Market Update

- Stocks near flat, oil strength fades. U.S. equities are clinging to gains this morning despite a slide in WTI crude crude oil prices from overnight highs. This morning’s action comes after indexes rebounded from initial losses to finish higher on Friday as traders digested the closely watched jobs report. Initial declines following a miss on the headline payroll figure gave way to optimism that the Federal Reserve Bank (Fed) may further temper rate hike expectations; investors will look to several Fed speakers today for more clarity. Overseas, Asian markets were mixed with Japan’s Nikkei rising 0.7%, snapping a six-session losing streak, while China’s Shanghai Compositetumbled 2.8% after trade data showed an unexpected drop in exports, sparking growth concerns. European indexes, meanwhile, are mostly higher in afternoon trading. Elsewhere, the dollar is gaining ground, COMEX gold is down sharply, and Treasuries are modestly higher.

Macro View

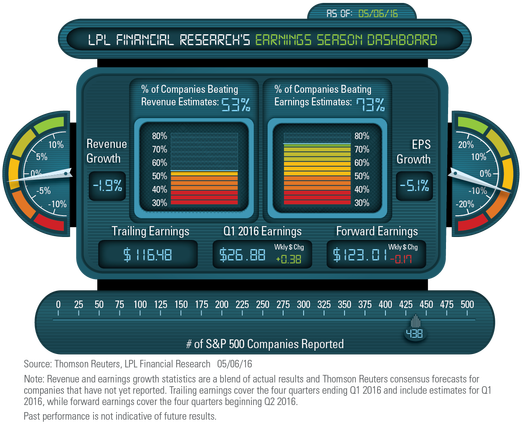

- Peak earnings weeks are behind us. With 87% of S&P 500 companies now having reported, earnings season shifts into slow gear this week with just 19 companies reporting. Thomson-tracked first quarter 2016 earnings growth is tracking to a 5.1% decline, more than 2% ahead of estimates when earnings season began. Excluding energy, earnings are tracking to gains of about 1%.

- Estimates holding up well. Forward S&P 500 earnings estimates, down 1.4% since April 1, fell only marginally last week as over 120 companies reported results. The weaker U.S. dollar and commodity stability are helping, while it is encouraging that sub-par economic growth has generally had little impact on companies’ near-term outlooks, which have largely factored it in.

- China data are key this week. China began reporting its April data over the weekend (see below), and by the of the week will have reported almost all of its key reports for April (retail sales, Consumer Price Index [CPI], exports, money supply, and new loan growth). In the U.S., April retail sales, the March Job Openings and Labor Turnover Survey (JOLTS) data, along with a half dozen or so Fed speakers are on deck. The Bank of England meeting is the key central bank meeting this week.

- China began a week of data dumping with trade and currency reserve data. Exports fell -1.1%, while imports fell -10.9%; both figures were well below consensus forecasts. Changes in the value of the yuan resulted in an increase in Chinese foreign currency reserves. Once the currency impacts are factored out, it appears that selling by the central bank has slowed from over $20 billion per month to around $4 billion. This is the first round of what will be a full week of data; thus far, the data reflect overall weakness in the global economy.

- Bounce off the 50-day moving average. The S&P 500 lost 0.4% last week for its second straight negative week. It hasn’t declined three consecutive weeks since the start of the year. Energy and materials lagged, while utilities and consumer staples led. Technically, the S&P 500 found support right at its 50-day moving average on Friday. This trend line could provide near-term support.

- Crude in the news again. Crude oil is at the forefront again this morning, as it is up slightly on news of the dismissal of Saudi Arabia’s energy minister. This could potentially open the door to a pullback of its strategy of maintaining high production. Also, wildfires in Canada have disrupted oil output from the energy-rich country. Crude oil is now more than 70% off of its February lows and up 20% for the year. Today on the LPL Research blog, we will take a closer look at where this move off the yearly lows ranks in history.

- Yet another disconnect. This week’s Weekly Economic Commentary, due out later today, explores the disconnect between the Fed and financial markets on job growth. Job growth is likely to slow in the next 12 months from the average 200,000 per month pace seen over the past six years. While the market might view that as a sign of an impending recession and more Fed stimulus, the Fed views job growth as slow as 120,000 per month as tightening the labor market.

- Initial thoughts on election market impact. In this week’s Weekly Market Commentary, due out later today, we look at what the upcoming presidential election may mean for markets in 2016. Markets do not like uncertainty, and Donald Trump certainly brings that. Although stocks may be more volatile between now and November as market participants size up Trump and assess his chances against presumptive democratic nominee Hillary Clinton, we believe the typical election year stock market pattern, our assessment of the more likely potential outcomes in November, and the macroeconomic backdrop all still suggest modest gains for stocks in 2016.

Monitoring the Week Ahead

Monday:

- China: New Loan Growth and Money Supply (Apr)

Tuesday:

- JOLTS (Mar)

Thursday:

- Mester (Hawk)

- Rosengren (Dove)

- George (Hawk)

- Norway: GDP (Q1)

- UK: Bank of England Meeting (No Change Expected)

Friday:

- Retail Sales

- Consumer Sentiment and Inflation Expectations (H1 May)

- Eurozone: GDP (Q1 – Revised)

- Malaysia: GDP (Q1)

Saturday

- China: Industrial Production (Apr)

- China: Retail Sales

Click Here for our detailed Weekly Economic Calendar

Important Disclosures

Past performance is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly.

Stock investing involves risk including loss of principal.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Treasury inflation-protected securities (TIPS) help eliminate inflation risk to your portfolio, as the principal is adjusted semiannually for inflation based on the Consumer Price Index (CPI)—while providing a real rate of return guaranteed by the U.S. government. However, a few things you need to be aware of is that the CPI might not accurately match the general inflation rate; so the principal balance on TIPS may not keep pace with the actual rate of inflation. The real interest yields on TIPS may rise, especially if there is a sharp spike in interest rates. If so, the rate of return on TIPS could lag behind other types of inflation-protected securities, like floating rate notes and T-bills. TIPs do not pay the inflation-adjusted balance until maturity, and the accrued principal on TIPS could decline, if there is deflation.

Bank loans are loans issued by below investment-grade companies for short-term funding purposes with higher yield than short-term debt and involve risk.

Because of its narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, disease, and regulatory developments.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Investing in foreign and emerging markets debt securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical and regulatory risk, and risk associated with varying settlement standards.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

Investing in real estate/REITs involves special risks such as potential illiquidity and may not be suitable for all investors. There is no assurance that the investment objectives of this program will be attained.

Currency risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged.

Technical Analysis is a methodology for evaluating securities based on statistics generated by market activity, such as past prices, volume and momentum, and is not intended to be used as the sole mechanism for trading decisions. Technical analysts do not attempt to measure a security’s intrinsic value, but instead use charts and other tools to identify patterns and trends. Technical analysis carries inherent risk, chief amongst which is that past performance is not indicative of future results. Technical Analysis should be used in conjunction with Fundamental Analysis within the decision making process and shall include but not be limited to the following considerations: investment thesis, suitability, expected time horizon, and operational factors, such as trading costs are examples.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-495703