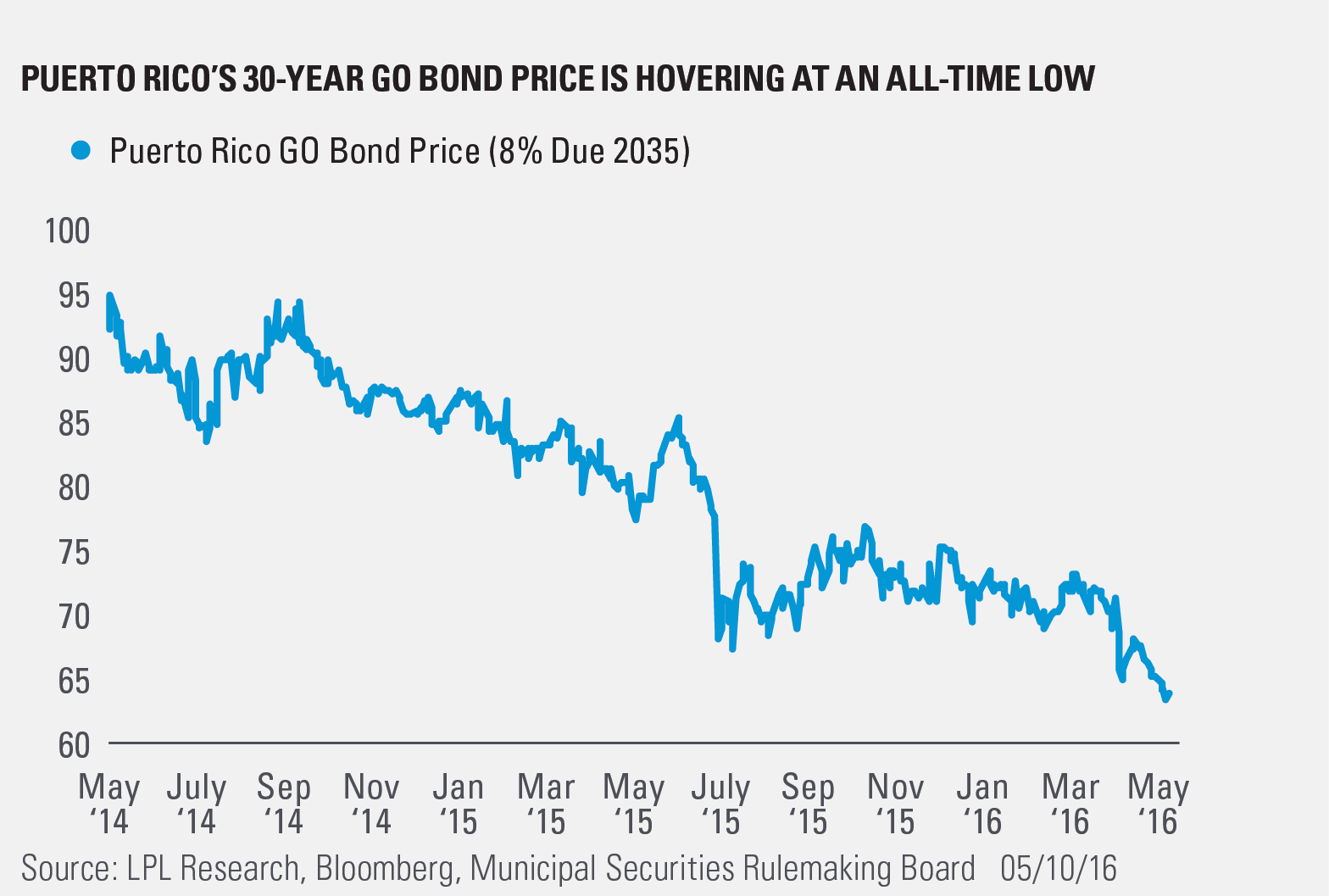

On May 2, 2016, Puerto Rico Government Development Bank (GDB) defaulted on a $400-plus million debt payment. The GDB became the third Puerto Rico issuer (out of a total of 17) to default, and the news was largely expected given the longstanding financial distress. Nonetheless, the default further soured investor sentiment. Prices of Puerto Rico general obligation (GO) bonds continue to hover near record lows ahead of a key July 1, 2016, debt payment that the commonwealth will likely be unable to make.

Thankfully, spillover to the broader municipal bond market has been negligible and is likely to remain so. Most investors correctly view Puerto Rico as an isolated case and not representative of the broad market, even if it remains a constant presence in the news. Additionally, most traditional tax-exempt investors sold at the first signs of more serious trouble in 2013 and 2014 and most of the debt is currently held by traditional taxable investors.

Still, investors are right to be skeptical.

- The commonwealth has not yet provided audited financial statements since the 2013 fiscal year. By comparison, states do so within 5–12 months following the end of the fiscal year. The passage of time continues to erode the Puerto Rican government’s credibility.

- A proposed debt restricting for GDB holders is dependent on other bondholders—including those holding bonds with a senior claim—to accept similar terms, which is unlikely to be achieved.

- The Puerto Rican government has shown a lack of “willingness to pay” by loosely interpreting laws to their potential benefit and seeking a broad-based debt restructuring. After several failed attempts with bondholders, Puerto Rico’s last step is relying on Congress for restructuring oversight.

- Legislation to help Puerto Rico restructure its debt may reach the floor of the U.S. House of Representatives next week, but is unlikely to be finalized ahead of the July 1 payment. The bill’s possible appointment of a presidential board to oversee payment prioritization lends further uncertainty to bondholders. The bill is not intended to be a financial bailout, but instead, provide a restructuring path due to the lack of Chapter 9 access for Puerto Rico.

- Finally, current debt restructuring efforts lack any meaningful discussion of policy or steps to help Puerto Rico emerge from an ongoing multiyear recession and population exodus. Without a viable economic plan, the ability to service new debt remains questionable.

Puerto Rico debt remains highly uncertain and very speculative, with investors now simply trying to anticipate a default or debt restricting outcome. We expect spillover to the broader municipal bond market to remain limited.

IMPORTANT DISCLOSURES

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

General obligation (GO) bonds are municipal bonds backed by the credit and “taxing power” of the issuing jurisdiction rather than the revenue from a given project.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-496830 (Exp. 05/17)