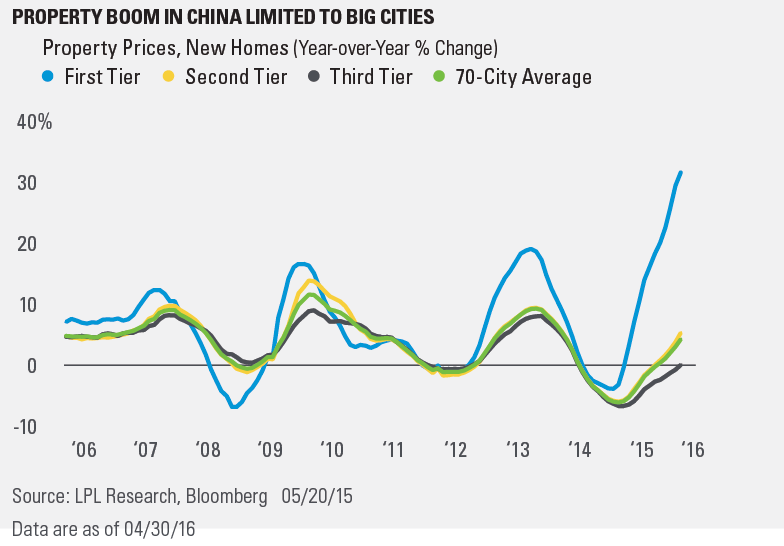

The media lately have been buzzing with stories of the property bubble in China, noting the prices in “tier one” cities have risen nearly 34% recently. Clearly, that is part of the debt-fueled bubble in China that will inevitably pop. Or is it? Prices for new residential construction have boomed only in tier one cities. There is no formal definition for tier one, but it always consists of at least the four largest cities (including Beijing and Shanghai), with the two next two largest cities sometimes also included. As you can see, outside of the very largest cities, property prices have been much more subdued.

Also important to note is that not only do the Chinese save much more than Europeans or Americans, they save differently. One traditional store of value for Chinese people is real estate, often in the form of residential property. First time home buyers must have a down payment of 30%; for second and third homes, down payments are between 40-50%.

The reality of housing in China is complicated, and varies greatly by region and city. In tier one cities, there is the housing bubble created by rising prices, but there is also pent-up demand for more affordable “social housing,” as it is referred to in China.

IMPORTANT DISCLOSURES

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Stock investing involves risk including loss of principal.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking #1-501048 (Exp. 05/17)