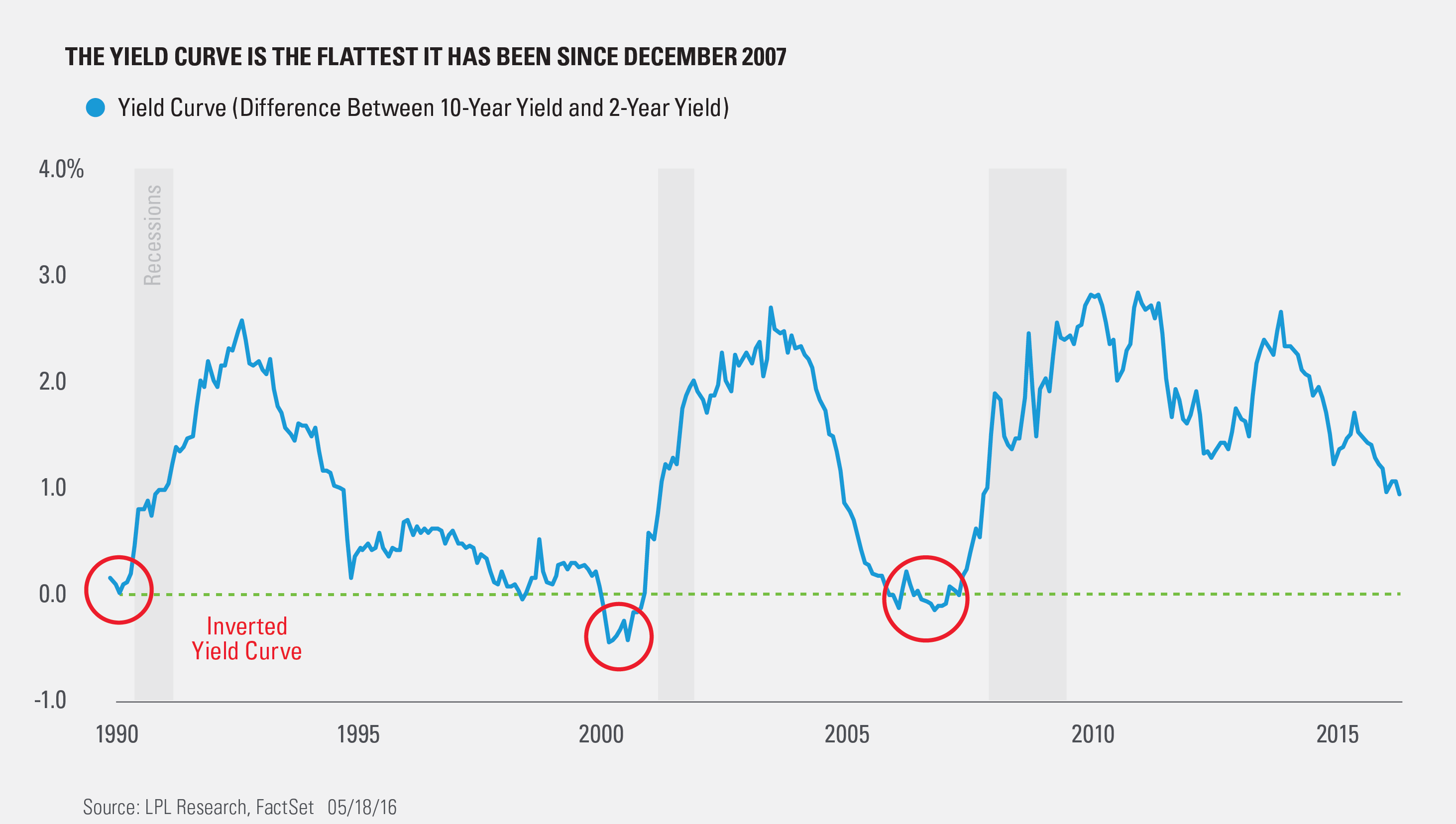

Something very worthwhile is taking place in the bond market. Short-term yields have been surging higher as inflation continues to tick higher and the possibility of higher interest rates increases, while demand for long-term bonds remains strong thanks to foreign demand. As of Tuesday, the 2-year note yielded 0.823% and the 10-year note yielded 1.759%, for a difference of 0.936%, the lowest since December 2007.

Anytime we hear “the last time this happened was 2007” it perks our interest, as we know that was right before the last recession. So what does it mean? Well, a flattening yield curve usually suggests economic weakness, while a steep curve suggests economic strength. (The yield curve shows the interest rate for Treasuries with different maturities.) The big warning sign is should the yield curve invert (short-term rates higher than long term), which could suggest a coming recession. Ahead of both the tech bubble and the financial crisis, the yield curve inverted, delivering a warning sign in advance that something was wrong. The good news is, the yield curve isn’t close to inverting currently.

As the chart below shows, inverted yield curves have taken place well before recessions started. There was one brief time the yield curve inverted in 1998 that didn’t lead to a recession, but the other times it has inverted led to recessions soon after.

Why is the yield curve at its flattest level in more than eight years? Aggressive monetary policy in Europe and Japan is one theory. While global negative interest rates are also adding to the worries. Others point out that the yield curve tends to flatten ahead of Federal Reserve (Fed) interest rate tightening. We asked our own Anthony Valeri on Twitter earlier this week what the flat yield curve could mean, and in 91 characters he summed it up like this.

For more color on this, we asked Anthony to elaborate. He has forgotten more about bonds than most of us will ever know, but here’s what he had to say.

Yes, the yield curve slope is at its flattest level since December 2007, meaning that the bond market still believes rate hikes may be dangerous for the economy given still fragile global economic growth. So the yield curve is still valid as an indicator of economic growth.

By way of comparison, the 25-year average yield slope is 1.25%, so really not that far off the long-term historical average. Other measures of the yield curve, such as 5s-10s, tell a similar story.

Despite a perfect track record for forecasting recessions, there is no guarantee it will invert if a recession is forthcoming, and it will be harder for the yield curve to invert with short rates so low. But still, I think it’s premature to rule out this tried and true indicator and the current message is one of slow growth, not recession.

There you go. We will continue to monitor this situation closely.

IMPORTANT DISCLOSURES

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Stock investing involves risk including loss of principal.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond and bond mutual fund values and yields will decline as interest rates rise and bonds are subject to availability and change in price.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-499292 (Exp. 05/17)